*U.S. housing starts declined by 22.3% to 1,216k annualized in March from 1,564k in February, reflecting the shutting down of activities in the second half of the month (Chart 1). The historic 42pt drop in the National Association of Home Builders Housing Market Index in early April portends a much sharper drop in starts in April (Chart 2).

*Building permits declined by only 6.8% to 1,353k annualized in March from 1,452k in February (Chart 3), reflecting an increase in multifamily permits (+22k to 469k) and decline in single-family permits (-121k to 884k). In the coming months, the number of housing units authorized but not yet started will provide a useful gauge of the backlog of projects that could start once restrictions are lifted (Chart 4).

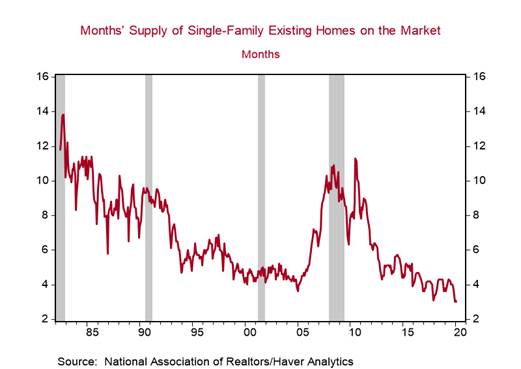

We expect residential construction to be a positive contributor to the economic recovery, primarily because of the very tight inventory of unsold homes entering this crisis (Comments on US housing, April 7, 2020). The months’ supply of both new and existing homes were hovering near all-time lows in February, contrasting the 2008-2009 housing crisis that involved over-building that resulted in record highs in the inventory of unsold homes (Charts 5 and 6).

Clearly, the huge job losses, declines in disposable incomes and household net worth, and a re-tightening of lending standards resulting from the pandemic will weigh on housing demand. But the expected decline in home values in some communities and low mortgage rates will boost affordability and entice potential buyers. Banks will still be willing to lend to creditworthy individuals.

Residential construction has been exempted from stay-at-home orders in several states, so building projects are likely proceeding in some areas. Moreover, in states where residential construction has been deemed non-essential, we expect it to be one of the earliest activities allowed to resume. The Department of Homeland Security has designated housing construction as an essential infrastructure business “to ensure additional units can be made available to combat the nation’s existing housing supply shortage.” This is an advisory and not a directive to states.

The slight uptick in lumber futures recently, after the sharp decline, reflects modestly improving expectations for residential construction once the acute stage of this crisis ends (Chart 7).

Demographics remain favorable for housing in the intermediate run. Over the next five years the 30-39 age cohort, a group that will boost demand for new housing units as they form families, is projected to increase by 2.6m.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com