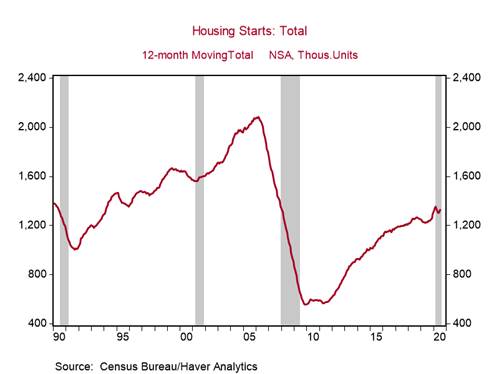

*U.S. housing starts surged by 22.6% m/m to 1,496k annualized in July from 1,220k in June, exceeding its 2019 average of 1,295k and boosting its yr/yr change to +22.1 from -0.4% (Chart 1). The 12-month rolling sum of housing starts increased to 1,324k, reflecting the strong momentum in housing leading into the crisis and the V-shaped recovery (Chart 2). Starts increased in all regions: Northeast (+41k to 157k annualized), Midwest (+11k to 201k), South (+207k to 830k), West (+17k to 308k).

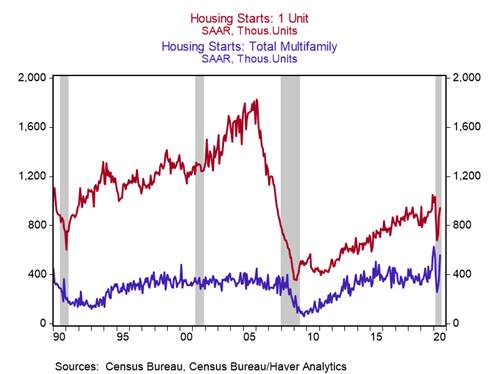

*Multifamily starts increased by 205k to 556k annualized, the second highest level in the last 33.5 years, and single-family starts increased by 71k to 940k annualized (Chart 3). Multifamily starts are very volatile, so we expect a reversal in the coming months, but single-family starts will continue to rise as more persons pursue home ownership.

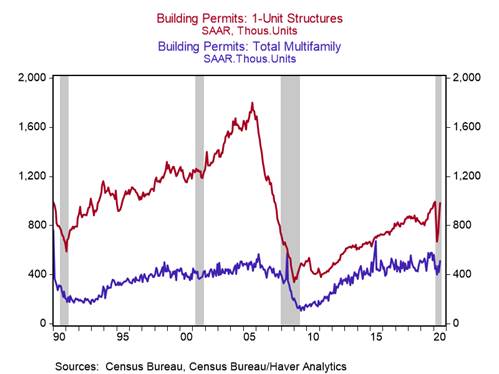

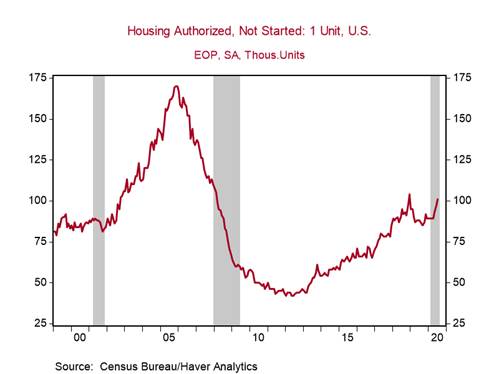

*Building permits increased by 18.8% m/m to 1,495k annualized in July, reflecting a 143k increase in single-family permits to 983k annualized and a 94k increase in multifamily permits to 512k (Chart 4). The number of single-family housing units authorized but not yet started remained elevated in July (+20.8% yr/yr), indicating a sizable number of projects in the pipeline that could start in the coming months (Chart 5).

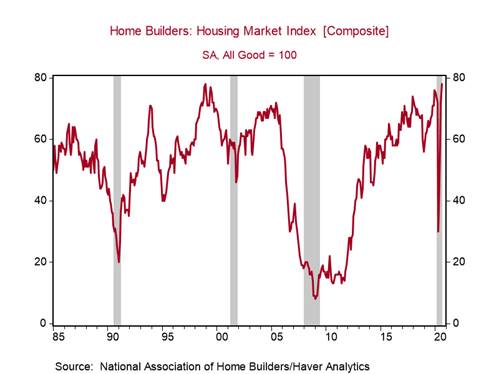

The strong starts data are consistent with elevated home builder optimism. The National Association of Home Builders (NAHB) housing market index increased by 6pts to 78 in August, matching its all-time high set in December 1998 (Chart 6). The headline index was driven by the traffic of prospective buyers subindex which bodes well for sustained strong momentum.

Historically low mortgage rates that have reduced the monthly cost of servicing a mortgage is driving housing demand. Mortgage applications for home purchases which started to rebound in mid-April - earlier than most other indicators - are now up 21% yr/yr.

This crisis is different from the 2008-2009 Great Recession in a key way. The debt-financed housing bubble of the 2000s involved over-building that resulted in record highs in the inventory of unsold homes leading into the 2008-2009 recession. In sharp contrast, as we have emphasized consistently, home sales in 2018-2019 were constrained by insufficient supply that led to significant increases in housing starts.

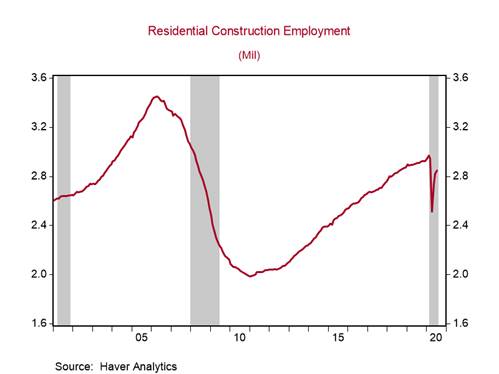

This strong momentum in housing activity is positive for the broader economy: 1) employment in residential construction has bounced back faster than other sectors - it is only 4.1% below its February level compared to total nonfarm employment which is 8.4% below (Chart 7); 2) sales at furniture, home furnishing, and electronics and appliance stores have returned close to pre-pandemic levels; and 3) sales at building materials, garden equipment and supply dealers have jumped to all-time highs (Chart 8). Although housing accounts for a small share of GDP, its impact on the broader economy is wide.

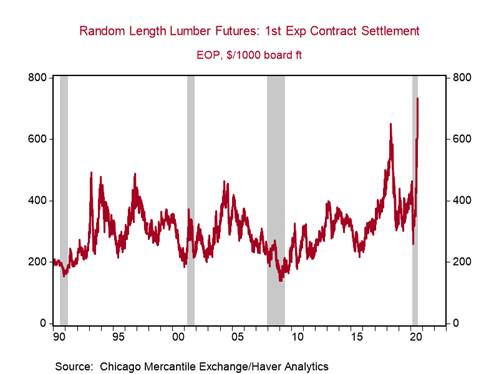

Skyrocketing lumber prices could dent momentum in the housing sector. They are at a record high (data begin in 1990), almost double last year’s average (Chart 9).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Roiana Reid, roiana.reid@berenberg-us.com