*In the midst of the COVID-19 shock, the Department of Labor’s (DOL) U.S. Unemployment Insurance Weekly Claims report, which is released with a one-week lag, provides a timely read on labor market conditions and the economy, so we will be monitoring it very closely. Today’s report showed a sizable increase in jobless claims last week, but comments from state labor agencies suggest that jobless claims are surging this week (Table 1).

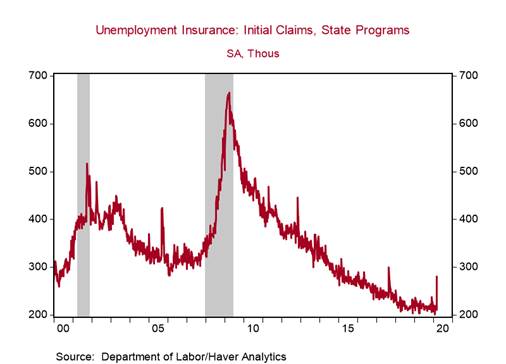

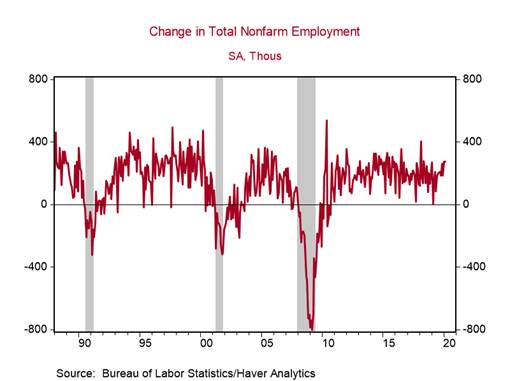

*U.S. initial jobless claims increased to 281k during the week ending March 14 from 211k in the prior week, the highest level since September 2017 and well above its two-year average (219k). In March 2009 – during the Great Recession – initial jobless claims peaked at 665k (Chart 1). Nonfarm payrolls declined by 800k that month (Chart 2).

This claims data for the week ending March 14 includes the survey period for the Establishment Survey, which produces the Bureau of Labor Statistics (BLS) Monthly Employment Report. The Establishment Survey counts a person as employed if he/she received pay at any point during the pay period that includes the twelfth calendar day of the reference month. Given that steps taken to slow the spread of COVID-19 in the U.S. ramped up after March 12, the BLS’s March Employment Report (set for release on April 3) will not fully reflect the deterioration in labor market conditions. The April Employment report will show the bulk of the job losses, assuming that this stoppage in economic activity lasts through at least the first half of April.

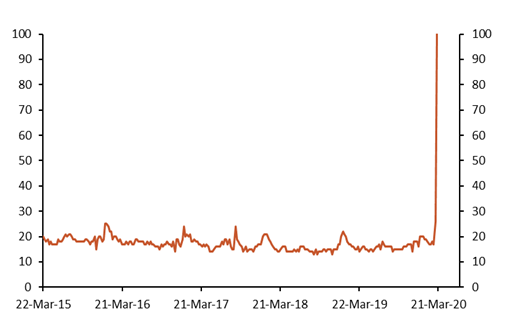

Several state labor agencies have reported a sharp jump in unemployment insurance applications this week, with some even experiencing website malfunctions because of the surge (Table 1). Indeed, Google Trends shows that interest in the term “unemployment benefits” has surged in the last couple of days relative to the prior five years. This spike in claims will show up in next week’s DOL jobless claims report that covers the week ending March 21 (Chart 3).

We estimate that the private service sectors most vulnerable to COVID-19 had 26 million persons on payrolls in February, or 17% of total nonfarm payrolls. The leisure & hospitality sector alone accounted for 17 million of these jobs. Major U.S. automakers have already announced factory closures through the end of March, and our hunch is that other manufacturers will soon follow suit. Manufacturing payrolls totaled 13 million in February.

Small businesses (<500 employees), which are presumably having the most challenging time maintaining operations, account for roughly 49% of private employment. Governments should ensure that these small firms are able to maintain payrolls, provide income support quickly, and expand unemployment benefits programs to reach more affected persons.

Job losses will reduce incomes and weigh heavily on confidence. Household spending on non-necessities and services will be cautious. Some households will not be able to afford essentials. We expect continued declines in business production and capital spending to constrain the turnaround in labor markets even after the economy re-opens. This massive shock is destabilizing what had been a robust labor market through February.

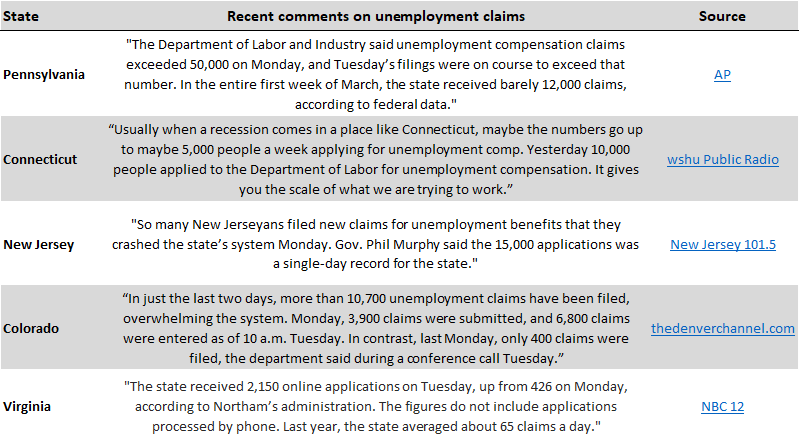

Table1: Comments from states about the surge in jobless claims

Chart 1:

Chart 2:

Chart 3: Google Trends - Relative interest in the term "Unemployment benefits" in

the U.S. over the last five years

Source: Google

Roiana Reid, roiana.reid@berenberg-us.com