Industrial production firms in April

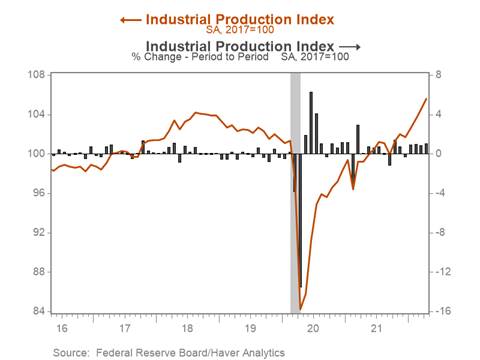

*Industrial production increased 1.1% m/m in April, the fourth consecutive monthly increase, with growth broad based across sectors (Chart 1). Industrial production has accelerated through 2022, rising at a 12.2% three-month annualized rate in April. Results of purchasing manager and business surveys point to robust current production and sizable order backlogs but suggest the pace of new order growth has begun to decelerate. Although Russia’s invasion of Ukraine and China’s lockdowns pose near term supply-side risks, we expect supply constraints and bottlenecks to ease through 2022.

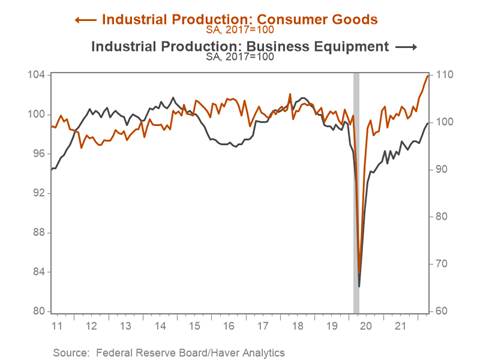

*Production of consumer goods ticked up 0.8% m/m, bolstered by increased production of home electronics, autos, and a 1.1% m/m increase in energy goods production, that has lifted consumer goods production 4% above its January 2020 level (Chart 2). Production of business equipment edged up 1.1% m/m, largely reflecting a 3.3% monthly increase in transit equipment production and a 0.7% increase in information processing equipment. Rising domestic production of consumer goods should help realign supply and demand and ease some price pressures, particularly among durable goods.

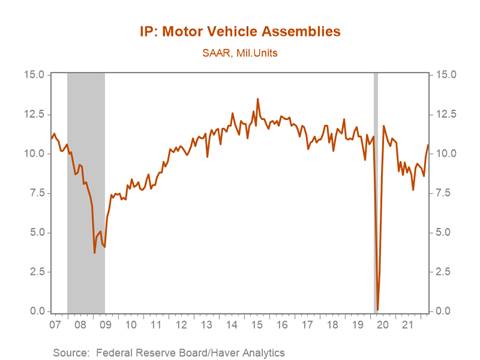

*Motor vehicle and parts production increased 3.9% m/m following an 8.4% m/m increase in March, with motor vehicle assemblies increasing to 10.6 million units on an annualized basis (Chart 3). Auto inventories are well below their pre-pandemic levels in real terms, particularly at the retail level, which together with strong current demand should lift auto production as semiconductor and parts shortages ease. Robust motor vehicle production growth is reflected in a jump in motor vehicle capacity utilization, which increased to 75.2%, the highest level since July 2020. More broadly, total industrial capacity utilization ticked up 0.8pp to 79%, well above February 2020’s 76.3% but still below the 2018 peak of 79.9%.

*Manufacturing production increased 0.7% m/m, and 0.5% m/m when excluding motor vehicle and parts production. Durable and nondurable goods manufacturing both advanced in April, increasing 1% m/m and 0.3% m/m, respectively, although monthly changes across industry groups were mixed. Production of fabricated metal products (0.8%), machinery (0.8%), and primary metals (1.3%) increased over the month, while production of furniture (-0.6%), and electrical equipment, appliances, and components declined (-0.7%).

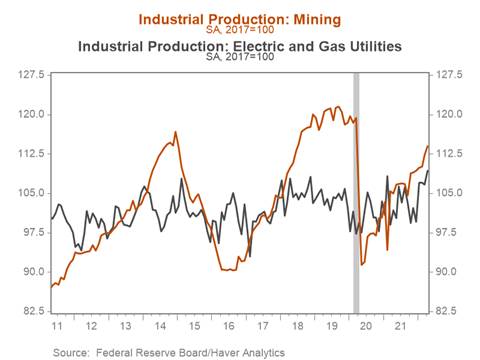

*Mining production jumped 1.6% m/m and has increased 4.7% in the last five months, but remains 4.8% below its January 2020 level. Utilities production increased 2.4% m/m and will likely be associated with higher services consumption in Q2 GDP (Chart 4). Despite investor pressure for oil and gas companies to exercise capital discipline, oil and gas well drilling production continues to ramp up, increasing 3.2% m/m in April, and 57% on a six-month annualized basis. Oil and gas well drilling production remains 4% below its March 2020 level, and sustained expansion in drilling activity will be required to make up for under investment during the pandemic. The pickup in oil and gas well drilling across the oil patch should boost structures and equipment investment through 2022.

Chart 1. Industrial Production

Chart 2. Industrial Production – Consumer Goods and Business Equipment

Chart 3. Motor Vehicle Assemblies

Chart 4. Mining and Utilities Production

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.