Real GDP contracts in Q1 driven by inventories and trade deficit

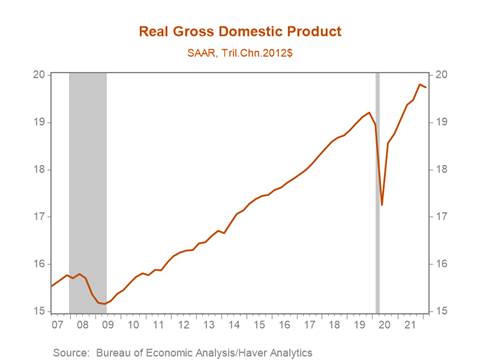

*U.S. real GDP contracted by 1.4% q/q annualized in Q1, a sharp deceleration from Q4’s 6.9% increase, largely driven by a sizable increase in the trade deficit and slower inventory investment relative to Q4 which subtracted 3.2pp and 0.8pp from annualized GDP growth (Chart 1). Despite the negative headline print, the underlying domestic demand backdrop was solid in Q1. Personal consumption increased 2.7% q/q annualized, with the mix of composition suggesting demand is shifting away from goods and toward services. Real business fixed investment, particularly in equipment was robust, while real residential investment expanded modestly reflecting a modest pickup in housing starts. The Fed understands these details and should proceed with a decision to raise rates 50 basis points and begin unwinding the balance sheet at its FOMC meeting next week.

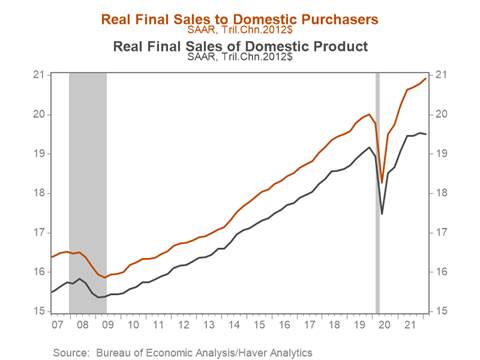

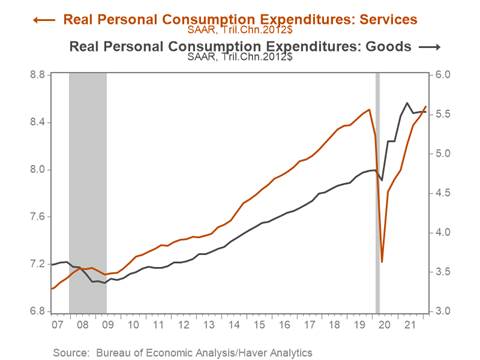

*Final real sales of domestic product declined a modest 0.6% annualized, reflecting weaker exports, with final real sales to domestic purchasers advancing 2.6% (Chart 2). Real consumption, which accounts for 70% of GDP contributed 1.8pp to GDP growth, underpinned by a rotation from goods to services consumption: services consumption boosted growth by 1.9pp, while goods consumption subtracted marginally from real growth, reflecting significant declines in real consumption of gasoline and energy (Chart 3). Looking ahead, real services consumption is likely to pick up further as the economy reopens more fully with the advent of the summer holiday season, while moderating goods consumption will likely continue to subtract from GDP growth in Q2.

*The strength in personal consumption is striking given the impact of the omicron variant, ongoing labor and supply shortages, and the acceleration in headline inflation through the latter portion of Q1 which eroded real disposable income and purchasing power. While household balance sheets largely remain healthy, and pent up demand for services remains strong, real disposable income has declined for seven consecutive months, the personal savings rate declined to 6.6% in Q1, and real consumption contracted in February and likely contracted modestly in March as well given the Q1 real consumption print. Tightening financial conditions, generally negative consumer sentiment, and inflation that is likely to remain elevated through 2022 tilts consumption risks to the downside.

*Real residential fixed investment increased a modest 2.1% annualized, but remains below its Q1 2021 level. Material and labor shortages paired with inclement weather earlier in the year crimped construction and housing starts, contributing to a significant backlog of homes under construction. Sharp increases in mortgage rates since the turn of the year are likely to weigh on new construction and home sales. Mortgage originations have fallen sharply in recent months, and existing home sales have slowed in response to soaring home prices and the deterioration in housing affordability.

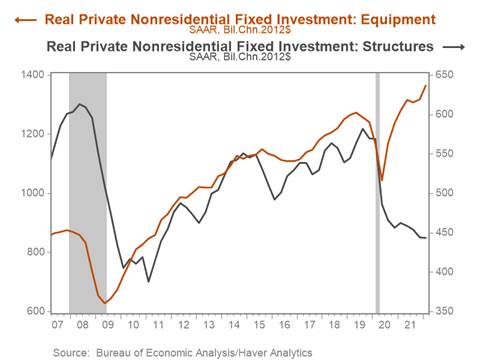

*Business fixed investment jumped 9.2% q/q annualized, reflecting a 15.4% annualized spike in equipment investment that more than offset a modest 1% annualized decline in structures investment (Chart 4). Core durable goods orders and gauges of manufacturing sentiment point to sustained growth in equipment investment, while investment in structures and equipment is likely to be buoyed by a burgeoning response from the oil patch in response to elevated energy commodity prices. Risks, however, are tilted to the downside. Russia’s invasion of Ukraine and disruptions to supply chains and manufacturing in China in the wake of lockdowns in response to COVID-19 could exacerbate supply shortages and elongate disruptions to product distribution. Businesses continue to retain significant amounts of cash on hand, which paired with still negative real rates should continue to support business fixed investment even as financial conditions tighten.

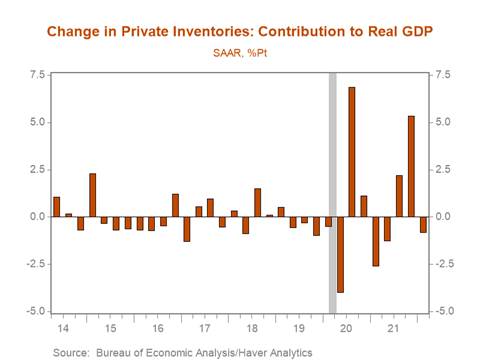

*Private inventory investment represented a significant drag on Q1 real GDP growth (-0.8pp), which partly reflects a natural moderation following the outsized lift it provided to growth in Q4 (+5.3pp). Although real private inventories increased by $160 billion annualized in Q1, what is relevant for GDP growth is the change in the change in private inventories. Consequently, because Q1’s $160 billion increase was lower than the $190 billion jump in Q4, the change in the change in private inventories was negative, and subtracted from real GDP growth (Chart 5). The real stock of private inventories remains below pre-pandemic levels, and inventory depletion is particularly severe at the manufacturing and retail trade levels, particularly in the auto industry.

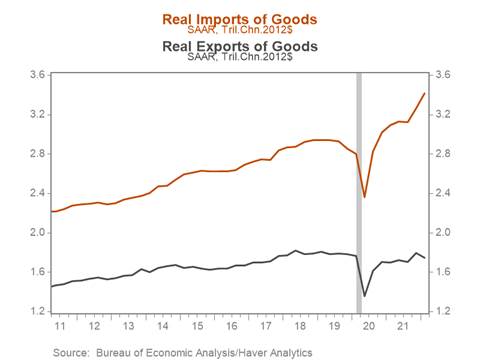

*Net exports subtracted 3.2pp from real GDP growth, as imports surged ($155bn) and exports slumped ($36bn). The rise in imports and decline in real exports were concentrated in goods to meet demand and restock shelves (Chart 6). Softer global growth, risks to Europe, and the stronger dollar could weigh on exports in the near term.

*Federal government purchases declined 5.9% annualized, reflecting continued declines in both defense (-8.5% ann.) and non-defense spending (-2.2% ann.). State and local government purchases declined modestly (0.8% ann.) but have recovered close to pre-pandemic levels, and this decline, together with that in federal government expenditures subtracted 0.5pp from real GDP growth in Q1. State and local government coffers are flush, and in response to accelerating food and energy prices will likely implement a raft of tax cuts and stimulus measures that will likely boost real output, although any fiscal transfer payments will not be measured directly in GDP.

Chart 1. Real Gross Domestic Product (SAAR)

Chart 2. Real Final Sales to Domestic Purchasers and Real Final Sales of Domestic Product

Chart 3. Real Personal Consumption of Services vs. Goods

Chart 4. Real Business Fixed Investment – Equipment and Structures

Chart 5. Change in Private Inventories Contribution to Real GDP Growth

Chart 6. Real Exports of Goods and Real Imports of Goods

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.