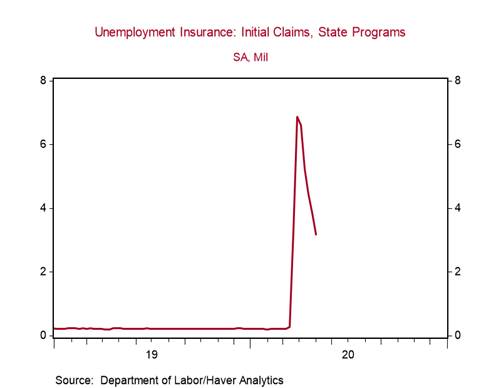

*U.S. initial jobless claims declined to 3.2m during the week ending May 2 from 3.8m in the prior week (consensus: 3.0m), bringing the total over the last seven weeks to 33.5m (Chart 1). Initial claims have declined for five consecutive weeks and are now 54% below the end of March peak. But at 3.2m, initial claims remain historically high (4.6 times the pre-COVID pandemic peak of 695k), signaling another significant rise in the unemployment rate in May.

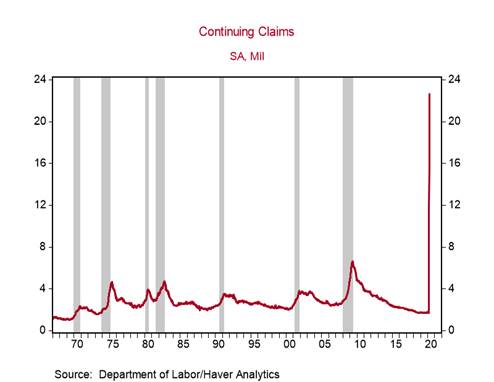

*Continuing claims for unemployment insurance increased to 22.6m during the week ending April 25 from 18.0m in the prior week, an all-time high, and triple the Great Recession peak (6.6m). See Chart 2. Continuing claims will be useful in identifying the eventual peak in the unemployment rate.

Based on the 26m total initial jobless claims between March 15 and April 18, we expect the Bureau of Labor Statistics (BLS) to report that U.S. nonfarm payrolls declined by 21m in April and that the unemployment rate increased to 16.2% from 4.4% in its Official Monthly Employment Report, scheduled for release tomorrow (U.S. April employment preview: largest collapse in history, May 6, 2020). The 7m total initial claims between April 19 and May 2 will be reflected in the May Employment Report as a continued large increase in unemployment.

Furloughed employees and those on temporary layoff are eligible for unemployment insurance benefits and thus are included in the weekly claims count. The April Employment Report will estimate the number of unemployed persons that are on temporary layoff/furlough. In March, temporary layoffs increased by 1m, accounting for the bulk of the 1.4m increase in total unemployment. The greater the share of persons on temporary layoff, the faster the labor market recovery. However, we caution that some temporary layoffs will be made permanent.

States with the highest number of initial jobless claims (in non-seasonally adjusted terms) last week include California (318k), Texas (247k), and Georgia (227k). Encouragingly, almost all states reported declines in claims. Florida had the largest decline (-260k) and Maryland had the largest increase (+27k). As states gradually reopen their economies in coming weeks, claims should decline at a faster rate.

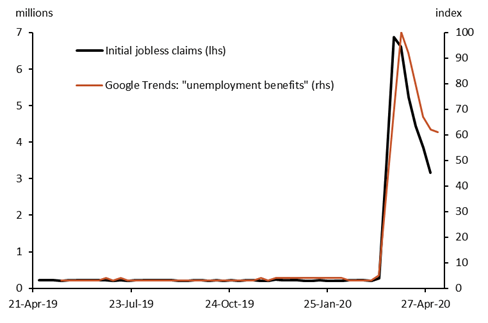

Google Trends indicates that interest in the term “unemployment benefits” continues to fall this week, pointing a further decline in initial jobless claims in next week’s report, albeit at a slow pace (Chart 3).

Chart 1:

Chart 2:

Chart 3: Google Trends - Interest in the term "Unemployment benefits" in the

U.S. over the last year vs. initial jobless claims

Sources: Google and Berenberg Capital Markets

Roiana Reid, roiana.reid@berenberg-us.com