Industrial production ticks up in May even as manufacturing slips

*Headline industrial production increased 0.2% m/m in May following an upwardly revised 1.4% m/m gain in April, lifting production 4% above its January 2020 level (Chart 1). May’s increase reflects sharp increases in mining and utilities production which increased 1.3% and 1% respectively, offset by weaker production within certain durable goods sectors. While production of durable consumer goods edged up 0.1% m/m, this largely reflects robust auto production. Production of appliances, furniture, and carpeting declined 2.6% m/m – the fourth consecutive monthly decline – and could exhibit further weakness in coming months as housing market activity slows in response to rising mortgage rates.

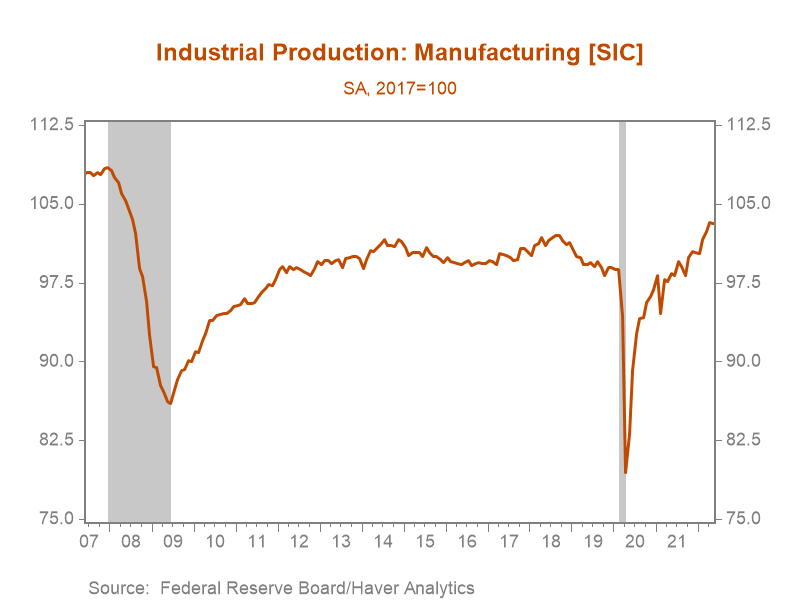

*Manufacturing production declined 0.1% m/m following robust back-to back 0.8% monthly increases in March and April (Chart 2). Weaker manufacturing output was largely the culprit of a 0.3% m/m decline in durable goods manufacturing following a period of robust growth through April which saw durable goods production rise 3.5% from January-April. Monthly declines in production were pronounced in machinery (-2.1%), fabricated metal products (-0.8%), and electrical equipment, appliances, & components (-1.9%). The shift in consumer spending from durable goods to services, together with normalization of inventories and inventory-sales ratios within retail and wholesale trade sectors closely linked to durable goods consumption skews risks to consumer durable goods production to the downside.

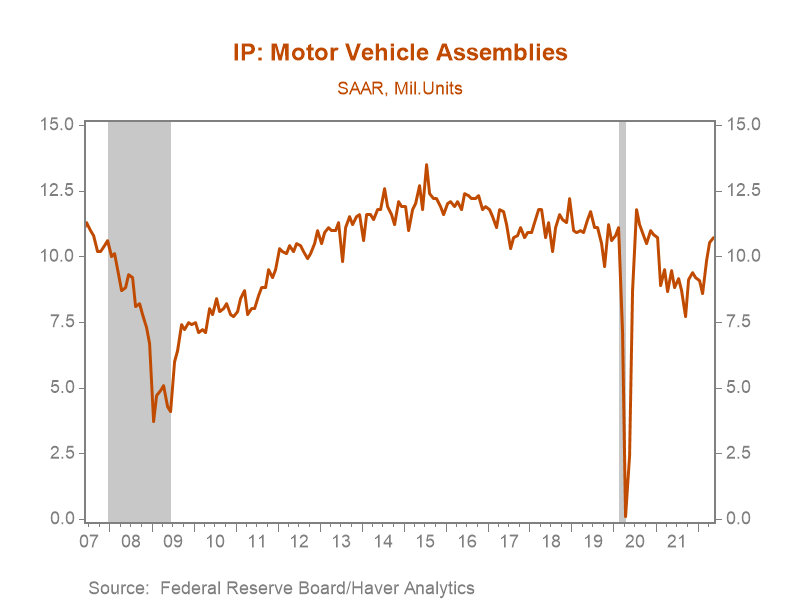

*One bright spot in May’s industrial production report is the continued recovery of auto production, with motor vehicle and parts production increasing 0.7% m/m. This increase is mirrored in motor vehicle assembly data through May, with total assemblies increasing to 10.7 million annualized, just 0.4 million below the level in February 2020 (Chart 3). Significantly depleted inventories at the retail level, pent up demand for new vehicles, and an easing of the semiconductor and parts shortage through the end of 2022 should support auto production.

*Energy production increased for the second consecutive month, rising 1.4% as producers slowly begin to expand supply in response to elevated energy commodity and fuel prices. Oil and gas well drilling production has surged from its mid-2020 nadir, and is now above its pre-pandemic level. Well drilling production accelerated through 2022 in response to higher crude oil prices, rising 6.2% in May, lifting the year-to-date increase to 27% (Chart 4). Through the pandemic, oil producers relied extensively on tapping drilled but uncompleted wells (DUCs) to maintain production, significantly depleting their stocks of DUCs, so just maintaining production at current levels will necessitate increased capital expenditure on drilling and exploration.

Chart 1. Industrial Production Index

Chart 2. Manufacturing Production

Chart 3. Motor Vehicle Assemblies

Chart 4. Industrial Production - Oil and Gas Well Drilling

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.