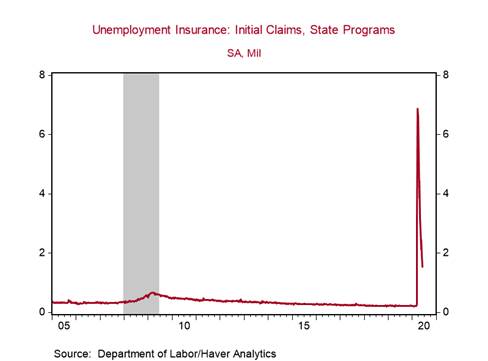

*U.S. initial jobless claims declined to 1.5m last week from 1.9m in the prior week, the tenth consecutive weekly decline, reflecting slowing but still historically high layoffs. At 1.5m, initial jobless claims are 2.2 times the pre-crisis high of 695k (See Chart 1). As the surprise 2.5m increase in the Bureau of Labor Statistics’ (BLS) estimate of nonfarm payrolls in the Official May Employment Report showed, initial jobless claims reflect only one side of labor market dynamics – layoffs – and do not capture hiring.

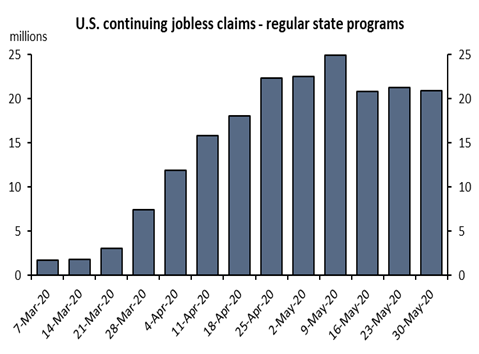

*Continuing claims for regular state unemployment compensation (reported with a two-week lag), which are a better gauge of the BLS’s estimate of unemployment, declined to 20.9m during the week ending May 30 from 21.3m in the prior week. Continuing claims peaked at 24.9m during the week ending May 9, declined sizably by 4.1m to 20.8m during the week ending May 16, and stagnated in the last two weeks of May (Chart 2). This suggests that the improvement in labor markets from the reopening in mid-May could be slowing.

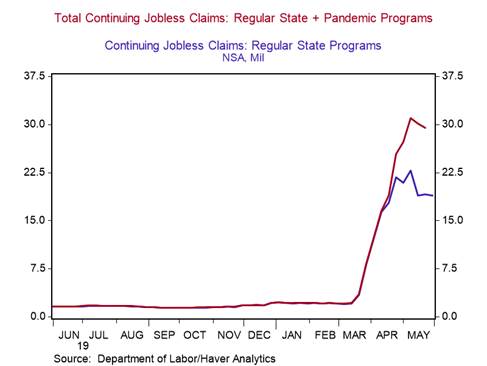

The CARES Act expanded unemployment compensation beyond the regular state benefits program. A comprehensive count of continuing jobless claims, which includes the regular state unemployment compensation program plus the special pandemic unemployment benefits, shows that the total number of persons receiving unemployment benefits during the week ending May 23 was 29.5m (non-seasonally adjusted), well above the 19.1m persons (non-seasonally adjusted) that received “regular state” benefits that week (See Chart 3).

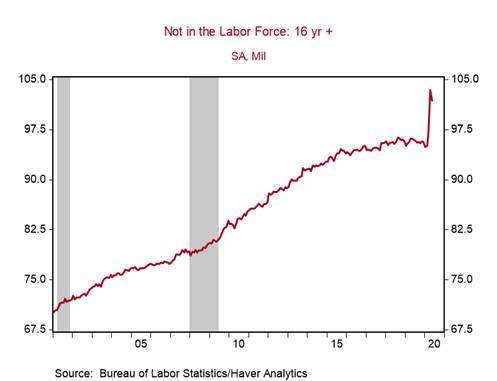

Note that total continuing claims during the reference period for the BLS’s Official May Employment Report (week ending May 16) was 30m, much higher than the 21m persons estimated as unemployed by the BLS in May. The BLS’s estimate of unemployment undercounts the number of jobs lost due to misclassification and because persons who are not actively looking for jobs are considered to be out of the labor force and thus not characterized as unemployed. The BLS estimates that the number of persons not in the labor force increased from 95m in February to 102m in May (Chart 4).

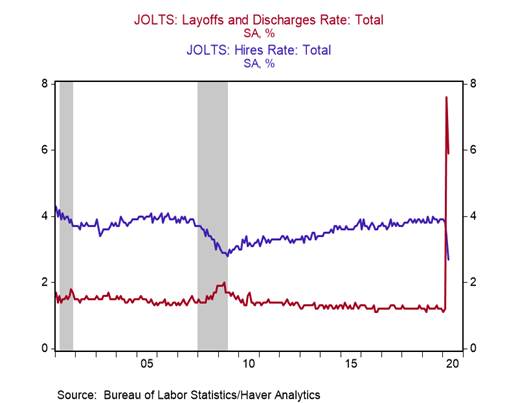

We expect labor market churn to remain elevated in coming months. The latest monthly Job Openings and Labor Turnover Survey (JOLTS) covering April showed a historic rate of layoffs and a plunge in the rate of hiring (Chart 5). As states allow the resumption of more nonessential activities in coming months, we expect the rate of hiring to increase sizably and outweigh layoffs, though layoffs will likely remain historically high due to sluggish demand. The pace of rehiring of laid off and furloughed workers will be determined by the pickup in product demand and cash flows of businesses and this will vary in different sectors.

Almost 50% of states reported an increase in initial claims last week, a concerning trend if sustained. States reporting the highest number of initial jobless claims (in non-seasonally adjusted terms) for the week ending June 6 include California (258k), Georgia (135k), and Florida (111k). California had the largest increase in claims (+29k) and Florida had the largest decrease (-97k).

Chart 1:

Chart 2:

Source: Department of Labor and Berenberg Capital Markets

Chart 3:

Chart 4:

Chart 5:

Roiana Reid, roiana.reid@berenberg-us.com