Durable goods orders and shipments growth slows in April

*Durable goods orders ticked up 0.4% m/m in April following a downwardly revised 0.6% m/m increase in March, pointing to a softer demand outlook for manufactured goods and business equipment investment in the coming months (Chart 1). In nominal terms, durable goods orders remain 14% above their pre-pandemic levels. Durable goods shipments increased 0.1% m/m, a significant slowdown from the 1.4% m/m increase in March (Chart 2). Notably, shipments of motor vehicles and parts edged down 0.1% over the month despite a sharp increase in motor vehicle assemblies in April.

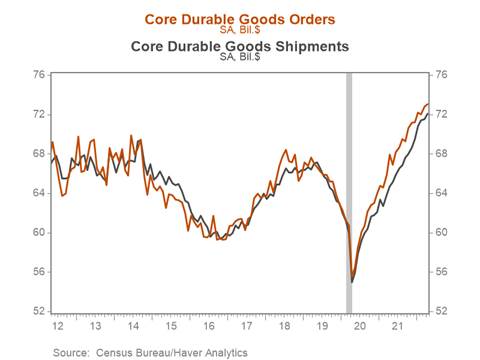

*Core durable goods orders (nondefense capital goods excluding aircraft), a gauge of underlying manufacturing demand decelerated, rising 0.3% m/m following a robust 1.1% increase in March. Core durable goods shipments, a proxy for business equipment investment in GDP, gapped up 0.8% m/m following a downwardly revised 0.2% m/m gain in March (Chart 3).

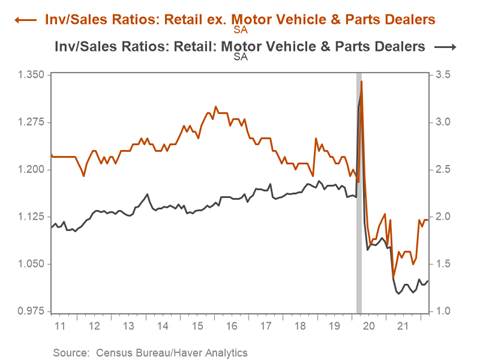

*Although we expect consumer demand for manufactured goods to moderate as the composition of consumption tilts back towards services, it will likely remain above its pre-pandemic trend in the near term. Moreover, inventories remain relatively low at the retail level, particularly among motor vehicle and parts dealers, and we anticipate inventory rebuilding will boost durable goods orders and shipments absent a sharp slowdown in retail demand. At the retail level, the inventory to sales ratios among motor vehicle and parts dealers has fallen to 1.3, compared to a pre-pandemic level of 2.2, while the retail inventory to sales ratio excluding autos is 1.1, compared to its pre-pandemic level of 1.2 (Chart 4).

*Durable goods shipments were mixed across industries. Primary metals (0.9%), machinery (0.2%), and computers and electronic products (0.5%) all posted solid monthly gains, while shipments of electrical equipment, appliances and components (-0.6%), and fabricated metal products (-0.2%) declined over the month. Supply chain disruptions associated with lockdowns in China likely contributed to the slowdown in shipments in April, while manufacturing sentiment surveys continue to point to labor shortages as restraints on production. As these constraints ease through 2022, shipments should rise to meet both new order and the backlog of unfilled orders, which has increased 7.4% since February 2020.

*Rising interest rates could begin to weigh on demand within certain manufactured goods sectors. For example, the moderation in home sales and housing market activity associated with higher mortgage rates and elevated home prices could restrain demand for household appliances and durables.

Chart 1. Durable Goods Orders

Chart 2. Durable Goods Shipments

Chart 3. Core Durable Goods (Nondefense Capital Goods ex. Aircraft) Orders and Shipments

Chart 4. Inventory to Sales Ratios

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.