Existing home sales decline in February while supply remains low

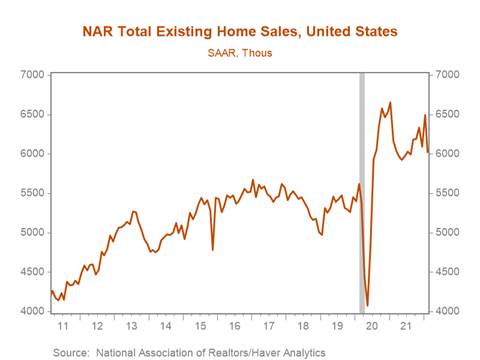

*Existing home sales declined 7.2% in February to 6m annualized, a 500k decline from January with sales broadly lower across different regions (Chart 1). Existing home sales are well above their pre-pandemic trend, and the twelve-month moving average remains 700k above its pre-pandemic level. The median sales price of existing single-family homes ticked up to $364k, reflecting strong demand amid extremely limited inventory. The total number of existing homes available for sale remained near an all-time series low, rising 20k to 870k, while the months’ supply of existing homes ticked up to 1.7 months, and remains less than half its 2018-19 average of 4 months.

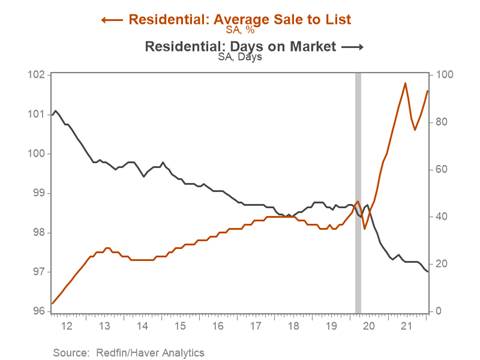

*Tight supply amid strong demand is reflected in the average number of days a listing remains on the market, which ticked down to 17 days in January, while the average sale-to-list price ratio edged up to 101.6%, pointing to bidding wars and strong competition among prospective home-buyers (Chart 2).

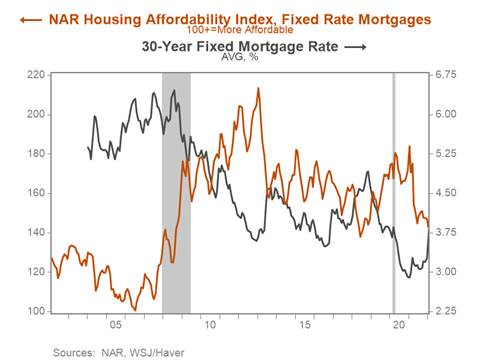

*Reflecting the sharp increase in mortgage rates (Chart 3) and surging home prices, the National Association of Realtors’ Housing Affordability Index, which compares the hypothetical mortgage payment on a median priced home to median household incomes, has fallen to 143 from a peak of 184 in January 2021, pointing to declining affordability, although notably this measure suggests houses remain more affordable than during the debt-financed housing bubble pre-2008.

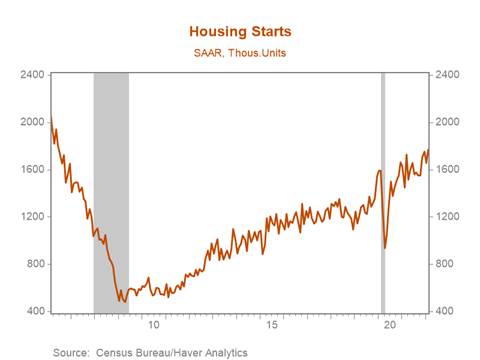

*Housing starts ticked up to 1.77m annualized in February, their highest level since 2006 with solid gains in both single-family (+65k) and multi-family starts (+47k) (Chart 4). February’s starts data marks a modest rebound from January, a month in which adverse winter weather delayed construction and elevated levels of COVID-19 cases exacerbated ongoing labor supply shortages in the industry. Robust growth in housing starts has been supported by pent-up demand for housing, expectations of further home price appreciation, and real interest rates that remain deeply negative.

*Building permits ticked down to 1.86m annualized, but remain near their pandemic high, with the bulk of February’s decline in permits attributable to softer multi-family permit issuance. Permits edged up in the Northeast (+30k) and West (+10k) but fell in the South (-55k), with the decline in the South driven by a 64k fall in multi-family permits although permits in the South remain well above pre-pandemic levels.

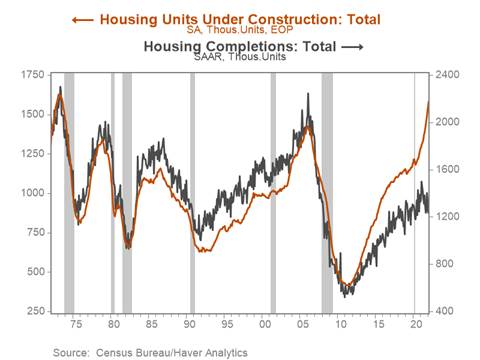

*The pipeline of home construction points to a sizeable number of single and multi-family units that should hit the market in 2022-24, although material and labor shortages continue to weigh on construction. The number of housing units permitted but not started ticked up to an all-time high of 270k as did the number of housing units under construction, which rose to 1.58m (Chart 5). Housing completions have lagged and remain close to their pre-pandemic level despite the surge in housing demand over the past two years, with completions rising to 1.3m annualized in February, just 15k above their February 2020 level.

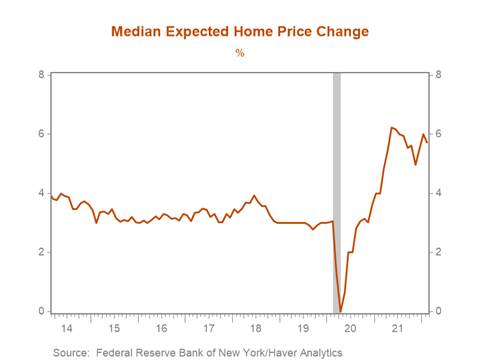

*Construction costs remain elevated, rising 16.7% yr/yr in January, and upward cost pressures are likely to intensify in the near term reflecting the recent surge in industrial commodity and lumber prices, paired with rising labor costs. The labor shortage in construction is acute – despite the acceleration in construction activity, employment in the sector remains below its pre-pandemic level, and job openings in the sector are 40% higher than their 2019 average. Thus far homebuilders have been able to pass on increased costs to home buyers, but further increases in mortgage rates and the extent of price appreciation in the past two years paired with a cooling of home price appreciation expectations (Chart 6) may limit pricing power.

Chart 1. Existing home sales

Chart 2. NAR Housing Affordability Index vs. 30-yr FRM

Chart 3. Sale-to-list ratio vs. days on market

Chart 4. Housing starts (SAAR)

Chart 5. Housing units under construction & housing completions

Chart 6. Median home price change expectations

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.