Solid retail sales growth in April reflects resilient U.S. consumer

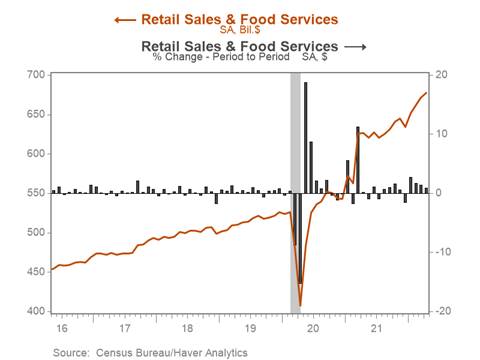

*Retail sales increased 0.9% m/m in April following an upwardly revised 1.4% increase in March, lifting the year-to-date increase in nominal retail sales to 6.8% (Chart 1). April’s solid sales data point to still solid nominal consumer demand buoyed by rising nominal disposable income, robust household balance sheets, and increased reliance on credit and savings to facilitate spending. However, risks are tilted to the downside. The pace of average hourly earnings growth has downshifted, while tightening financial conditions, elevated inflation, and deteriorating consumer sentiment could weigh on consumer spending in coming months.

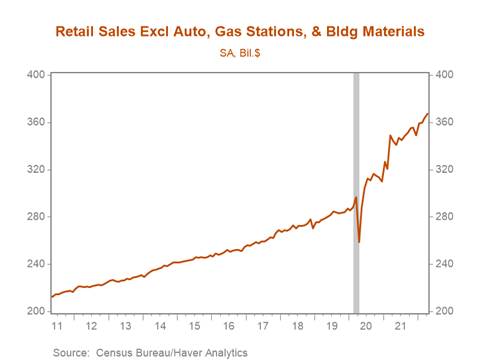

*Control group retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, increased 1% m/m following a significant upward revision in March from a 0.1% m/m decline to a 1% m/m increase (Chart 2), and point to solid nominal consumption growth through the first half of 2022. Notably, significant revisions to retail sales data point to continued growth in real retail sales (deflated using the Consumer Price Index), which increased 0.6% m/m.

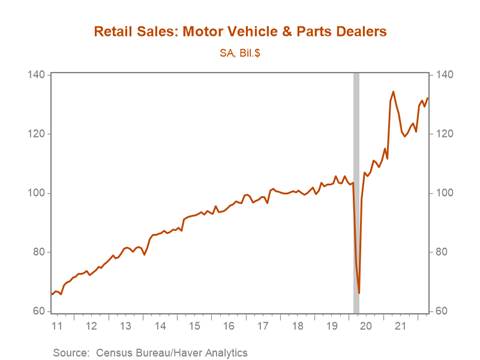

*The monthly gain in retail sales in April was underpinned by a jump in motor vehicle sales, which increased 2.2% m/m following a 1.6% contraction in March (Chart 3). While motor vehicle sales rose in nominal terms, in real terms the increase will be partially offset by a robust monthly increase in motor vehicle prices in April. Spending at non-store retailers jumped 2.1% m/m – the fourth consecutive monthly increase – lifting the yr/yr increase to 12.7%. The sharp increase in non-store retail sales is notable. Large monthly increases in non-store retail sales during the pandemic have typically coincided with shifts away from in-person shopping due to rising COVID-19 case counts and public health concerns. That this was not the case in April reflects underlying strength in nominal demand and could point to shifting consumer behavior in response to rising fuel prices.

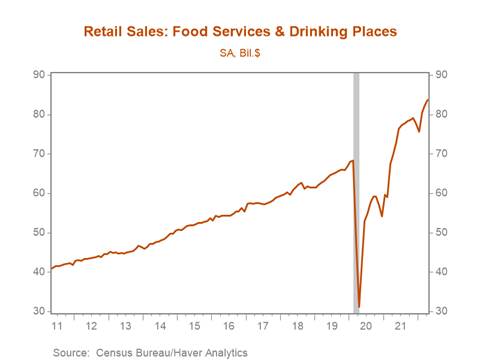

*Although April’s retail sales data are consistent with a shift in consumption from goods to services as the economy fully reopens, demand for goods remains firm. Sales at furniture and home furnishing stores (0.7%), electronics and appliance stores (1%), and department stores (1%) advanced on a m/m basis. Spending at food services and drinking places increased 2% m/m and 19.8% yr/yr in April, and we expect continued growth in nominal spending on dining out and on leisure and hospitality services more broadly through the summer (Chart 4).

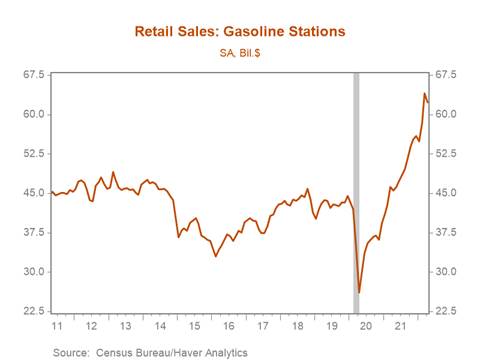

*Sales at gasoline stations declined 2.7% m/m following a 9.7% m/m increase in March, as retail gasoline prices eased in April (Chart 5). However, gas prices have since soared to record highs, which, together with the impending summer holiday season, is likely to boost gasoline station sales next month.

Chart 1. Retail Sales Total and m/m % Change

Chart 2. Control Group Retail Sales (ex. autos, gas stations, building supplies)

Chart 3. Retail Sales – Motor Vehicles and Parts

Chart 4. Retail Sales – Food Services and Drinking Places

Chart 5. Retail Sales – Gasoline Stations

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.