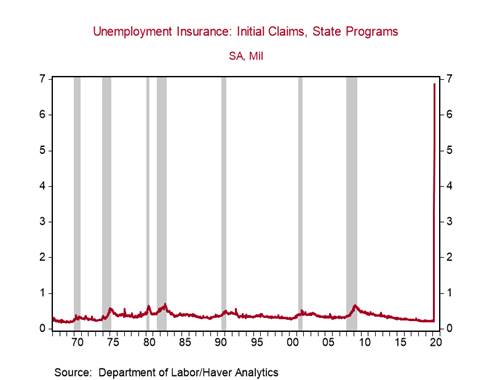

*U.S. initial jobless claims declined to 5.25m during the week ending April 11 from 6.62m in the prior week, remaining frustratingly high (Chart 1). Initial claims have totaled 22m between March 14 and April 11, suggesting that the unemployment rate is approaching 20%. This deterioration in labor market conditions has been rapid and dramatic, but the improvement will be sluggish.

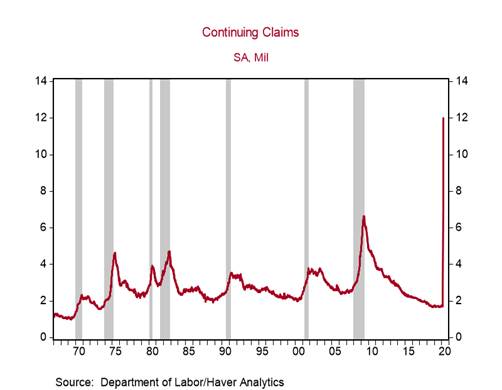

*Continuing claims for unemployment insurance, which are reported with a two-week lag, increased to 12m during the week ending April 4 from 7.4m in the prior week, almost doubling its high from the Great Recession of 2008-2009 when the unemployment rate peaked at 10% (Chart 2).

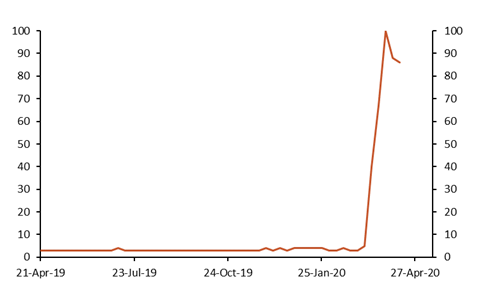

States reporting the highest number of initial jobless claims (in non-seasonally adjusted terms) for the week ending April 11 include California (661k), New York (396k), and Georgia (318k). With almost all states issuing stay-at-home orders, initial claims have likely peaked, but Google Trends suggests that interest in the term “unemployment benefits” is still high, indicating a slow descent for initial claims (Chart 3).

The estimate of unemployment in the April Employment Report (scheduled for release on May 8) will reflect labor market conditions for the week of April 12-18, which should include the 22m initial jobless claims between March 14 and April 11 plus initial claims covering this week.

According to the Fed’s most recent Beige Book:

“Employment cuts were most severe in the retail and leisure and hospitality sectors, where most Districts reported widespread mandatory closures and steep falloffs in demand. Many Districts said severe job cuts were widespread, including the manufacturing and energy sectors. Contacts in several Districts noted they were cutting employment via temporary layoffs and furloughs that they hoped to reverse once business activity resumes. The near-term outlook was for more job cuts in coming months.”

The recovery in labor markets is likely to be sluggish. Some businesses will permanently close and others that reopen may reduce payrolls because of weak demand. Labor market dislocations will take a while to sort out. By year-end 2021, we expect the unemployment rate to fall to 9.1%, which would be more than double its pre-crisis rate of 3.5%. These job losses will weigh heavily on confidence. Household spending on non-necessities and services will be cautious.

Chart 1:

Chart 2:

Chart 3: Google Trends - Relative interest in the term "Unemployment benefits"

in the U.S. over the last year

Source: Google

Roiana Reid, roiana.reid@berenberg-us.com