Could wage growth be higher than official data suggest?

Economic data in recent months have often sent mixed signals over the state of the economy. This is unsurprising given the numerous crosscurrents buffeting the economy, but recent discrepancies seem quite pronounced. One puzzling development is the deceleration in nominal wage growth measured by the Bureau of Labor Statistics (BLS) despite 1) official labor market data pointing to extreme labor market tightness; 2) anecdotal evidence from businesses suggesting labor remains scarce and labor shortages are a significant constraint on production, and that businesses are paying more to hire workers; and 3) a jump in realized and expected inflation that has generated a reduction in real wages that should have pushed workers to bargain for higher wages.

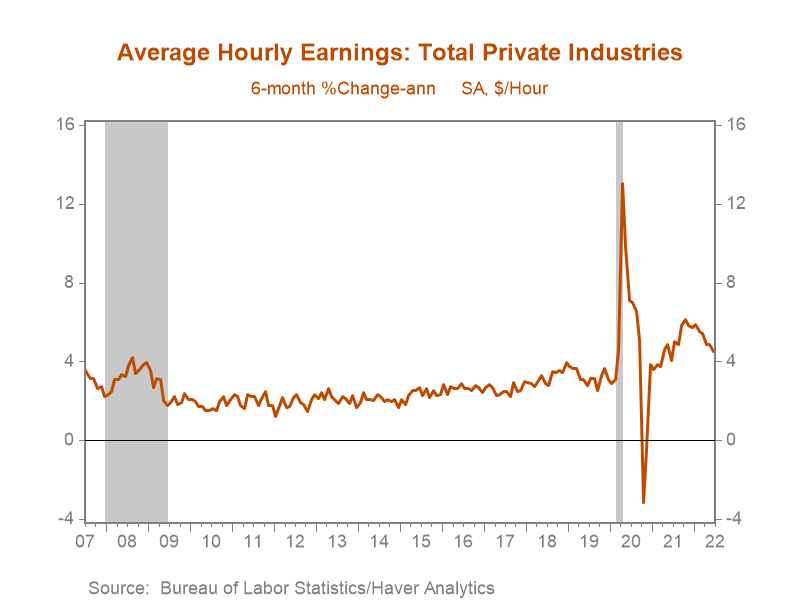

Despite these factors, growth in average hourly earnings (AHE), the best “real-time” gauge of nominal wages, has flattened, and the rate of growth has been trending down since October of last year (Chart 1). Other measures of nominal wage growth tell a decidedly different story. The Atlanta Fed’s Wage Growth Tracker (WGT) has continued to trend up and spiked in June. According to the WGT, median wage growth rose to 7.4% from 6.5% on a year-over-year basis. In contrast, the BLS’s official average hourly earnings data suggest nominal wage growth decelerated 0.2pp to 5.1% on a year-over-year basis (Chart 2).

The robust wage growth reflected in the Atlanta Fed’s WGT measure is seemingly more consistent with anecdotal evidence and data indicating labor markets remain extremely tight. Over the last six months, the BLS JOLTS data report that job openings have risen above 11 million. Moreover, the ratio of job openings to unemployed individuals rose to an all-time high of 2.0 in March and remains near this peak. Given the degree of labor market tightness, the sluggish observed growth in the BLS’s official average hourly earnings data stands out.

The higher wage growth in the FRB Atlanta WGT measure also meshes better with the strong growth in nominal spending and acceleration in business operating costs and inflation. The faster pace of nominal wage growth indicated by the WGT could potentially explain the resilience in nominal personal consumption and the relatively modest draw-down of household excess savings thus far.

Chart 1. Average Hourly Earnings (%, 6-month annualized)

Chart 2. Average hourly earnings and the Wage Growth Tracker trending in different directions

One benefit of the Atlanta Fed’s measure of wage growth is that it tracks the same people at 12-month intervals and observes the increase in their average hourly earnings today relative to 12 months ago. This may be a better gauge of underlying labor market trends at this moment than the BLS’s average hourly earnings data, which are heavily skewed by the composition of employment and may not pick up on one-off bonuses/incentives such as hazard pay and inflation-linked bonuses.

To construct the WGT in each month, the Atlanta Fed tracks around 2,000 people and calculates the median of the 12-month change in average hourly earnings across those individuals in each month. A disadvantage of this method is that only individuals who were employed today and twelve months ago will be included in the monthly sample. If these people differ systematically from the broader population, then the WGT is likely to misrepresent aggregate trends. According to the Atlanta Fed, the WGT sample tends to include a “slightly greater share of older, more educated workers in professional jobs.” If this historical tendency has held up through the pandemic, then it makes the acceleration in the WGT all the more striking. Wage growth during the pandemic was concentrated in lower-wage sectors that involved a higher degree of in-person contact. It is possible that the upward trend in the WGT reflects the broadening of wage growth pressures to higher-wage industries.

According to the WGT, while job switchers continue to experience higher wage growth than job stayers, the gap has narrowed in recent months (Chart 3). The widening of the gap between wage growth of job switchers and stayers likely reflects the degree of labor market tightness. This gap tends to flip during periods of slack labor markets such as the Great Financial Crisis, when job stayers experienced higher wage growth than switchers. The narrowing of the wage-change gap in June is a potential sign that wages are becoming more responsive to inflation for incumbents and existing employees.

Chart 3. 3-Month Moving Average of Median Wage Growth for Job Switchers vs Job Stayers

In summary, while there is no guarantee the Atlanta Fed’s Wage Growth Tracker is accurate, it provides an alternative measure of wage gains to the BLS’s average hourly earnings and aligns well with underlying economic momentum, rapid growth in employment through H1 2022, and ongoing labor market tightness.

If wage growth remained elevated or even accelerated, reflecting ongoing labor market tightness and a catch-up of wages to inflation, it would present Fed policymakers with a challenge as they seek to slow demand and cool inflationary pressures, and could necessitate a more aggressive policy stance. The Employment Cost Index for Q2, the Fed’s preferred gauge of nominal compensation, is released next week, and will provide more information about this important issue.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.