*U.S. initial jobless claims declined to 3.8m during the week ending April 25 from 4.4m in the prior week, bringing its total over the last six weeks to 30.3m (Chart 1). Although initial claims are down 44% from its peak at the end of March, the pace of the declines have slowed, suggesting that unemployment will continue to increase through at least May.

*Continuing claims for unemployment insurance, which are reported with a two-week lag, climbed to 18.0m during the week ending April 18 from 15.8m in the prior week, almost tripling its pre-COVID high from the Great Recession of 2008-2009 (Chart 2).

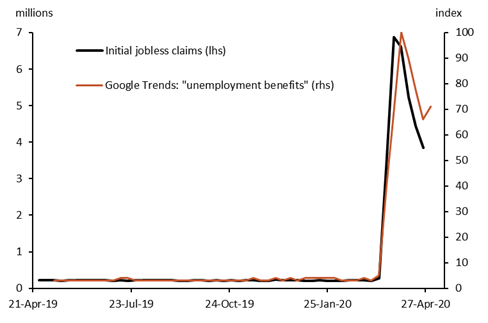

States reporting the highest number of initial claims during the week ending April 25 include Florida (432k), California (328k), and Georgia (265k). Washington recorded the largest increase in claims (+62k to 146k). Encouragingly, initial claims declined in almost all states. This declining trend should continue given that some states are now reopening their economies. However, Google Trends indicates that interest in the term “unemployment benefits” has actually increased this week, pointing to a possible tick up in initial jobless claims in next week’s report (Chart 3).

The estimate of unemployment in the April Employment Report (scheduled for release on May 8) will reflect labor market conditions for the week of April 12-18, which should include the 26m initial jobless claims between March 15 and April 18. Initial claims data released today will be reflected in the May Employment Report.

The Cares Act significantly enhanced unemployment insurance by an additional $600 per week for up to four months. While this is a commendable policy during this crisis, it could distort sections of the labor market once normal activities resume. In February, the average weekly state unemployment benefit nationwide was roughly $387 (varies significantly by state) and average weekly earnings was $981. The additional $600 benefit was a deliberate attempt by Congress to close the gap between the usual state unemployment benefit and average weekly earnings. This enhanced unemployment benefit exceeds typical earnings for many individuals and could constrain labor supply in some sectors once the economy reopens.

Furloughed employees and those on temporary layoff are eligible for unemployment insurance benefits and thus included in the weekly claims count. In a perfect world, all of these workers would return to their jobs when activities are allowed to resume, but some businesses may permanently reduce payrolls and some may permanently close. We expect the labor market to take some time to return to its pre-COVID state, with the unemployment rate likely to be more than double its pre-crisis level at the end of 2021.

Chart 1:

Chart 2:

Chart 3: Google Trends - Interest in the term "Unemployment benefits" in the

U.S. over the last year vs. initial jobless claims

Sources: Google and Berenberg Capital Markets

Roiana Reid, roiana.reid@berenberg-us.com