Retail sales decline in May as inflation bites

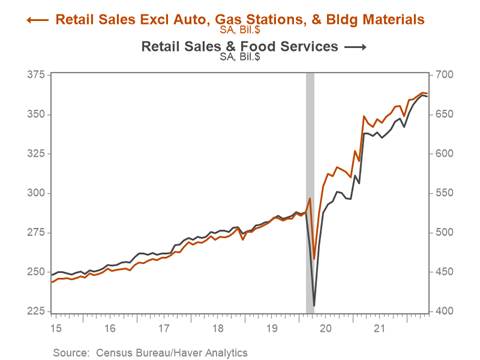

*Driven by a broad-based deceleration in nominal spending, and a sharp contraction in spending on autos and other durable goods, retail sales declined 0.3% m/m in May following a downwardly revised 0.7% m/m increase in April. Control group retail sales (excluding autos, gasoline stations, and building supplies) which will enter directly into Q2 calculations of private consumption were flat over the month following a significant 0.5pp downward revision to April’s data (Chart 1).

*Together, the data suggest the spike in headline inflation in recent months together with slowing nominal wage growth is beginning to restrain consumer spending. Moreover, the data point to slowing consumption of durable goods and suggest the rotation in consumption from goods to services is gathering momentum. The downward revisions to control group retail sales and flat report in May point to softer real consumption growth in Q2, although this could be offset by a further acceleration in real consumption of services.

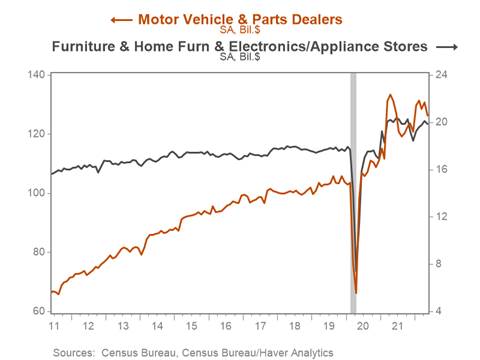

*May’s decline in retail sales was underpinned by a 3.5% m/m decline in spending on motor vehicles and parts. This reflects a mix of still limited inventories, lofty auto prices, and surging retail gasoline prices that likely pinched demand (Chart 2). Spending on durable goods more broadly softened in May. Sales at furniture, home furnishing stores, and electronics & appliance stores moved down 1.1% m/m and, with the slowing pace in housing market activity, are poised to weaken further in the coming months. Sales at general merchandise stores ticked up 0.1% m/m on the heels of a 0.5% m/m decline in April. The deceleration in nominal sales growth paired with rapid inventory accumulation in this sector could prompt further price cuts across durable goods categories through 2022.

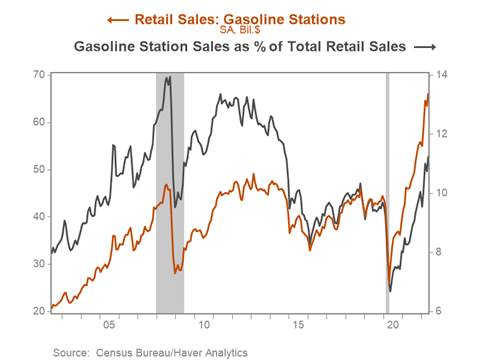

*Nominal spending at gasoline stations jumped 4% m/m reflecting the acceleration in retail gasoline prices from $4.2/gallon to $4.6/gallon through May together with the start of the peak driving season. Retail gasoline prices have continued to climb through June while demand has remained resilient reflecting pent-up demand for travel during the summer holiday season. Spending at gasoline stations has jumped to 11.2% of total retail sales, significantly above the pre-pandemic level but well below the 2008 peak of 14% (Chart 3).

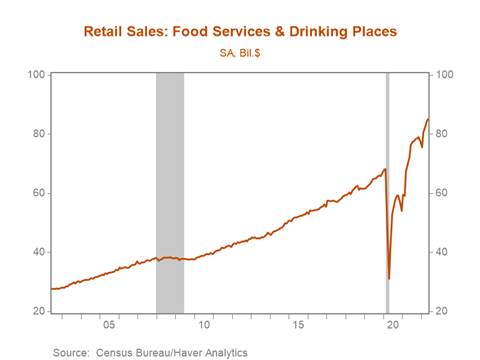

*Sales at food services and drinking places increased 0.7% over the month, a sharp deceleration from April’s exuberant 2.5% increase (Chart 4). While we expect pent-up demand for dining out to support continued growth in spending at restaurants and drinking places through the summer, May’s retail sales report suggests the pace of growth could moderate in the months ahead. With gauges of consumer sentiment at all-time lows, and headline inflation likely to accelerate again in June, consumers could begin to pull back on some discretionary services consumption.

Chart 1. Control Group Retail Sales (ex. autos, gas stations, building materials) and Retail Sales

Chart 2. Retail Sales at Motor Vehicle & Parts Dealers and Furniture, home furnishing, electronics & appliance stores

Chart 3. Retail Sales at Gasoline Stations and Gasoline Station Sales as % of Total Retail Sales

Chart 4. Retail Sales – Food Services and Drinking Places

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.