U.S. CPI inflation jumps modestly more than anticipated, upward trend

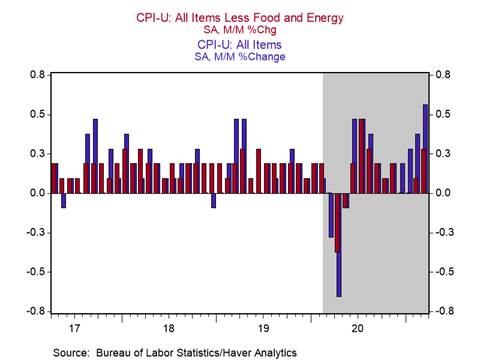

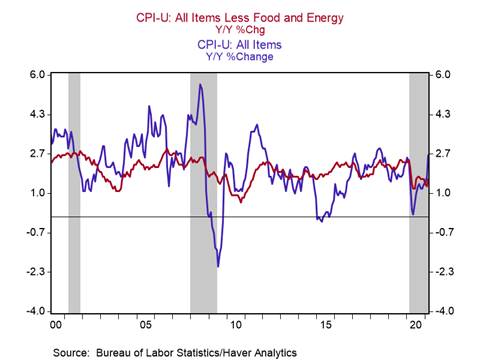

*CPI inflation rose 0.6% in March, lifting its yr/yr increase to 2.6% from 1.7% in February, and the core CPI index excluding food and energy rose 0.3%, lifting its yr/yr increase to 1.6% from 1.3%, reflecting largely higher energy prices and the base adjustment from the decline in the CPI in March 2020 (Charts 1 and 2).

*While this report of higher yr/yr consumer inflation was widely anticipated and the base adjustment and higher energy prices are expected to boost the CPI further in April and May, some components of the CPI suggest that the trend in inflation is likely to persist as aggregate demand in the economy provides the backdrop for higher price increases. (In April 2020, the CPI incurred a monthly decline of 0.70%, so its yr/yr change will rise above 3% this April, while the core CPI fell 0.37%, thus its yr/yr change is expected to rise above 2% in April.)

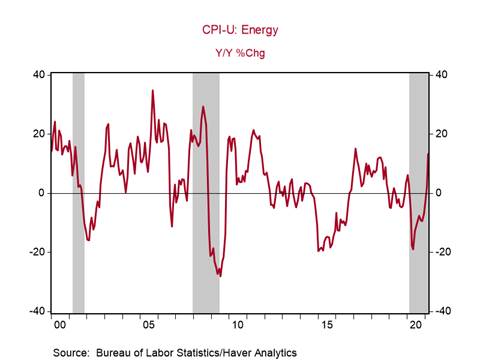

*Energy prices rose 5% in March as higher retail prices of gasoline, heating oil, and other energy products reflect the earlier price increases in WTI oil (Chart 3). Food prices rose 0.1%, but their yr/yr increase remains 3.5%.

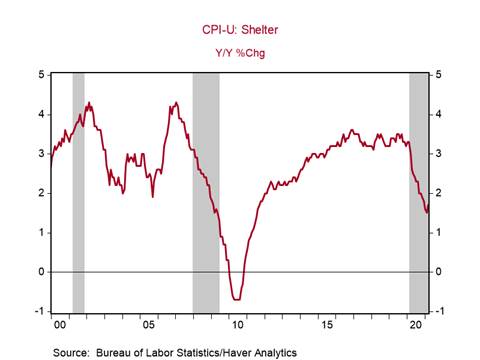

*Housing shelter, the largest single component of the CPI that comprises estimated rents of primary residencies and owner-occupied rental equivalents, rose 0.3% in March, but its yr/yr increase remains a modest 1.7% (Chart 4). This major component is expected to rise gradually but persistently in lagged response to the average 11% increase in home prices that will eventually be reflected in rental costs.

The critical issue is whether this rise in consumer inflation is temporary or will persist. Certainly, the impacts of the base adjustment from March-May 2020 and the big jump in oil prices are temporary. However, there is mounting evidence that businesses are beginning to raise product prices in response to sharp increases in costs of production, reflecting higher prices of commodities, materials, and operating costs, while prices of some products are rising due to supply chain bottlenecks that are constraining supply.

If, as we have projected, strong growth in aggregate demand is sustained following the initial reopening of the economy, excess demand will provide businesses more flexibility to raise product prices and consumer inflation will continue to rise. (Strong US growth, inflation and the Fed’s challenges, February 11, 2021). This will become more apparent as the services sectors of the economy reopen while demand for consumer goods continues to grow at a healthy pace.

Chart 1. Headline and core inflation monthly changes

Chart 2. CPI and Core CPI inflation trends

Chart 3.

Chart 4.

Mickey Levy, mickey.levy@berenberg-us.com