Retail sales growth moderates in February

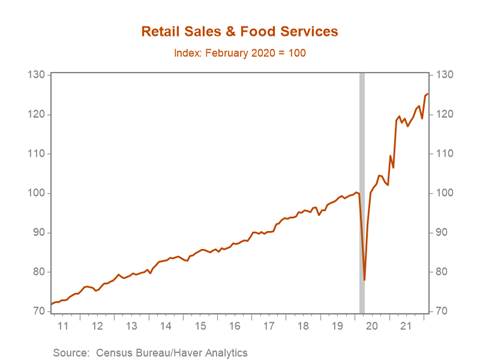

*Retail sales ticked up 0.3% m/m in February on the heels of a significantly upwardly revised 4.9% m/m gain in January, with the deceleration reflecting more modest growth in motor vehicle sales and softening non-store retail sales (Chart 1). Retail sales remain 25% above their pre-pandemic levels and, despite decelerating in February, expanded at an 11.8% six-month annualized pace. February’s retail sales data does not reflect the full effect of Russia’s invasion of Ukraine and associated spikes in gasoline and energy commodity prices or the hits to consumer confidence, which could weigh on retail sales and consumption in the coming months.

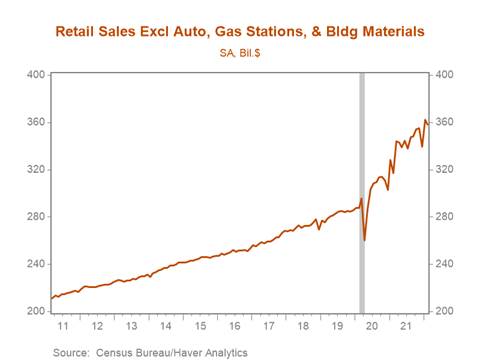

*Control group retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into Q1 GDP, declined 1.2% m/m, reflecting a 3.7% drop in non-store retail sales, which accounted for $3.6 billion of the $4.2 billion decline in control group retail sales (Chart 2). The fall in non-store retail sales is consistent with the decline in COVID-19 cases through February and high frequency mobility data pointing to increased throughput at retail and recreation locations over that period.

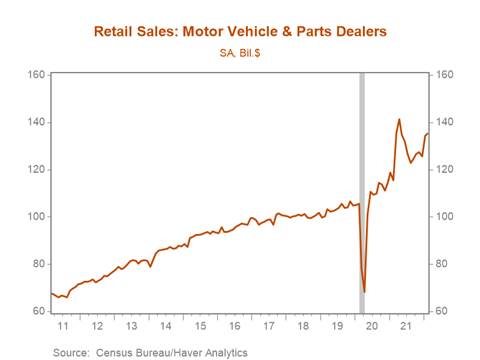

*Sales growth across retail sales categories was mixed, with just seven of the thirteen major retail sales categories advancing in February. Notably, sales declined at furniture and home furnishing stores (-1% m/m), health and personal care stores (-1.8% m/m), and general merchandise stores (-0.2%). Sales at motor vehicles and parts dealers increased 0.8% m/m following a robust 6.9% m/m increase in January, but ongoing supply shortages exacerbated by Russia’s invasion of Ukraine, surging commodity prices, and the rapid spread of COVID-19 across key manufacturing and shipping hubs in China amid depleted inventories could constrain future sales (Chart 3).

*Retail sales at gasoline stations jumped 5.3% m/m in February, reflecting sharp increases in retail gasoline prices, which rose from a national average of $3.3/gallon at the start of February to $3.6/gallon at the end of the month. Current retail gasoline prices are close to $4.3/gallon and will further boost retail sales at gasoline stations in March. Strong sales at gas stations contributed significantly to February’s retail sales growth and, excluding gasoline stations, retail sales declined 0.2% m/m.

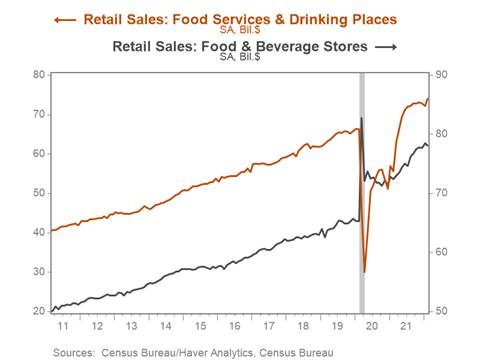

*There is evidence that consumption patterns associated with a return to “normal” are beginning to pick up. Sales at food services and drinking places rose 2.5% m/m and are likely to rise further as the summer holiday season approaches, while sales at food and beverage stores declined 0.5% m/m (Chart 4). Sales at clothing and accessory stores ticked up 1% m/m and have increased in five of the last six months.

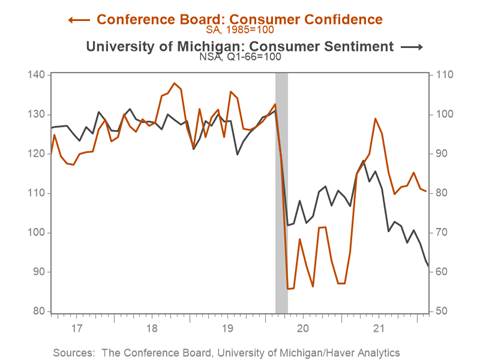

*Despite moderating growth in February, retail sales remain well above pre-pandemic levels. Continued strong payroll employment growth paired with tight labor markets are likely to boost nominal wage growth, and households continue to maintain a sizeable buffer of excess savings, which should support consumption growth in the near term. Risks, however, are tilted to the downside. Measures of consumer confidence have declined sharply in the last two months and surging headline inflation driven by rising gas prices is dampening real purchasing power (Chart 5). Elevated uncertainty, further declines in consumer confidence, and the risk of further increases in energy commodity and gas prices could weigh on consumption in the coming months.

Chart 1. Retail Sales & Food Services (Index: February 2020 = 100)

Chart 2. Control Group Retail Sales (ex. food services, autos, gas stations & building materials)

Chart 3. Motor Vehicle & Parts Dealers Sales

Chart 4. Food Services & Drinking Places vs. Food & Beverage Stores

Chart 5. Consumer Confidence & Consumer Sentiment

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.