Robust employment gains reflect booming labor market

*The March employment report points to broad strength across the labor market, underscored by robust employment growth across both the household and establishment surveys, a further decline in the unemployment rate, and continued nominal wage growth. The relatively slower recovery of the labor force participation rate paired with the solid pace of job creation and declines in unemployment are consistent with our view that labor market tightness is unlikely to ease in the coming months (“Tight labor markets to remain tight”, March 31, 2022).

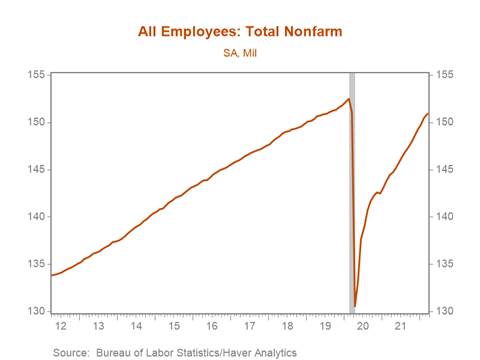

*Payroll employment increased 430k in March following a significantly upwardly revised 750k gain in February, marking the 11th consecutive month in which payroll employment has increased by more than 400k (Chart 1). Robust payroll employment growth was mirrored by the household survey in which employment jumped by 730k, bringing total employment to within 400k of its February 2020 level and lifting the employment-to-population ratio 0.2pp to 60.1%.

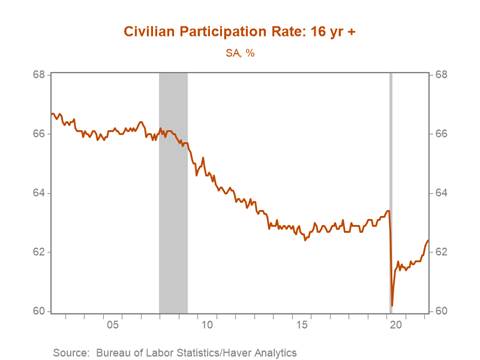

*The recovery of the labor force participation rate (LFPR) continues to lag other labor market indicators, rising 0.1pp in March to 62.4% - 1pp below its pre-pandemic level (Chart 2). The elongated recovery of the LFPR reflects a mix of excess retirements above those implied by demographic trends, caregiving obligations, and a decline in immigration during the pandemic.

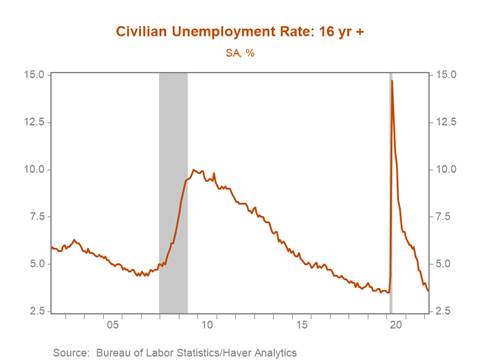

*Unemployment declined 320k over the month on the heels of a 240k decline in February, pushing the unemployment rate down to a pandemic low 3.6%, while total unemployment is now just 230k above its pre-pandemic level (Chart 3). Measures of labor market slack suggest current labor market conditions are consistent with a much lower unemployment rate than 3.6%.

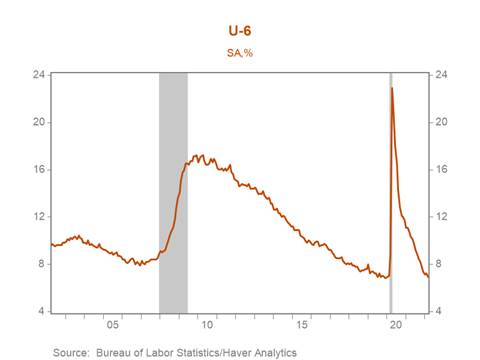

*Inclusive labor market indicators largely improved over the month. The Black unemployment rate dropped 0.4pp to 6.2% - within 0.2pp of its February 2020 level – while the Hispanic unemployment rate continues to fall further below its pre-pandemic level, declining to 4.2%. The number of marginally attached workers continues to retrace its pandemic jump, while U-6, a broad measure of labor underutilization, declined to 6.9%, roughly in line with its pre-pandemic lows (Chart 4). Sustained labor market tightness through 2022 should facilitate continued improvement in these inclusive labor market indicators.

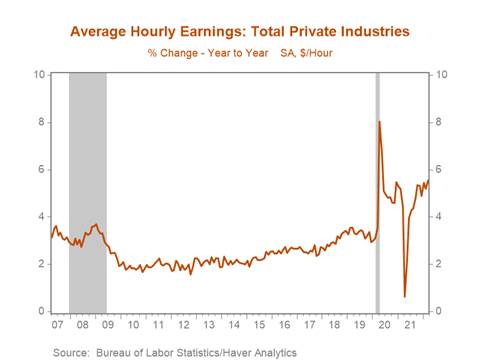

*Average hourly earnings growth accelerated, rising 0.4% m/m in March following a modest 0.1% m/m increase in February, lifting the yr/yr increase to 5.6% (Chart 5). We expect nominal wage growth to accelerate modestly and remain elevated, reflecting a catch-up to elevated inflation, rising inflationary expectations, and tight labor markets that have shifted the balance of power in wage negotiations towards workers. Average hourly earnings growth has been pronounced in lower-wage industries, and those that have experienced heightened levels of labor market churn, such as leisure and hospitality, in which average hourly earnings rose 1.2% m/m. Nominal wage growth in service sector industries will be supported in the coming months by rising product demand as the economy continues to reopen.

*Expanding payroll employment has boosted aggregate hours worked, which paired with rising average hourly earnings points to increased nominal disposable income in March, although elevated inflation is likely to weigh on real disposable incomes.

*Despite the jump in payroll employment, significant shortfalls remain in certain industries. Employment in leisure and hospitality remains 1.5m below its pre-pandemic level, and at the current rate of employment growth would take 12 months to return to its pre-pandemic level. Shortfalls in state and local government education, and health care and social assistance relative to pre-pandemic levels remain significant.

Chart 1. Nonfarm Payroll Employment

Chart 2. Labor Force Participation Rate (%)

Chart 3. Unemployment Rate (%)

Chart 4. U-6 (%)

Chart 5: Average Hourly Earnings (yr/yr, %)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.