U.S. JOLTs Data Corroborate Strong Labor Market Recovery

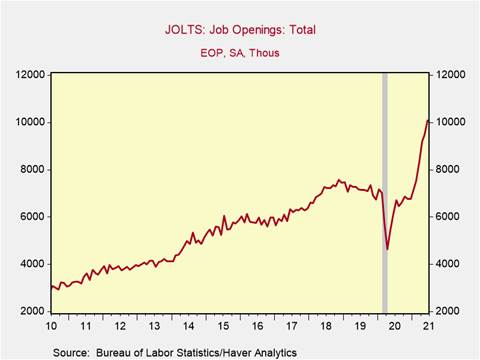

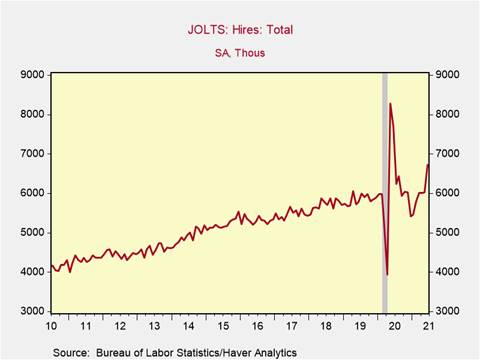

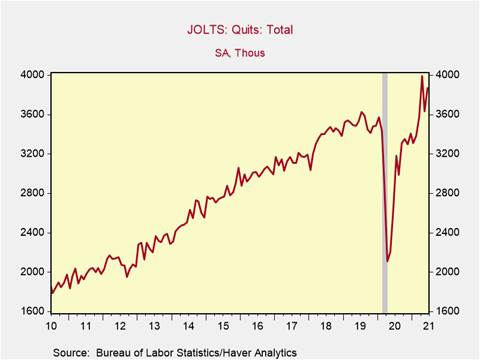

*The Bureau of Labor Statistics’ (BLS’s) JOLTs Report, which provides labor market details with a one month lag, showed that in June job openings jumped above 10 million for the first time ever (Chart 1) while hires jumped to 6.7 million from 6.0 million (Chart 2), consistent with the high demand for workers and strong gains in employment despite ongoing labor market shortages. Employment quits rose to 3.87 million, close to an all-time high, reflecting worker confidence in the job market (Chart 3).

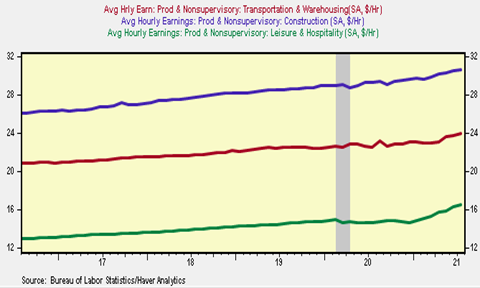

*The BLS’s Employment Reports and JOLTs data in recent months measure the solid improvements in the labor market as it continues to regain pre-pandemic levels. Through July, total establishment payrolls have risen over 4 million in the last six months, a 680k monthly average rise. Employment is now 5.4 million below its pre-pandemic level. In the Household Survey, the number of unemployed has fallen 1.4 million during this period and is now 2.9 million above the pre-pandemic level. The elevated level of job openings reflects strong business demand for labor. Wage gains continue to climb (Chart 4).

*The BLS’s labor market reports combined with the GDP report for Q2 provide keen insight into perhaps the most critical question facing economic and financial performance and the Federal Reserve’s policies: Following the reopening spurt in the economy, what happens next? The strong gains in labor markets point to further gains in consumer purchasing power while the ongoing inventory liquidations, despite strong product demand, point toward sustained growth in consumer spending and rapid growth in production. Of course, all of this must be tempered by the temporary negative economic impacts that may be imposed by the Delta variant, but they are nevertheless very positive.

-In particular, the dramatic rise in employment (+943k) and aggregate hours worked (+0.7%) and wages (+0.4%) in July point toward a big increase in disposable personal income and consumer purchasing power. There is still pent up demand, excess savings and record level household net worth, and confidence is high.

-The GDP Report for Q2 showed robust growth in final domestic sales (3.4% q/q or 14.4% q/q annualized) but a continued sharp liquidation of inventories ($169 billion in Q2 following $94 billion in Q1). This ongoing inventory depletion—the largest during any economic expansion in U.S. history–is undesired, as production is constrained by supply bottlenecks.

-These reports suggest sustained strong growth in consumption and production as businesses strive to meet product demand and replenish inventories. Also, business investment spending is projected to grow at a healthy pace in this environment of strong product demand, profits and cash flows, and very low interest rates and costs of capital.

*If this economic scenario plays out, pressures on producer and consumer inflation are likely to persist. Not surprisingly, average hourly wages continue to accelerate. To argue as the Fed has that the rise is temporary due to supply constraints is incomplete and ignores the impact on production costs and consumer prices of sustained growth in demand and the need for businesses to produce. This week’s data releases on the CPI and PPI for July will provide further information about inflation.

Chart 1: JOLTs: Job Openings total

Chart 2: JOLTs: Hires total

Chart 3: JOLTs: Quits total

Chart 4: Average Hourly Earnings – Transportation & Warehousing/Contrsuction/Leisure & Hospitality

Mickey Levy, mickey.levy@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.