U.S. Establishment Payrolls up Modestly, Household Survey Booms

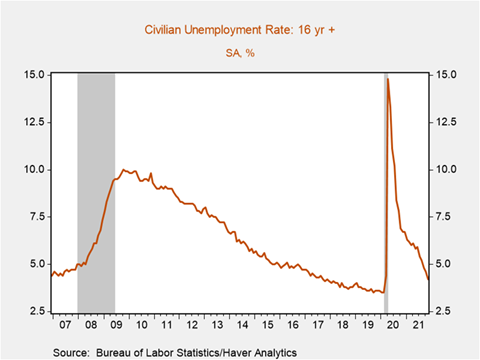

*The November Employment Report was mixed: the Establishment Survey reported job gains of 210,000, decidedly below consensus, while the Household Survey was robust in every way, with monthly increases of +594k in the labor force and 1.1 million in employment resulting in sizable jumps in the labor force participation rate and employment-to population ratio, while unemployment fell 542k, lowering the unemployment rate to 4.2% from 4.6% (Chart 1). Average hourly earnings of production and nonsupervisory workers rose 0.46%, lifting its yr/yr increase +0.1 pp to 5.9%.

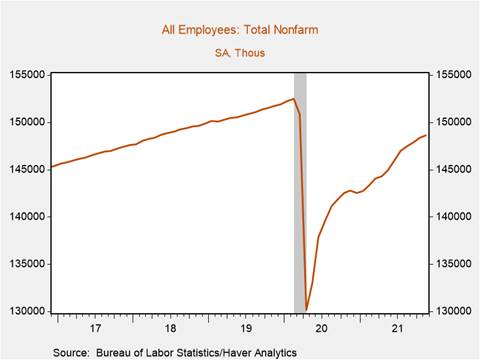

*While the rise in establishment payrolls was the slowest of the year, jobs are up 5.8 million in the last year and just 3.9 million shy of the pre-pandemic peak in January 2020 (Chart 2). Jobs in manufacturing and construction continued to rise at a healthy pace, each adding 31k. The monthly weakness in nonfarm payroll employment compared to the 546k increase in October were largely in three sectors: leisure and hospitality, where jobs rose 23k vs. 170k in October; and education and health services, where jobs rose 4k vs. 59k in the prior month. State and local government payrolls fell 27k, continuing their declining trend, with notable employment shortfalls relative to pre-pandemic levels in state and local government education services.

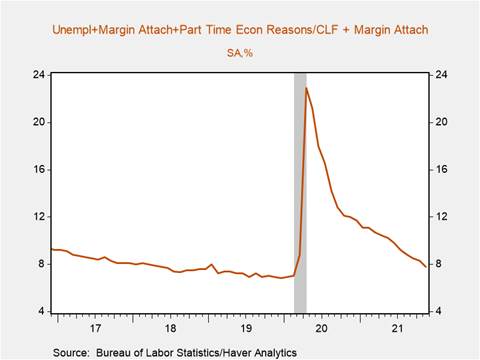

*Labor market indicators closely watched by policymakers improved markedly in November and highlight the breadth and pace of the labor market recovery relative to that after the great financial crisis. U-6, the broadest measure of underemployment that includes marginally attached and part time workers fell -0.5 pp to 7.8%, while there were notable declines (-136k) in the number of people employed for 27 weeks or longer (Chart 3). Inclusive measures of employment also improved substantially: the black unemployment rate fell 1.2 pp to 6.7%, just 0.7pp below its February 2020 level, while the black employment to population ratio edged up to 56.7% (+0.4pp). Similarly, the Hispanic unemployment rate fell 0.7pp to 5.2%, while the Hispanic employment to population ratio surged 1pp to 62.9%. Despite the weaker than expected headline payroll employment increase, November’s household survey will improve policymakers’ labor market outlook.

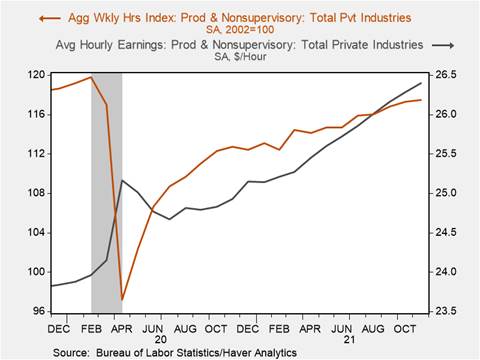

*Aggregate weekly hours worked by production and non-supervisory employees rose 0.17% m/m and 4.3% yr/yr (Chart 4). Rising aggregate hours worked and average wages point to continued solid increases in disposable income, paving the way for healthy growth in consumption. Average hourly earnings growth continues to lag price increases and nominal wage growth should accelerate in a ‘catch up’ to inflation.

*Average hourly earnings rose across most industries, with pronounced increases in durable goods manufacturing (+0.6% m/m) and transportation and warehousing (+2.1%) reflecting the impact of supply chain bottlenecks and sustained strong demand for durables. Average hourly earnings declined 0.24% m/m in leisure and hospitality, potentially due to readjustment following a very strong 1.2% m/m increase in October, while average hourly earnings rose 0.16% m/m in retail trade. Despite the m/m decline in average hourly earnings in leisure and hospitality, they remain elevated on a yr/yr basis rising 13.4%. Anecdotal evidence and JOLTS data on job openings relative to hires suggest labor markets remain tight with many businesses experiencing substantial difficulties with hiring. As labor market conditions improve and nominal wage growth continues, labor supply should continue to increase, contributing to an easing of labor shortages.

Chart 1. Unemployment Rate

Chart 2. Establishment Payrolls

Chart 3. U-6

Chart 4. Aggregate Weekly Hours and Average Hourly Earnings

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.