Aprilâs JOLTS data suggest labor market tightness has peaked

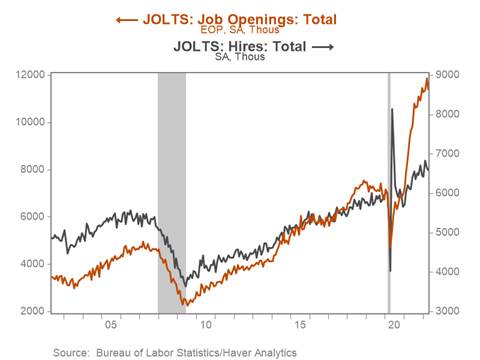

*Job openings eased in April, falling to 11.4m from an upwardly revised all-time high 11.8m in March. Although vacancies remain near record highs, Aprilâs data suggest labor market tightness has likely reached an inflection point (Chart 1). Other gauges of labor market tightness also showed some signs of softening. Quits ticked down to 4.4m while hires over the month fell by 60k relative to March. Aprilâs JOLTS data will be viewed as a small step in the right direction by the Fed, which has explicitly targeted a reduction in vacancies as a key component of the path to a soft landing.

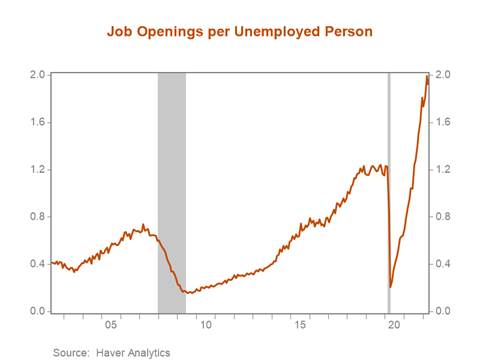

*The decline in job openings lowered the number of job openings per unemployed person from a record high 2.0 in March to 1.9. (Chart 2). This ratio remains significantly above its pre-pandemic level of 1.2 attained at the end of the longest labor market expansion in modern economic history, and a return of this measure to its pre-pandemic levels would likely require a significant cooling in labor demand from current elevated levels.

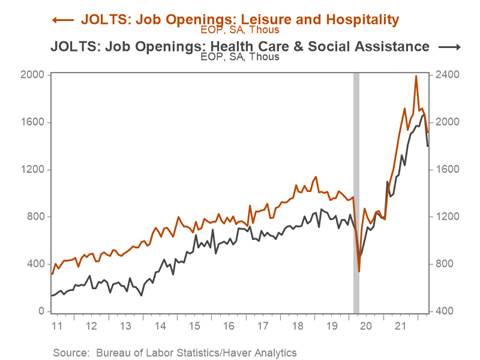

*Aprilâs 450k moderation in job openings was led by a 270k decline in openings in the healthcare and social assistance industry and the leisure and hospitality industry, which saw openings fall by 150k to 1.5m. Notably, hires over the month in leisure and hospitality also declined by 80k while total openings in the sector have fallen to 1.5m, a 500k decline from their peak in December, leaving openings just 600k above their February 2020 level (Chart 3). The job openings rate in leisure and hospitality has fallen from a peak of 11.7% in December to a still lofty 8.9%, but the data are suggestive of easing labor demand.

*Openings in the manufacturing sector gapped up to 120k, lifting the level of openings to an all-time high of 1m, while the opening rate jumped 0.8pp to 7.3%. The increase is consistent with the strength of industrial production and durable goods orders and anecdotal evidence from purchasing manager and business surveys in which manufacturers have stressed labor shortages as a significant constraint on production.

*Hiring activity slowed for the second consecutive month, with total hires falling 60k in April following a 190k decline in March, leaving the hiring rate flat at 4.4%. The gap between job openings and hires narrowed to 4.8m, a 400k decline relative to March, but remains almost 4m above its pre-pandemic level and suggests labor demand continues to significantly outstrip supply.

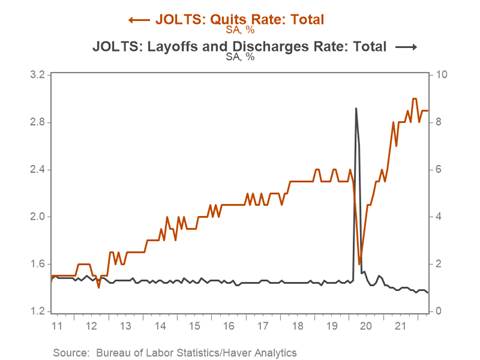

*Measures of labor market churn point to continued high rates of job switching and employee turnover. The quits rate was flat at a near record high 2.9% while the 4.4m total quits over the month is just 90k below Novemberâs all-time high (Chart 4). Heightened quits levels and rates suggest workers remain confident in their ability to secure new employment, with many enticed by the relatively higher wages offered to job switchers vs. job stayers. Tight labor market conditions have tilted the balance of power in wage negotiations toward workers and likely accentuated nominal wage growth, particularly in industries with pronounced labor demand-supply imbalances and elevated employee turnover such as leisure and hospitality. The recent surge in headline inflation driven by spikes in energy and food prices are likely to further incentivize job switching in search of better pay. Facing tight labor markets, businesses continue to hoard labor, reflected in a 0.1pp fall in the layoffs and discharge rate to a record low 0.8%.

Chart 1. Job Openings and Hires

Chart 2. Job Openings per Unemployed Person

Chart 3. Job Openings Leisure and Hospitality and Health Care & Social Assistance

Chart 4. Quits Rate and Layoff & Discharge Rate

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (âBerenberg Bankâ). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCMâs prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.