Further housing market cracks appear in June data

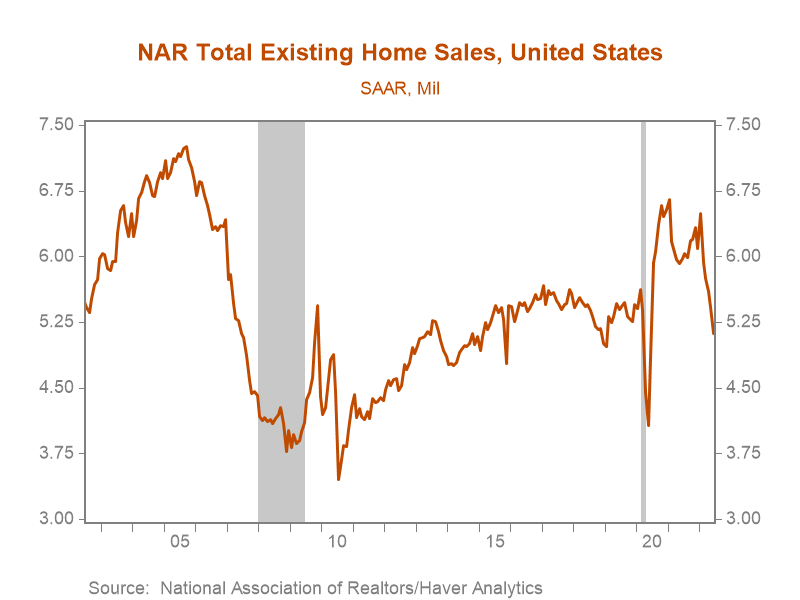

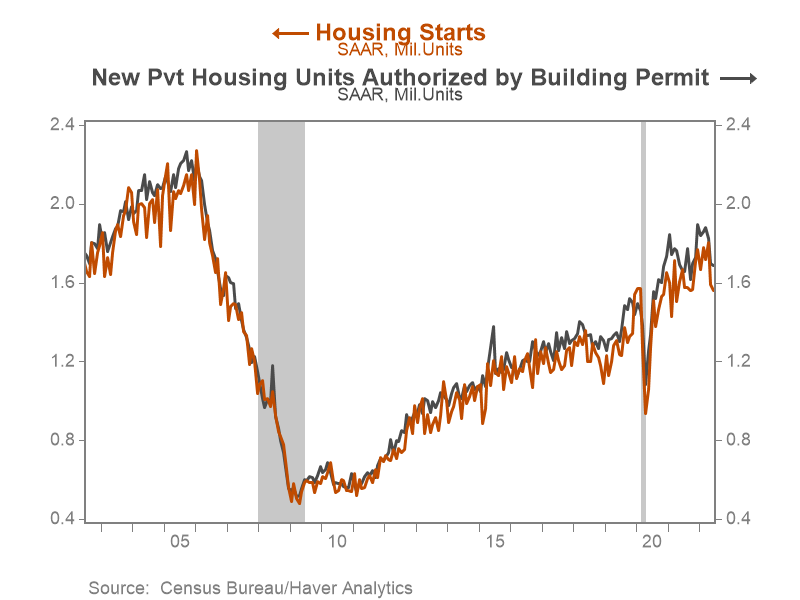

*Tightening financial conditions and surging home prices have eroded housing affordability and significantly slowed the pace of both home sales and construction. Existing home sales fell 5.4% in June to 5.1 million annualized, the fifth consecutive monthly decline, leaving the Q2 average 13% lower than in Q4. Sales are now at their lowest level since the May 2020 pandemic trough and have fallen 1.2 million annualized from their peak in November 2021 (Chart 1). New construction has also slowed markedly, with building permits and housing starts declining from 0.6% and 2% m/m, respectively (Chart 2).

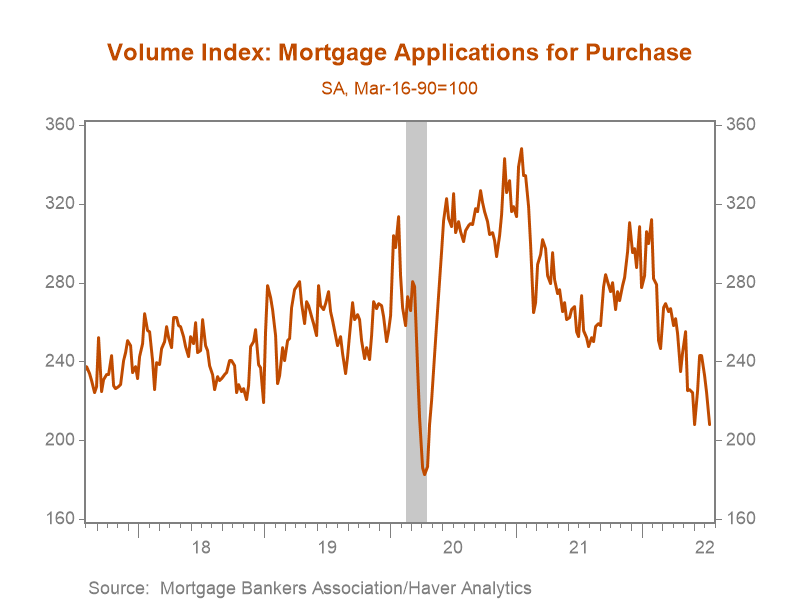

*Existing home sales are a lagging indicator as they are recorded when sales contracts close, and typically reflect housing market conditions with a 1–2-month lag. More timely indicators, such as mortgage origination volumes have slowed significantly. According to the Mortgage Bankers Association, the volume of mortgage applications for purchase have declined 30% from their January peak (Chart 3). New home sales, a timelier indicator that records sales when contracts are signed, is likely to show further weakness. Data through May points to a 16% decline in sales from the January peak, and data for June, released Tuesday next week, are likely to show a further moderation. Amid reports from home builders of a surge in cancellations and rising cancellation rates, it is likely that new home sales data in the coming months will overstate total sales as the Census Bureau does not adjust or revise new home sales data to account for cancelled sales contracts.

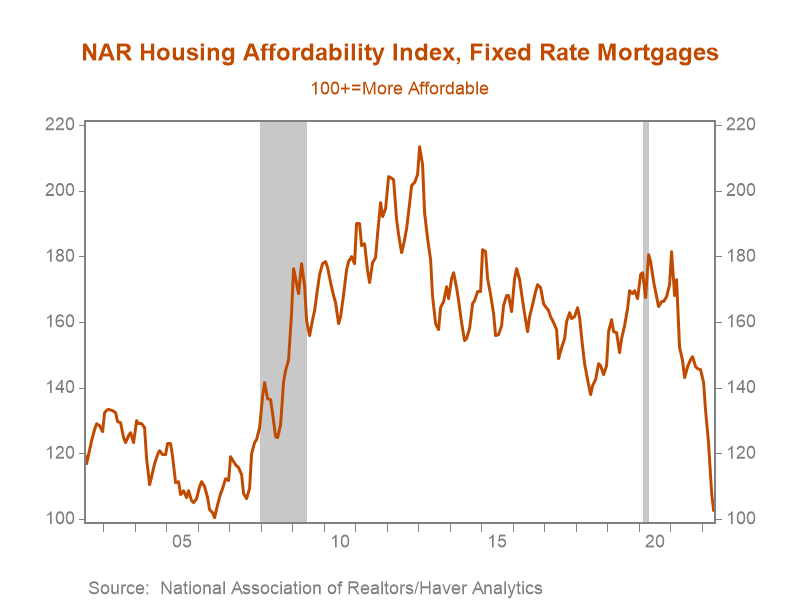

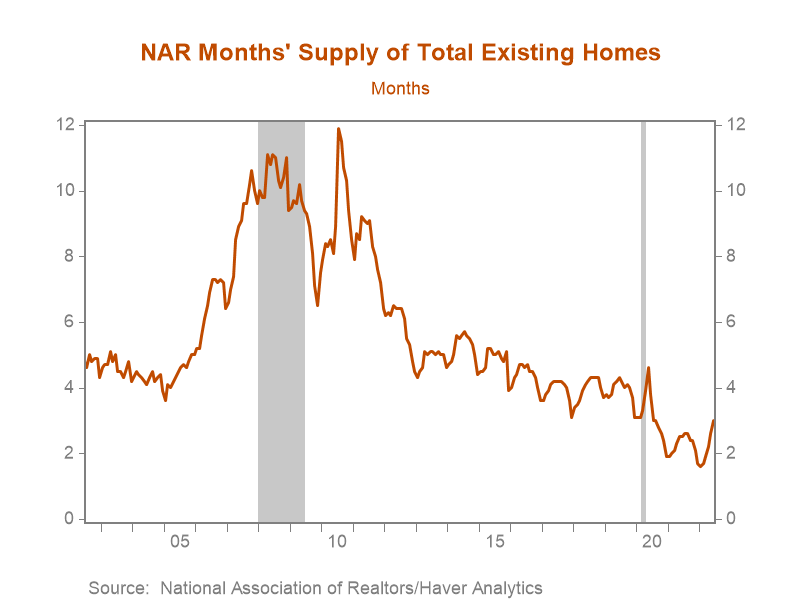

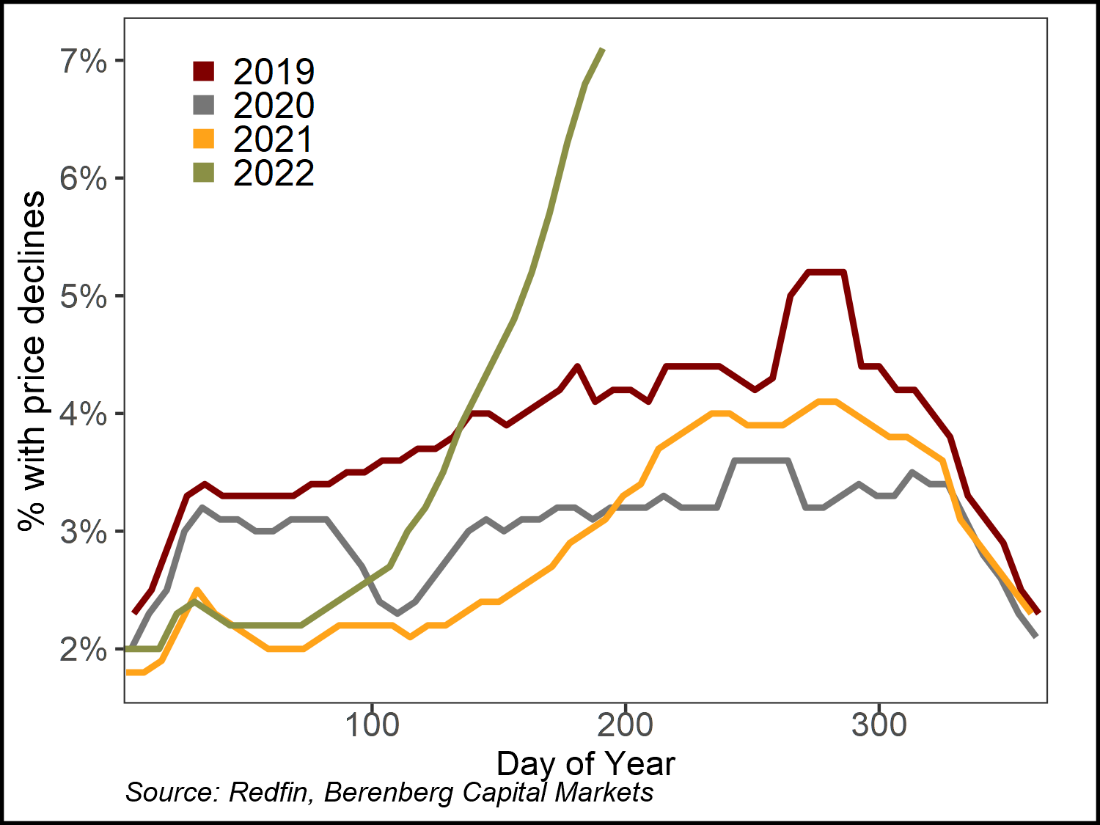

*Despite the moderation in sales activity, median home prices continue to trend up and rose to $416k in June. Ongoing increases in home prices and the sharp rise in mortgage rates have driven housing affordability to the lowest levels since 2006. The National Association of Realtor’s Housing Affordability Index declined to 102.5, a 30% decline ytd (Chart 4). Easing demand is beginning to provide some relief to still tight inventories of houses on the market and should contribute to a moderation in the pace of home price appreciation. The months’ supply of existing homes has increased for four consecutive months rising to 3 months in June, a modest improvement relative to the 2.5 months in June 2021 but still well below the average months’ supply in June prior to the pandemic, which saw inventories average closer to 4.2 months (Chart 5). The rise in inventories has been matched by a rise in the proportion of active home listings that have seen price cuts, which rose to 7.1% in the four-week period ending July 10, according to data from Redfin (Chart 6).

*Reflecting expectations of softer demand, building permits and housing starts have eased from their recent highs. Single family starts have declined in six of the last seven months and permits have fallen for four consecutive months. Interestingly, multifamily starts and permits continued to trend up, rising to 580k and 720k annualized, respectively. One factor underpinning this divergence between the single-family and multi-family construction outlook may be expectations of continued robust rental growth, in part driven by prospective home buyers priced out of the housing market turning to the rental market instead. The number of housing units under construction ticked up to 1.68 million and we expect home builders to focus on ramping up completions and working through the backlog of existing projects, efforts likely to be bolstered by easing supply chain disruptions.

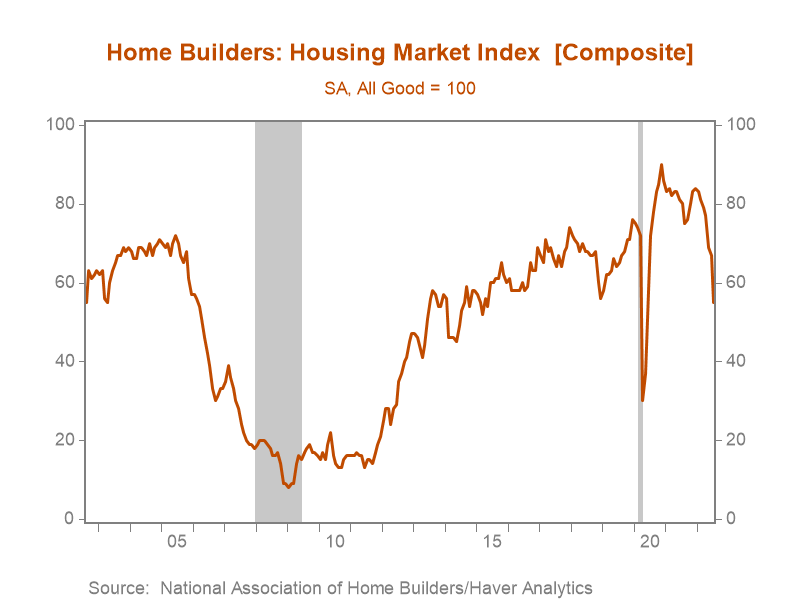

*Home builder sentiment continues to plummet. The NAHB’s Housing Market Index (HMI) plummeted 12pts in June to 55, reflecting a sharp deterioration in current sales, expected sales, and prospective buyer traffic (Chart 7). Declining competition among home buyers will alleviate some of the upward pressures on home prices and further limit the flexibility of home builders to pass on sharp increases in their input costs to consumers. On a six-month annualized basis, construction costs increased 18.3% in May, and incomplete cost pass through is likely to crimp home builder margins in coming months.

Chart 1. Existing Home Sales (SAAR)

Chart 2. Housing Starts and Building Permits (SAAR)

Chart 3. Mortgage Loan Applications for Purchase – Volume Index

Chart 4. National Association of Realtors Housing Affordability Index

Chart 5. Months’ Supply of Existing Homes

Chart 6. Percentage of Active Listings with Price Declines

Chart 7. NAHB’s Housing Market Index

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.