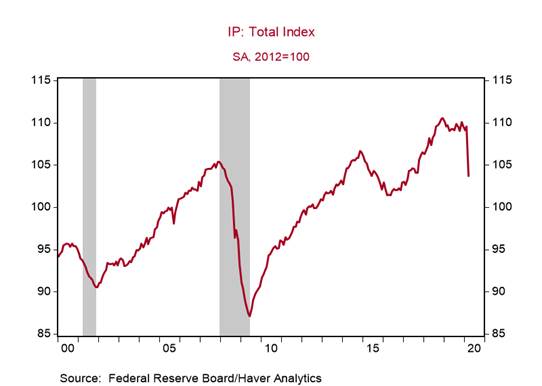

*U.S. industrial production (IP) declined by 5.4% m/m in March, the largest decline since January 1946, pushing it 5.5% below its year-ago level (Chart 1). Declines were broad-based, with auto production falling the most, reflecting the decision of major automakers to shut down factories early: motor vehicle and parts (-28.0% m/m), manufacturing ex motor vehicle (-4.5% m/m), utilities (-3.9% m/m), and mining (-2.0% m/m).

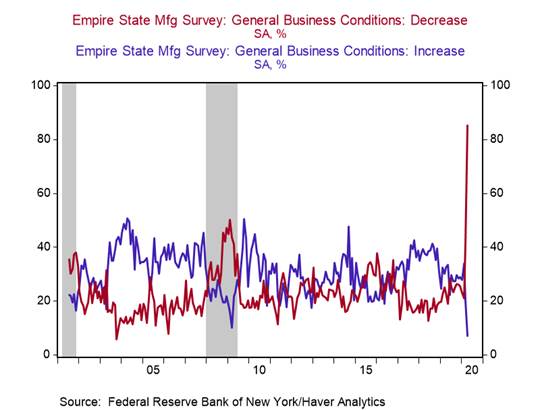

*The Empire State Manufacturing Index tumbled by 56.7pts to -78.2 in April, the lowest on record, as 85% of manufacturers reported a decline in business conditions and only 7% reported an increase (Chart 2). This reflects a combination of the mandated shutdowns of “non-essential” manufacturing activities in the New York Region and the sharp drop in both domestic and global demand. The survey’s six-month ahead business conditions index rose slightly to 7.0 from 1.2, suggesting that, on balance, little improvement is expected.

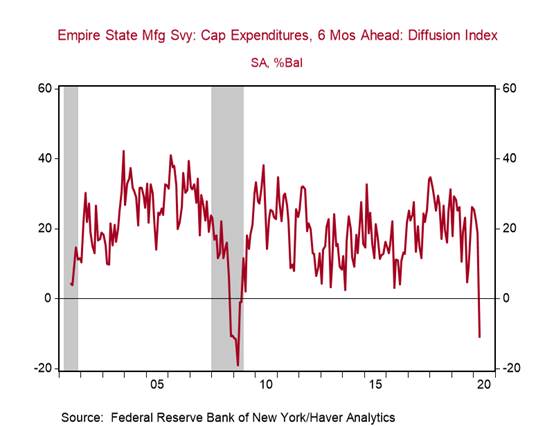

*We emphasize that industrial production will continue to fall even after the acute stage of this crisis ends, as businesses deal with the undesired inventory buildup from the sharp drop in product demand and as the disruption to global supply chains affects production processes. Moreover, businesses will be reluctant to increase investment amidst elevated uncertainties. Indeed, the Empire State manufacturing’s six-month ahead CapEx index declined sharply to -11.0 from 18.7, with 34% of manufacturers planning to decrease spending, compared to 23% planning to increase (Chart 3).

The measures of current activity in the Empire State manufacturing survey all recorded historical declines in April: the new orders index declined by 57pts to -66.3, shipments index declined by 66.4pts to -68.1, and the average workweek index declined by 51.0pts to -61.6. The number of employees index plummeted by 53.8 points to -55.3, reflecting significant job losses that are consistent with the historical spike in initial jobless claims.

The decline in the Empire State manufacturing “prices received” index to -8.4 from 10.1 is consistent with our forecast for a modest bout of deflation, reflecting insufficient aggregate demand relative to constrained supply that will put downward pressure on prices.

The short list of essential manufacturing activities that have been allowed to proceed in New York State during this shutdown explains the sharp decline in manufacturing activity in April: food processing, manufacturing agents, including all foods and beverages, chemicals, medical equipment/instruments, pharmaceuticals, sanitary products, telecommunications, microelectronics/semi-conductor, agriculture/farms, household paper products.

Industrial production will decline by much more in April than it did in March, reflecting a full month of stoppage of non-essential activities. The decline in overall IP will be exacerbated by categories related to the energy sector such as drilling of oil and gas wells and oil and gas extraction, reflecting the plunge in oil prices.

Chart 1:

Chart 2:

Chart 3:

Roiana Reid, roiana.reid@berenberg-us.com