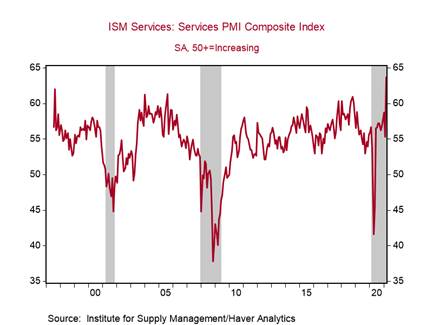

U.S. ISM services survey soars, indicating robust economic activity

*The ISM report on the business services index jumped from 55.3 in February (depressed by winter storms) to 63.7 in March, its highest measure since 1997 when the survey began (Chart 1). This sky-high reading of the diffusion index suggests that activity in the services sectors that were hard hit by the pandemic and government shutdowns are bouncing back strongly.

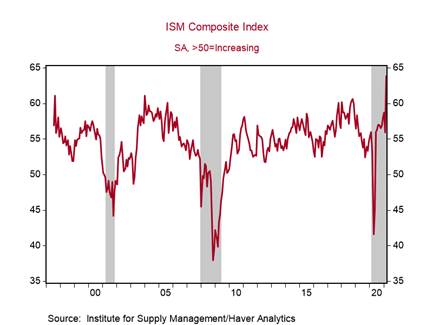

*The high reading lifted the ISM composite index that combines the ISM manufacturing and ISM services to an all-time high of 63.8 from 55.9 (Chart 2). This ISM reading for March is consistent with strong March reports on employment, housing activity, and consumer confidence. We expect similar readings on consumer spending and industrial production consistent with robust growth in economic activity.

*Of the four equally weighted components of the ISM services index, the index of business activity rose to an all-time high 69.4 vs. 55.5, new orders rose to 67.2 (vs. 51.9), its highest reading since 2003, the index for employment increased sharply from 52.7 to 57.2, and supplier deliveries remained elevated at 61.0 vs. 60.8.

*Of the businesses responding to the survey, only 7.9% said business activity had declined from the prior month, 10.6% said new orders had declined, and 11.1% said employment had declined.

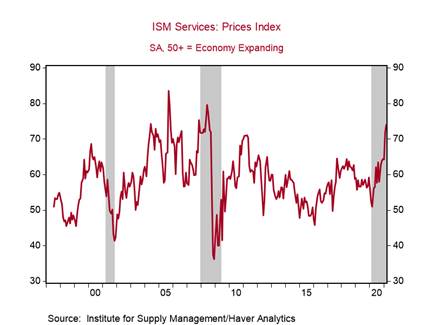

*The ISM services index for prices rose to 74.0 from 71.8, indicating that nearly three-quarters of all businesses surveyed were experiencing price increases from last month (Chart 3). Only 1% of all businesses surveyed said prices had declined from the prior month.

Chart 1.

Chart 2.

Chart 3.

Mickey Levy, mickey.levy@berenberg-us.com