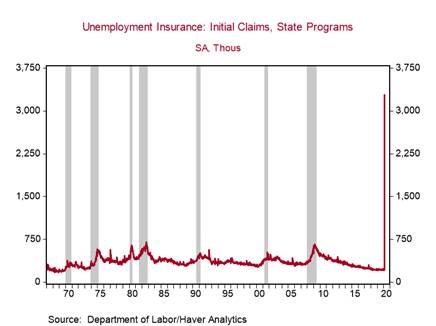

*U.S. initial jobless claims surged to 3.3m during the week ending March 21 (from 282k in the prior week), by far the highest on record. Yes, the surge in jobless claims was widely expected, but these numbers are still startling (US initial jobless claims jumped last week, but worst is yet to come and US employment to plummet – temporarily, we hope). See Chart 1.

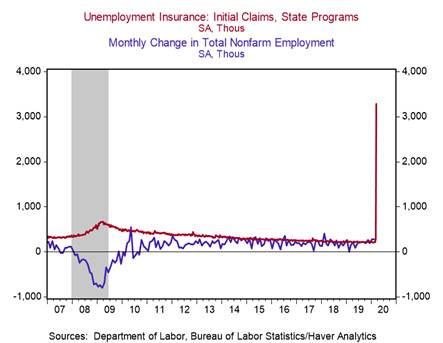

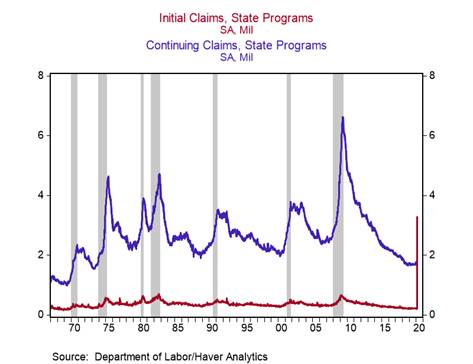

*To put into context how large these initial claims numbers are: 1)the prior record high was 695k in 1982; during the Great Recession when 8.7 million jobs were lost, weekly initial jobless claims peaked at 665k (Chart 2); and 2) for the first time on record, initial claims for unemployment insurance exceeded continuing claims from the prior week (1.8mn). See Chart 3.

Our baseline forecast is for the unemployment rate to increase from 3.5% to 12% in Q2 and fall to 8% by year-end (Forecasts at a Glance, March 26, 2020). We expect some of this stunning loss of jobs to be reversed following the acute stages of the pandemic crisis, but it will take some time for employment to return to pre-crisis levels.

Note that, because of the timing of the survey that produces the Bureau of Labor Statistics’ (BLS) Official Monthly Employment Report, the March Employment Report (set for release on April 3) will not fully reflect the deterioration in labor market conditions. The April Employment report scheduled for release on May 8 will show the bulk of the job losses.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, which has been passed by the Senate and that we expect to be passed by the House and signed into law, enhances and expands unemployment insurance (UI), so initial jobless claims will likely remain near these historic levels in coming weeks (US macroeconomic policy responses to the pandemic, March 25, 2020). The CARES Act provides an additional $600 per week for four months of UI coverage and it expands unemployment benefits to cover nontraditional, so-called “GIG workers” who are legally independent contractors rather than employees of firms. The Bureau of Labor Statistics estimates that roughly 6 million people hold contingent jobs and 11 million work as independent contractors.

The CARES Act provides loans and grants to businesses to help them maintain operations and payrolls, and also provides tax credits and other benefits to companies that retain employees. If the legislation works as intended, it would minimize job losses and reduce labor market dislocations, allowing the economy to rebound more quickly once the acute stage of this crisis ends.

Chart 1:

Chart 2:

Chart 3:

Roiana Reid, roiana.reid@berenberg-us.com