May Producer Price Index suggests pipeline inflationary pressures remain elevated

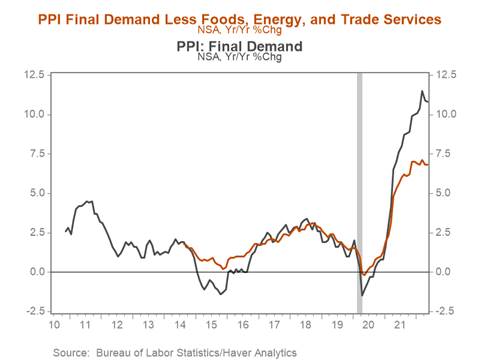

*The headline Producer Price Index (PPI) increased 0.8% m/m in May following a downwardly revised 0.4% gain in April, lowering the yr/yr increase 0.1pp to a still lofty 10.8%. Core PPI (excluding food, energy, and trade services) – a better gauge of underlying price pressures – advanced 0.5% over the month following a downwardly revised 0.4% increase in April, leaving the yr/yr change flat at 6.8% (Chart 1).

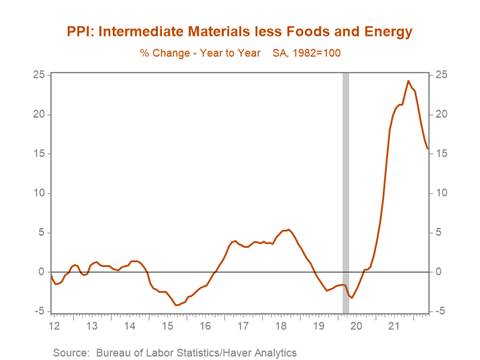

*Pipeline inflationary pressures continue to mount, suggesting that a moderation of inflation to levels consistent with the Fed’s 2% target will be a drawn-out process, with risks tilted to the upside. Prices of intermediate goods prices excluding food and energy accelerated in May, rising 1.7% m/m, the sharpest monthly increase since June of last year (Chart 2). Prices of materials and components for manufacturing jumped 2.1% m/m, while prices of materials for durable goods manufacturing advanced 4% over the month.

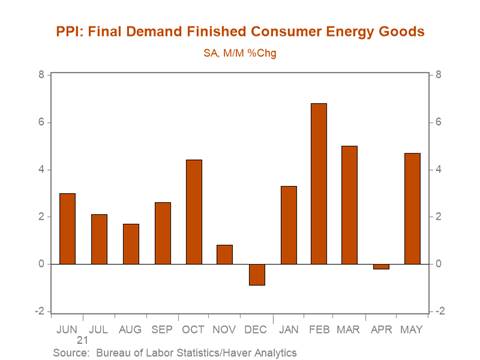

*May’s robust increase in producer prices partly reflects significant increases in energy commodity prices that pushed final demand energy and finished consumer energy goods prices up 5% and 4.7% m/m, respectively (Chart 3). With refined energy commodity prices up significantly in the first half of June, which look poised to remain elevated through the end of the month, energy prices will likely contribute to another robust m/m increase in producer and consumer prices in June. Moreover, these higher energy costs are likely contributing to sharp increases in distribution and transportation costs, with final demand transportation and warehousing services prices surging 2.9% m/m.

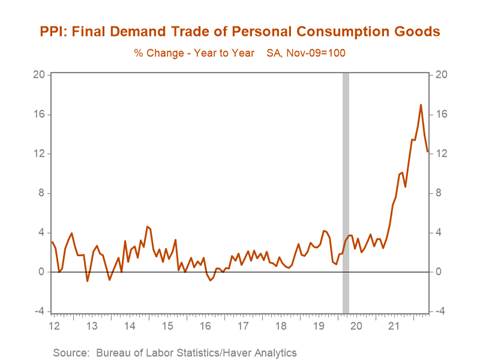

*However, even when excluding food and energy prices, goods prices continue to post sharp m/m gains. Nondurable consumer goods prices spiked 1% m/m, the steepest m/m increase since 2017, while durable consumer goods prices increased 0.7% m/m. Amid elevated inflation, which is eroding real disposable income, and slowing trend nominal wage growth, which is beginning to restrain consumer demand, May’s PPI print provides additional evidence that retail and wholesale margins are coming under further pressure. Prices for the trade of finished goods – a gauge of retailer and wholesaler margins – increased a modest 0.2% on the heels of a 0.6% decline in April, while prices of trade in personal consumption goods were flat in May after posting a 0.5% decline in April (Chart 4).

*Margins are likely to come under further pressure in coming months, reflecting the accumulated impact of elevated prices and steep increases in inventory-sales ratios within certain sectors at the retail and wholesale level that will lower the flexibility businesses have had in passing on rising costs to consumers.

Chart 1. Headline and Core (ex. food, energy, and trade services) PPI (yr/yr %)

Chart 2. Intermediate Materials (ex. Food and Energy) Old Methodology (yr/yr %)

Chart 3. Final Demand Finished Consumer Energy Goods (m/m %)

Chart 4. Final Demand Trade of Personal Consumption Goods

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.