U.S. GDP grows rapidly in Q1; stage is set for robust Q2

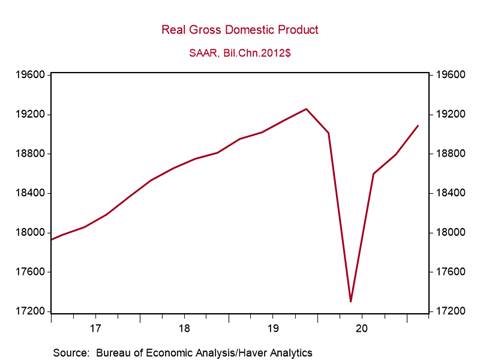

*The U.S. Department of Commerce’s GDP Report was strong in virtually every aspect, driven by a 10.7% annualized surge in consumption, reflecting the distribution of vaccines that have allowed the economy to reopen and the unprecedented government income support. The report also signaled a rise in the GDP price index, a broad measure of inflation. Real GDP rose 6.4% annualized in Q1, lifting it within 0.9% of its pre-pandemic level in Q4 2019 (Chart 1). The stage is set for robust growth in Q2, and further price pressures.

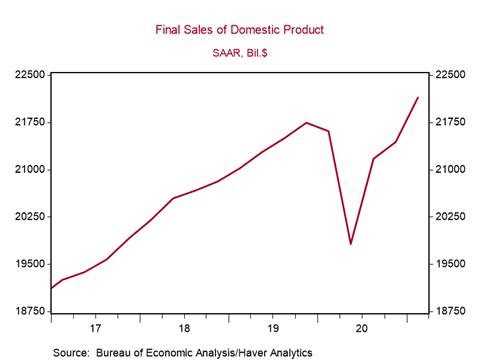

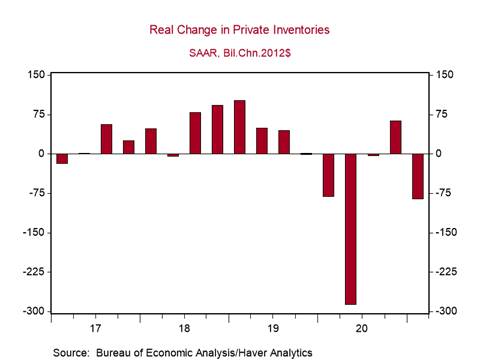

*Domestic demand surged above pre-pandemic levels (Chart 2), while GDP growth was suppressed by inventory liquidation and a widening trade deficit. Final sales of domestic product rose 13.8% annualized while inventories were liquidated by $85.5 billion from an inventory build of $60.1 billion in Q4 2020, as producers were unable to keep up with demand and also faced bottlenecks in supply chains and production (Chart 3). Producers will ramp up production in Q2 to meet strong product demand and rebuild inventories. Exports fell 1.1% annualized while imports jumped 5.6%. So, while domestic purchases rose 11.2% annualized, a larger share of domestic demand was met by foreign supply.

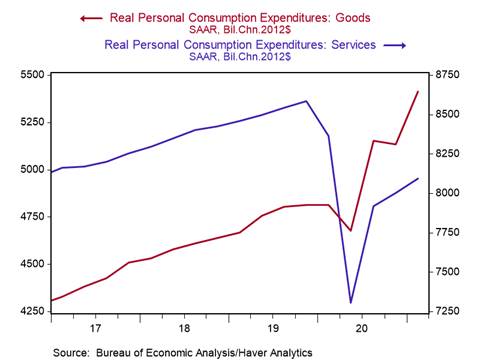

*The boom in consumption reflected ongoing rapid spending growth in goods and a significant recovery in spending on services that have begun to reopen (Chart 4). Consumption was lifted by robust quarterly gains in durable goods (+41.4% annualized), including motor vehicles and household and recreational vehicles. Consumption of nondurables jumped 23.5%, with robust gains in spending on food and beverages purchased from off-premises consumption and apparel. Services consumption rose a solid 4.6%, driven by big gains in transportation and recreation, but remained 5.3% below Q4 2019 levels.

*Business investment rose a solid 2.4%, with continued declines in spending on structures and healthy increases in equipment and software (3.9% annualized and intellectual property [2.4%]).

*Government purchases and investment jumped 6.3% annualized, driven entirely by a 14.5% rise in nondefense consumption related to government spending on the pandemic.

*The GDP deflator rose 4.1% annualized, as the price index for consumption rose 3.5% (5.4% for goods and 2.6% for services). The quarterly increase in the GDP deflator lifted its yr/yr rise to 1.9%. That increase should jump significantly in Q2, reflecting the decline in Q2 2020. Noteworthy, the price index for residential investment rose 11.4%, lifting its yr/yr to 7%. This is consistent with the boom in housing and sizable increases in construction costs.

While the GDP report did not come as a surprise, its robustness is striking. The economic recovery is V-shaped. The strong data reports in March lift the starting point for Q2 and point toward even stronger growth. This is the product of an economy reopening from a negative shock and overly aggressive fiscal and monetary stimulus. The rising inflation pressures require close scrutiny.

Chart 1. Real GDP

Chart 2. Final sales of domestic product

Chart 3. Change in inventories

Chart 4. Consumption of goods and services

Mickey Levy, mickey.levy@berenberg-us.com