U.S. housing starts slump temporarily during February storms, outlook robust

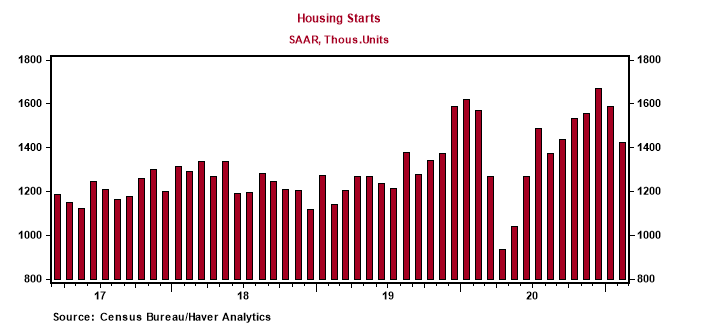

*Housing starts fell 10.3% to a 1.42 million annual pace in February, reflecting the temporarily crippling effects of severe winter storms that generated very large declines in the Northeast and Midwest and smaller declines in the South, while housing starts in the West rose (Chart 1).

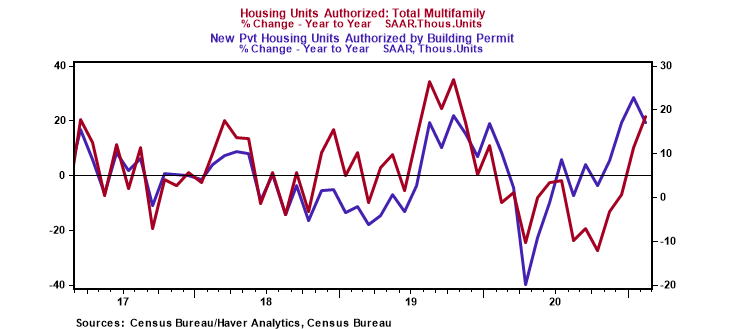

*Building permits also fell 10.8% in February to a 1.68 million annual pace. Even with this monthly decline, building permits in February were 17% higher than a year ago (Chart 2).

*Not surprisingly, it is difficult to begin new housing construction in severe winter storms. The large decline in housing starts in February, paralleling the sharp declines in retail sales and industrial production, is temporary. Construction is projected to surge in coming months and housing activity is expected to remain strong throughout the year.

Everything about housing remains strong. Demand is being boosted by cyclical factors (employment and lower unemployment rate, rising disposable income, low mortgage interest rates, and widespread availability of credit) and structural factors (including demographics and heightened mobility stemming from the pandemic). Home prices are increasing rapidly (over 10% yr/yr), and expectations of further increases are boosting demand.

The inventory of homes on the market is extraordinarily low, and new construction is having trouble catching up with strong demand. With such strong demand and low inventories, higher costs of materials (lumber, copper, etc.) and building costs are being passed on to new home buyers.

Chart 1.

Chart 2.