*The U.S. Job Openings and Labor Turnover Survey (JOLTS) is published with a one-month lag, but it complements the Bureau of Labor Statistics’ (BLS) Employment Report by providing detailed insights into labor market dynamics including job openings, hires, layoffs, and other separations. According to JOLTS, job openings declined for the first time since April in August, hires increased only slightly, remaining well below the level observed in the early stages of the recovery, but layoffs fell sharply.

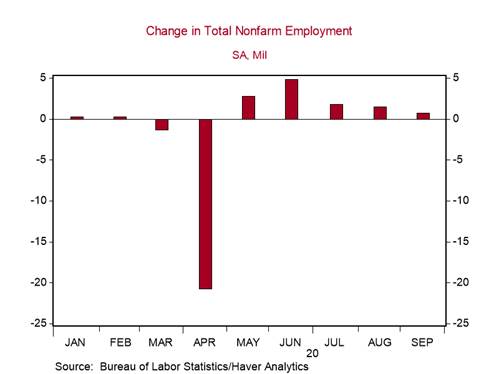

*The U.S. recouped 11.4m of the 22.2m jobs lost in March and April very quickly, but the levelling off in hires and decline in job openings suggest that it will take much longer to recoup the remaining 10.8m jobs lost. These labor market dynamics are consistent with the slowdown in nonfarm payroll growth over the summer following the strong rebound in May and June (Chart 1).

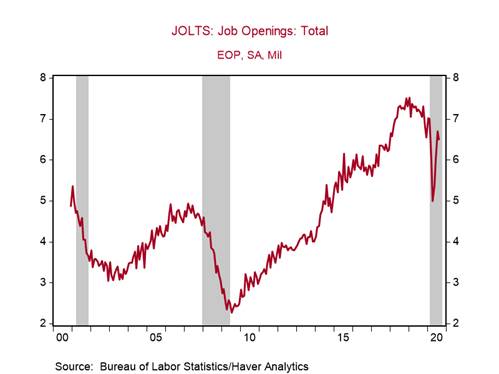

Job openings declined to 6.5m in August from 6.7m in July, falling further below its pre-pandemic average of 7.1m, a discouraging sign that the demand for labor is already softening less than six months into the recovery (Chart 2). In August, job openings fell in all private sectors except manufacturing (+30k, see Chart 3), accommodation and food services (+21k), professional and business services (+4k), and wholesale trade (+3k). Job growth in manufacturing, accommodation and food services, and wholesale trade sectors accelerated in September, even as overall job growth slowed.

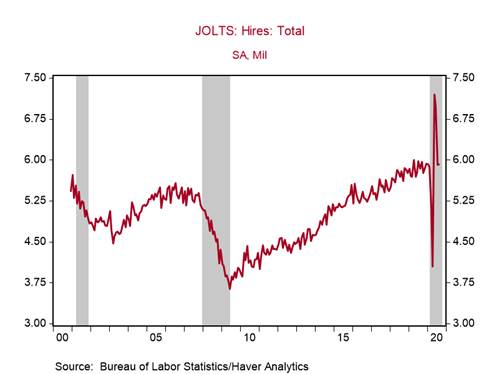

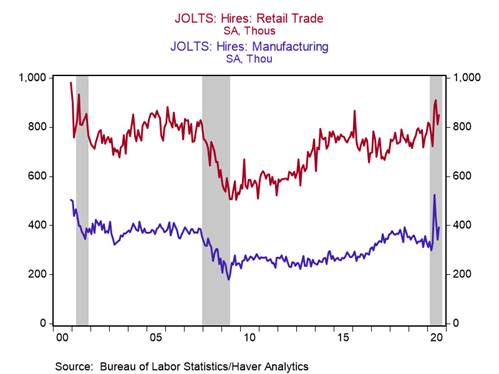

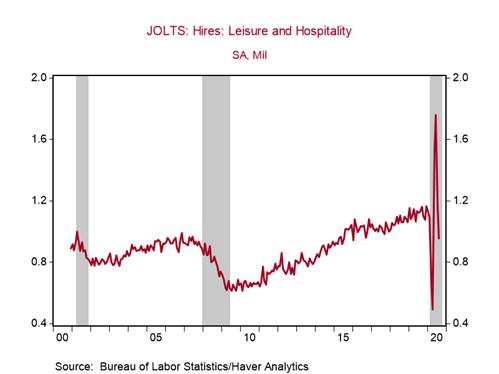

Total hires increased slightly, by 16k, to 5.92m in August after averaging 7.09m in May and June (Chart 4). A slowdown in the pace of hiring was to be expected after the initial boost from the reopenings, but its quick return to February’s level points to a sluggish labor market recovery going forward. Hires in the manufacturing (+58k above February’s level) and retail (+36k above) sectors remained elevated, consistent with the V-shaped rebound in retail sales, elevated manufacturing optimism, and strong growth in manufacturers’ new orders (Chart 5). Meanwhile, total hires in the leisure and hospitality sector - most adversely impacted by the pandemic - declined by 213k in August, placing it 136k below February’s level (Chart 6).

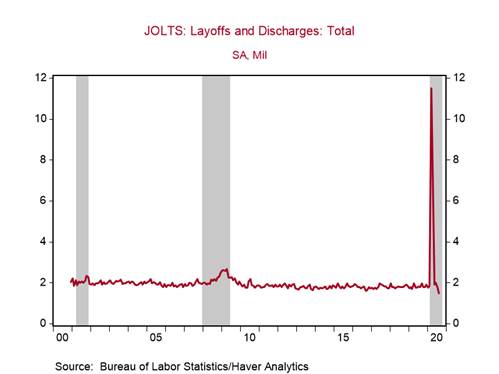

Total job separations remained very low, with layoffs declining to 1.5m in August from 1.7m in July (Chart 7), the smallest number of layoffs in the survey’s 20-year history, and voluntary job quits declined by 139k to 2.8m in August, well below the pre-pandemic average of 3.5m, suggesting that households are not confident in job-finding prospects.

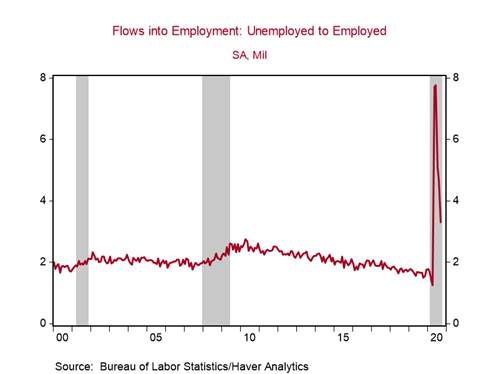

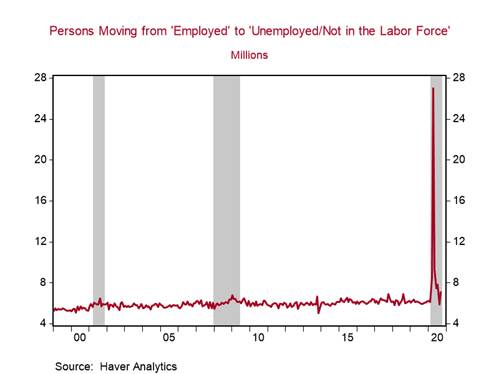

Labor market flows from the BLS’ Employment Report point to a further slowing in the rate of hiring in September: 3.3 million persons moved from “unemployed” to “employed”, down from 4.7m in August (Chart 8). Moreover, layoffs probably started to increase again in September: the number of persons moving from “employed” to “unemployed/not in the labor force” jumped to 7.1m from 5.8m in August (Chart 9).

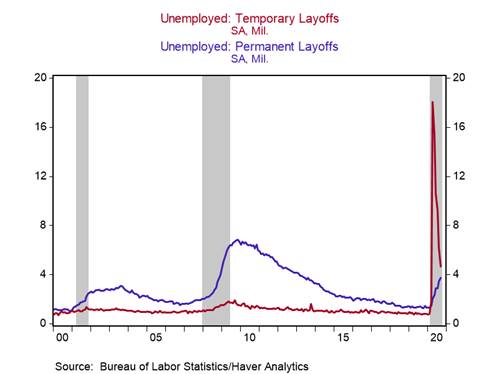

The BLS’ September Employment Report showed the number of individuals on temporary layoff/furloughs falling and number of individuals who have permanently lost jobs increasing (Chart 10). This is a troubling sign, suggesting that some temporary layoffs are being made permanent and that a greater share of new job losses are permanent. The permanent scars from this crisis are growing.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Chart 10:

Roiana Reid, roiana.reid@berenberg-us.com