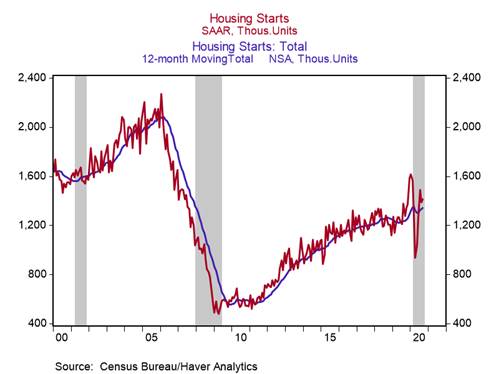

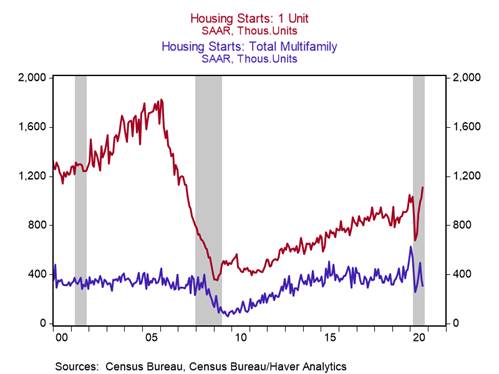

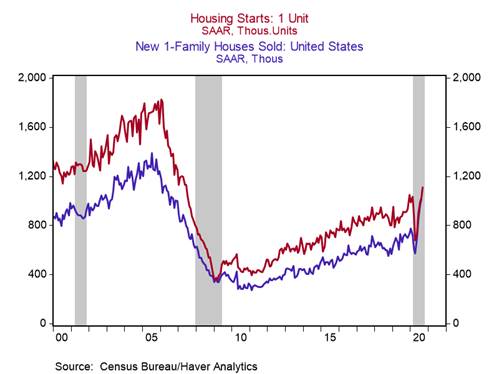

*U.S. housing starts increased by 1.9% m/m to 1.42m annualized in September from 1.39m in August, lifting its yr/yr change to 11.1%. The 12-month rolling sum of starts increased to 1.34m, one of the highest levels of the last 13 years, reflecting the acceleration in starts in the months before the pandemic and the V-shaped rebound (Chart 1). Single-family starts increased by 87k to 1.11m annualized in September, its fifth consecutive monthly gain and its highest level since June 2007, reflecting growth in homeownership, while (the volatile) multifamily starts declined by 60k to 307k (expect a rebound in the coming months). See Chart 2.

*Housing starts increased in the northeast (+58k to 145k annualized), the south (+44k to 755k), and the west (+5k to 350k), but decreased in the midwest (-80k to 165k annualized). The south drove the increase in total single-family starts in September (+97k to +645k).

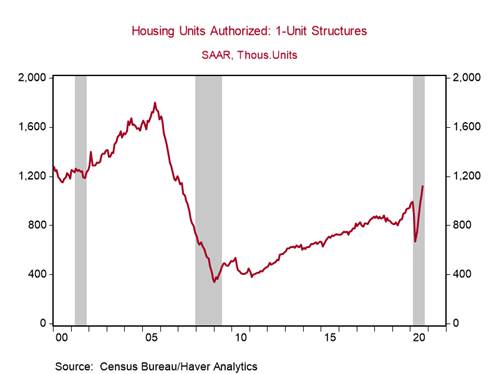

*Building permits increased by 5.2% m/m to 1.55m annualized in September, a 13.5-year high, driven by strong growth in single-family permits (+7.8% m/m to 1.12m), indicating that underlying demand for new housing units continues to grow (Chart 3). The number of single-family housing units authorized, but not yet started, increased by 27% yr/yr in September, reflecting a sizable backlog of projects that could start in the coming months (Chart 4).

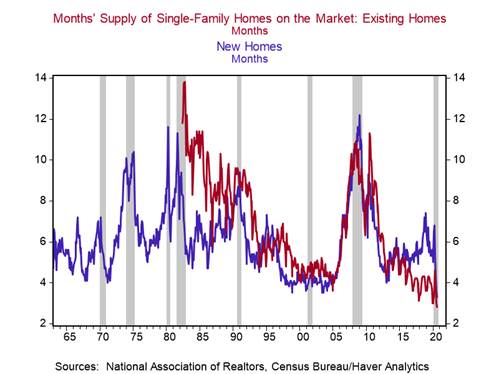

The tight supply of homes available for sale and strong demand will incentivize homebuilders to continue ramping up construction. In August, the months’ supply of new and existing single-family homes available for sale declined to all-time lows of 3.3 months and 2.8 months, respectively (Chart 5). Moreover, the gap between single-family housing starts and new home sales has narrowed significantly in recent months (new home sales are counted at initial contract signings), indicating that builders have a lot of catching up to do to meet demand, as housing starts typically exceed new home sales by a fairly wide margin (Chart 6).

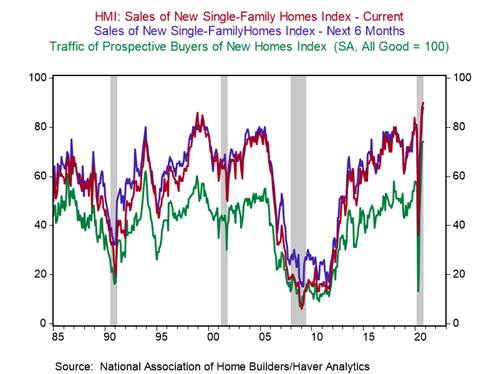

Strong housing demand drove the National Association of Home Builders (NAHB) housing market index to a new high in October, for the second consecutive month, driven by record highs in all its subcomponent indexes (current and future single-family sales, and traffic of prospective buyers indexes). See Chart 7. According to the NAHB “Traffic remains high and record-low interest rates are keeping demand strong as the concept of ‘home’ has taken on renewed importance for work, study, and other purposes in the COVID era.”

The increases in homebuilder optimism and single-family building permits indicate further growth in new home sales in September (set for release on October 26).

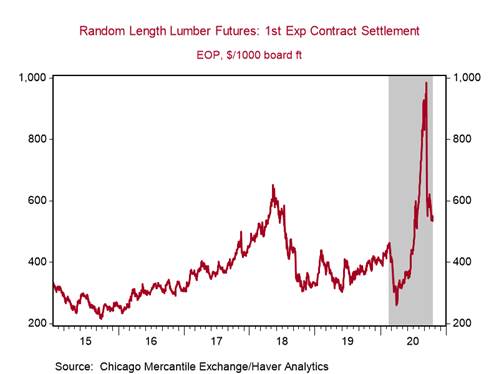

Builders are getting some reprieve from the decline in lumber prices over the last month, following the surge to $1,000 / 1,000 board feet (Chart 8). Note that the decline in lumber prices is seasonal, with less construction activity in the colder months, and not indicative of a falloff in underlying demand.

Very low mortgage rates that have reduced the monthly cost of servicing a mortgage will continue to drive housing demand, offsetting the impact of higher prices on affordability. Moreover, with the Fed’s shift to a flexible form of average inflation targeting, in which it favors inflation above-2% for some time, it will likely support low interest rates for an extended period.

We continue to emphasize that favorable demographics and pent-up demand from younger age cohorts will support housing demand in the intermediate term.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Roiana Reid, roiana.reid@berenberg-us.com