*U.S. housing starts declined by 30% m/m to 891k annualized in April from 1,276k in March, placing it 43% below February’s level (Chart 1). Starts declined sharply by sector – single-family (-221k to 650k) and multifamily (-164k to 241k) –and across regions –South (-187k to 532k), West (-141k to 184k), Northeast (-34k to 44k), and Midwest (-23k to 131k).

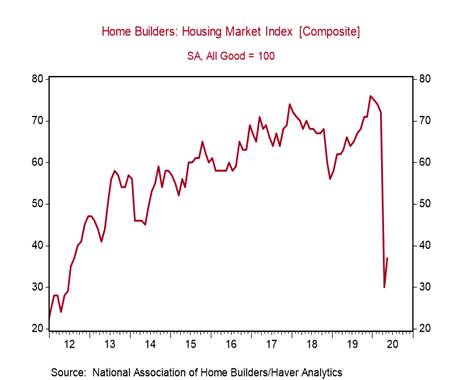

*We expect housing starts to increase in May, because construction activity has been allowed to resume in states where it was deemed “non-essential.” However, the National Association of Home Builders Housing Market Index suggests that the increase in starts in May will be modest (Chart 2).

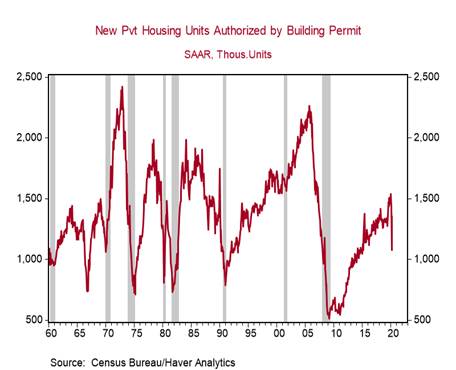

*Building permits declined by 21% m/m to 1,074k annualized in April from 1,356k in March, remaining well above the level of starts. The widening gap between permits and starts reflects the backlog of projects that will proceed as restrictions on construction are lifted (Chart 3).

We expect residential construction to be a positive contributor to the economic recovery. Historically low mortgage rates and attractive prices in some regions will pull potential buyers off the sidelines, providing some offset to the significant job losses, declines in household net worth, and re-tightening of lending standards. But demand will not immediately return to pre-pandemic levels.

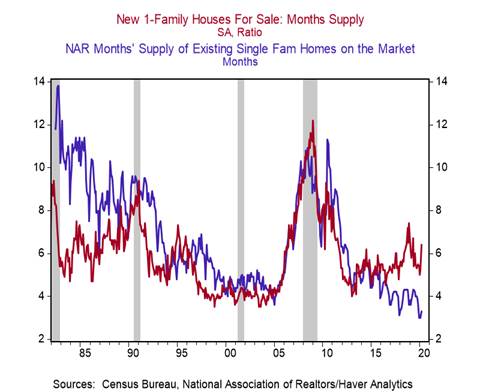

The tight supply of for-sale homes will drive demand for new construction. The supply of new and existing homes for sale entering this crisis was historically low, in contrast to the lead-up to the 2008 housing crisis when supply surged (Chart 4). We expect two factors to constrain supply: 1) the mortgage forbearance provision in the CARES Act on mortgages backed by federal agencies is preventing a wave of foreclosures, at least in the near term; and 2) some existing homeowners may hold off on selling their homes for now if they expect higher prices in the future.

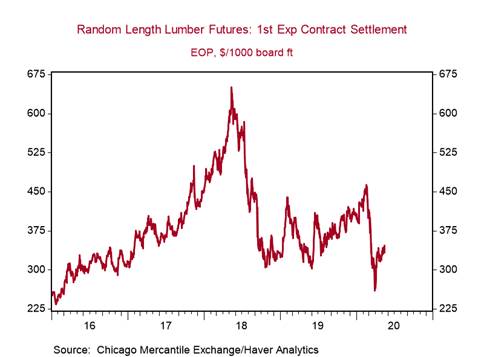

High frequency indicators suggest that housing demand is bouncing back. The Mortgage Bankers Association’s mortgage applications for loan purchases volume index has increased for four consecutive weeks and is now just 9.4% below its year-ago level (Chart 5). Applications had fallen as much as 35% yr/yr in early April. Lumber futures have increased to a two-month high, reflecting growing demand for home improvement projects as well as new construction (Chart 6).

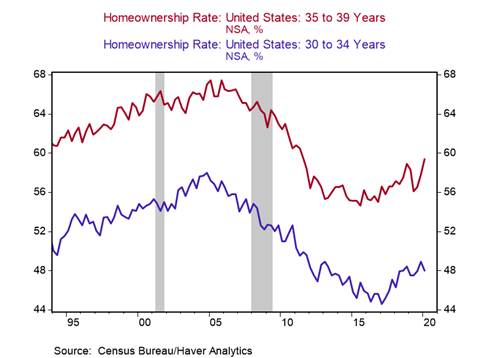

Demographics remain favorable for housing in the intermediate run. Over the next five years the 30-39 age cohort, a group that will boost demand for new housing units as they form families, is projected to increase by 2.6m. Note that homeownership rates for this cohort declined through most of the last expansion and only started to increase in recent years (Chart 7).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com