Durable goods orders and shipments increase in March

*The U.S. March Durable Goods Report showed a solid 0.8% m/m increase in durable goods orders following an upwardly revised 1.7% decline in February, reflecting broad based increases in orders across the major manufacturing industries (Chart 1). The report is consistent with purchasing manager and sentiment surveys that pointed to strong demand for manufactured goods and still depleted inventories. Durable goods shipments increased by 1.2% m/m, the seventh consecutive monthly increase.

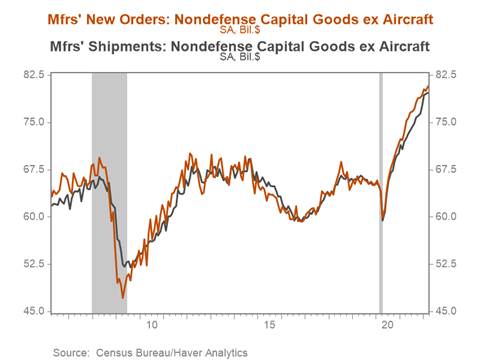

*Core durable goods orders and shipments (non-defense capital goods excluding aircraft) – a proxy for business equipment investment in GDP – increased 1% m/m and 0.2% m/m, respectively, and are 25% and 23% higher than their February 2020 levels in nominal terms (Chart 2). Tightening financial conditions, elevated inflation, Russia’s invasion of Ukraine, and the likely aggravation of supply bottlenecks due to China’s COVID-19 containment policies could weigh on durables goods orders and shipments.

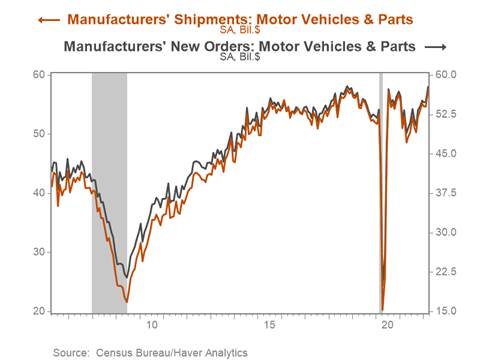

*Headline durable goods orders were boosted by a 5% m/m increase in motor vehicles and parts orders, lifting motor vehicle and parts orders to their highest level since October 2018. Shipments of motor vehicles and parts also jumped, rising 5% over the month, suggesting supply and material shortages which have constrained auto production through the pandemic might be easing (Chart 3), and is reflected in data pointing to an increase in domestic motor vehicle production and assembly in March.

*Durable goods orders expanded across eight of the nine primary categories of durable goods orders, although the growth in shipments was slightly less broad based, with shipments of communications equipment (-3.2% m/m) and aircraft and parts (-5.9%) both declining in March.

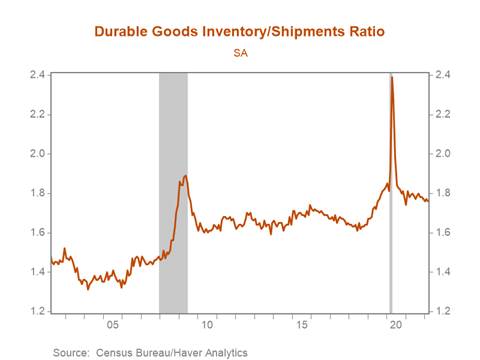

*Durable goods inventories increased 0.7% m/m and the inventory-to-shipment ratio ticked down to 1.76, modestly below the pre-pandemic level (Chart 4). We expect continued growth in durable goods orders and shipments to meet current demand, replenish depleted inventories, and to facilitate business equipment investment.

Chart 1. Durable Goods Orders

Chart 2. Core Durable Goods Orders and Shipments (non-defense capital goods ex. aircraft)

Chart 3. Motor Vehicle and Parts Orders and Shipments

Chart 4. Durable Goods Inventory to Shipment Ratio

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.