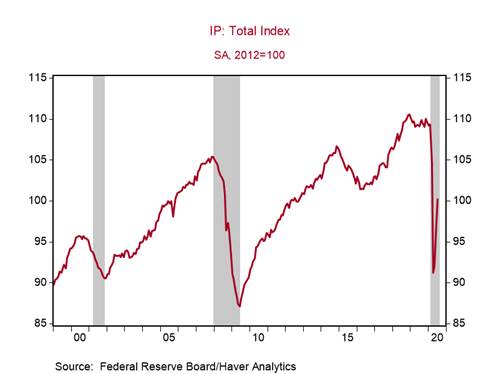

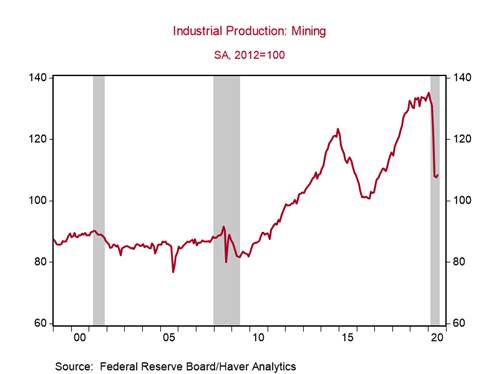

*U.S. industrial production (IP) increased by 3.0% m/m in July, bringing its three-month cumulate change to 9.8% and placing it 8.4% below February’s level (Chart 1). Production increased across all major industry groups: motor vehicle and parts (+28.3% m/m); manufacturing ex autos (+1.6% m/m); utilities (+3.3% m/m). Mining production increased for the first time since January (+0.8% m/m) but remained low (Chart 2).

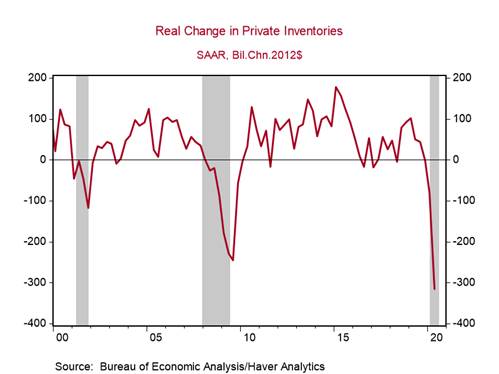

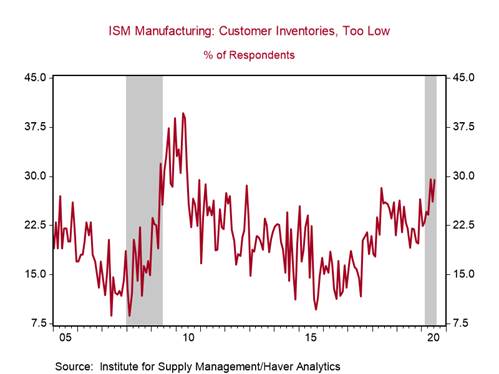

*We expect continued growth in production in the near term as businesses rebuild inventories. The mandated lockdowns constrained production, while the reopening of the economy resulted in a faster rebound in goods consumption than production. This resulted in a depletion of inventory investment which subtracted 4pp from growth in Q2 (Chart 3). Surveys suggest that an elevated share of manufacturers’ continue to view their customers’ inventories as too low (Chart 4) and that small businesses view their own inventories as low.

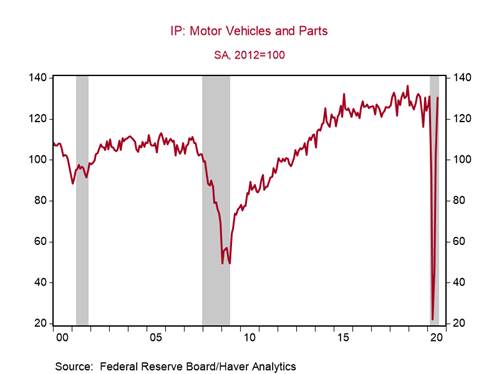

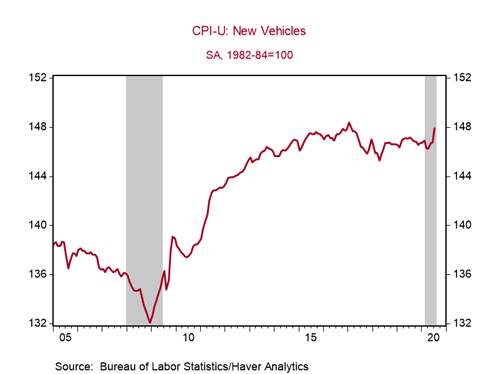

The massive 490.9% cumulative increase in motor vehicle and parts production over the last three months has pushed it back to pre-pandemic levels, after its stunning collapse to a record low (monthly data began in 1972) in April (Chart 5). Auto production has rebounded strongly in response to the robust gains in vehicle sales. The large 0.8% m/m increase in the consumer price index for new vehicles in July to a 3.5-year high suggests that demand is continuing to outpace supply, so further growth in auto production is needed (Chart 6).

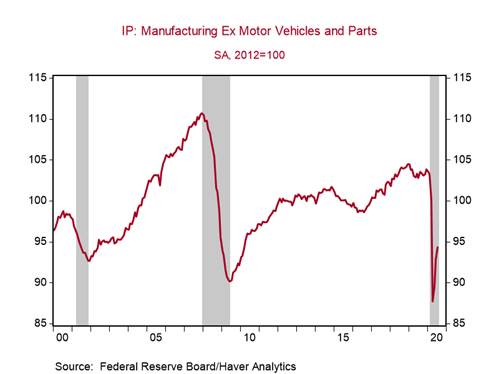

Manufacturing production ex motor vehicles, which is indicative of broader manufacturing trends, has increased by only 7.5% over the last three months and is 8.7% below February’s level (Chart 7). Outside of autos, demand for manufacturing goods remains subdued.

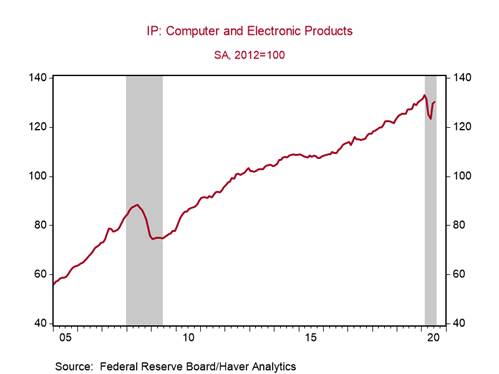

Production of computer and electronic products increased by 0.7% m/m in July, placing it only 2.1% below February’s level. It has outperformed all other industries except autos, with demand for computer products boosted by the shift to work from home (chart 8).

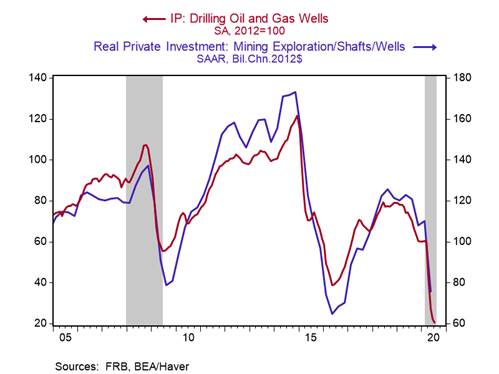

The IP subcategory drilling of oil and gas wells declined by 8% m/m in July -- its 16th monthly decline since the start of 2019 -- to a new all-time low and will again weigh heavily on the Bureau of Economic Analysis’ estimate of structures investment in GDP in Q3 (Chart 9). Investment and hiring in oil and gas and supporting sectors will remain sluggish even as activity rebounds in other sectors.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Roiana Reid, roiana.reid@berenberg-us.com