Solid retail sales growth in June, step-down in household inflation expectations

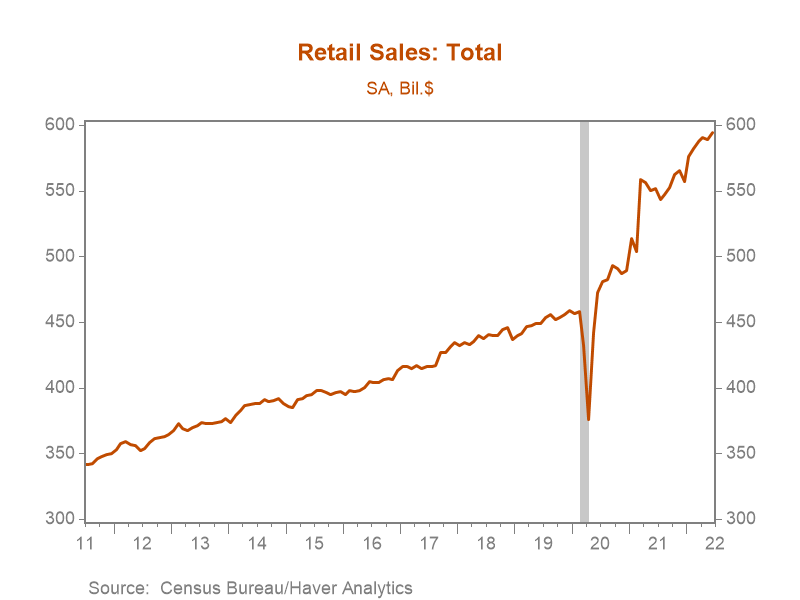

*Nominal retail sales increased 1% m/m in June following an upwardly revised 0.1% decline in May, reflecting a broad-based increase that saw 10 of 13 major retail sales categories advance over the month (Chart 1). However, some of the June rise reflects a bounce back from flat to negative retail sales in May. Moreover, a surge in spending at gasoline stations in June boosted spending over the month, and this may unwind to some extent in July given the recent decline in gasoline prices.

*Elevated inflation will erode much of June’s retail sales gains in real terms, and downbeat consumer sentiment could weigh on spending in the months ahead. Interestingly, details of the University of Michigan’s Consumer Sentiment survey suggest some consumers are pulling forward durable goods spending to get ahead of anticipated price increases down the line. It is worth emphasizing that current conditions are highly uncertain, with hard data, surveys, and anecdotal evidence pointing in different directions. For example, the Fed’s latest Beige Book points to slowing demand and a moderation in consumer spending that is seemingly inconsistent with the retail sales data released today (July Beige Book points to moderating growth, elevated price pressures).

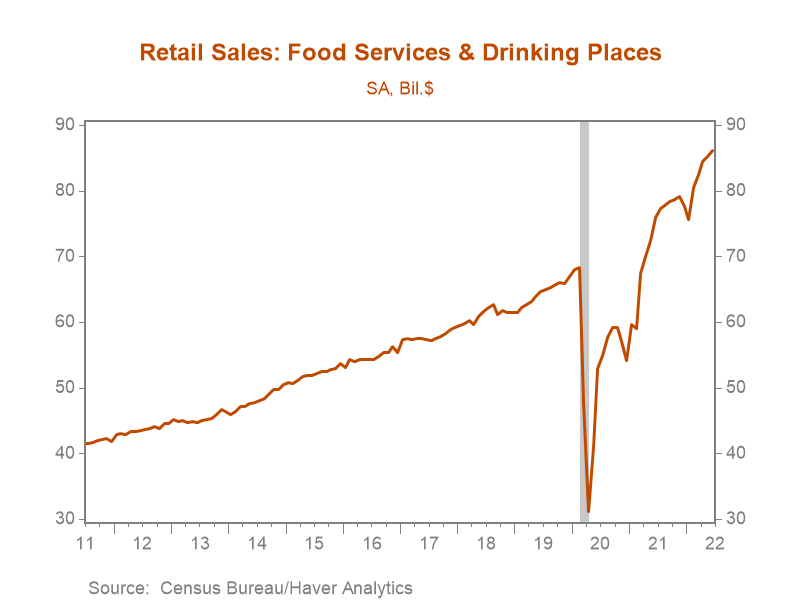

*The mix of consumer spending in June indicates that while goods consumption remains well above the pre-pandemic trend, the mix of consumption is continuing to shift toward services. Spending at food services and drinking places increased 1% m/m and is up 20% on a three-month annualized basis, supported by the vigorous rebound in travel amid a broader economic reopening and the summer holiday season. A key question is whether discretionary spending on services will maintain momentum as the accumulated effect of elevated inflation continues to bite into disposable income.

*Low dealer inventories and constraints on production continue to weigh on spending at motor vehicles and parts dealers, which remains below its April level despite a 0.8% monthly increase. Control group retail sales (excluding autos, gas stations, and building supplies), which will factor directly into Q2 calculations of personal consumption in GDP, increased 0.8% m/m on the heels of a downwardly revised 0.3% decline in May, leaving the two-month change at a modest 0.5%. There were some signs of weaker discretionary goods consumption. Spending at general merchandise stores softened, falling 0.2%, while spending at building materials, garden equipment, and supply dealers declined for the third consecutive month, falling 0.9%.

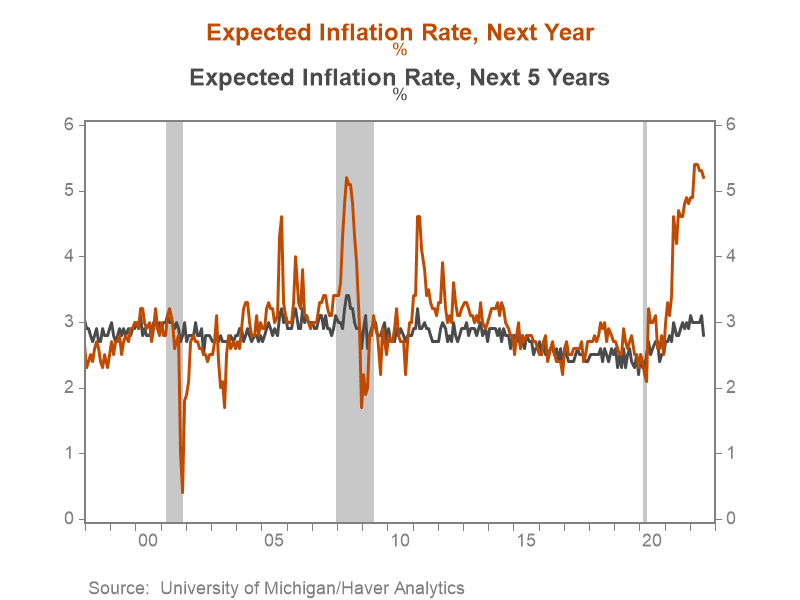

*The Fed will likely take comfort in a 0.3pp decline in the University of Michigan’s preliminary July 5-10 year ahead household inflation expectations survey to 2.8% (Chart 3). The Fed explicitly pointed to an increase in the preliminary June survey to 3.3% as a key factor behind its decision to hike rates by 75bp at its June meeting. The June survey result has since been revised down to 3.1%, which together with the further step-down to 2.8% suggests long-run inflation expectations are likely still anchored at levels consistent with the Fed’s 2% inflation target. However, year-ahead household inflation expectations remain elevated at 5.2% and could lead to prolonged upward inflationary pressures if these expectations feed through more broadly into wage and price-setting behavior.

*Solid but not exuberant nominal retail sales data together with a marked step-down in the University of Michigan’s 5-10 year ahead survey-based measure of household inflationary expectations reinforces our view that the Fed will stick with a 75bp policy rate increase at its July meeting.

Chart 1. Retail Sales

Chart 2. Retail Sales – Food Services & Drinking Places

Chart 3. University of Michigan 12-months ahead and 5-10 Year Ahead Inflation Expectations

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.