*The U.S. Job Openings and Labor Turnover Survey (JOLTS) is published with a one-month lag, but it complements the closely watched U.S. Monthly Employment report by providing detailed insights into labor market dynamics such as job openings, hirings, layoffs, and other separations. According to JOLTS, hiring increased in May as expected given the reopening of businesses, layoffs declined sharply, and job openings remained depressed.

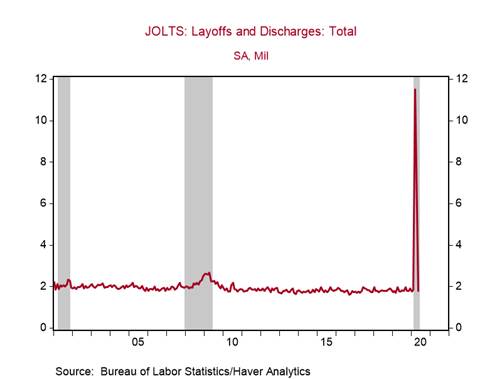

*Layoffs declined to 1.8m in May, already returning to its pre-pandemic level after surging to 11.5m in March (Chart 1). This quick drop in layoffs to normal levels is a welcome surprise, increasing the likelihood of sustained net increases in employment in the coming months. Layoffs returned near pre-crisis levels for all major industries except mining and logging and wholesale trade. Clearly widespread business reclosures from COVID-19 incidence spikes would reverse these trends. The sharp decline in layoffs contrasts the still historically high weekly initial jobless claims, providing more evidence that the jobless claims data that are collected at the state level are an unreliable gauge of labor market dynamics during this crisis (see Technical note below).

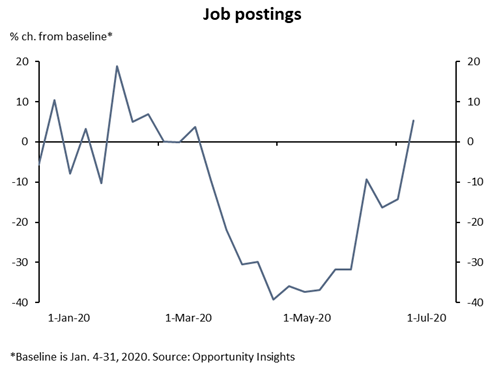

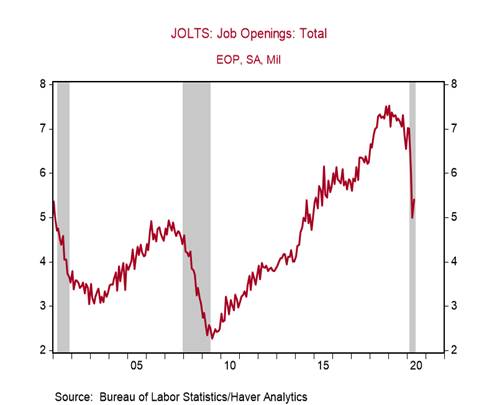

*The sharp fall in layoffs in May explains the faster-than-expected rebound in nonfarm payrolls growth in May, and, based on the 4.8m increase in June’s payrolls, this trend continued. But payrolls are still 14.7m below February’s level, indicating that the labor market recovery still has a long way to go. Encouragingly, high frequency data on job postings continued to rise through the end of June, pointing to further increases in job openings from its depressed level in May (Chart 2).

Technical note. JOLTS data are collected from establishments while weekly jobless claims data are collected from state labor department offices. Initial jobless claims data are usually a useful gauge of layoffs, but the speed of this crisis, the enhanced and expanded unemployment benefits from Congress, combined with antiquated systems at state labor department offices have led to delays and inconsistencies in processing jobless claims. Reports indicate that multiple applications for jobless claims from individuals, backlogs at state labor department offices, inconsistent methodologies for counting claims across offices, and fraud are leading to an over-count of jobless claims, making them an unreliable gauge of labor market activity during this crisis (Bloomberg, June 30, 2020).

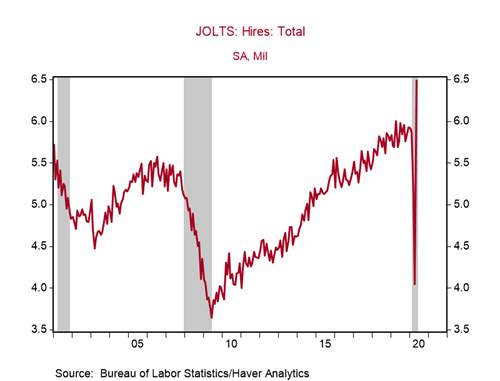

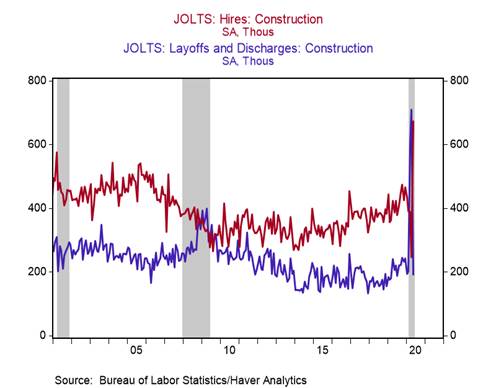

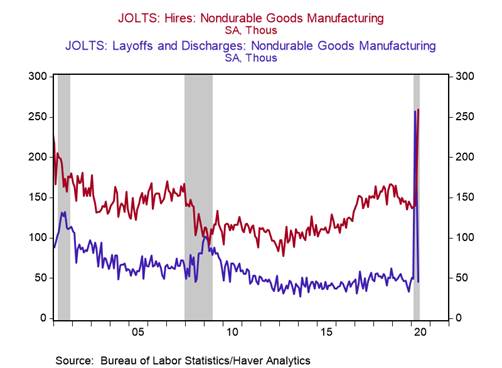

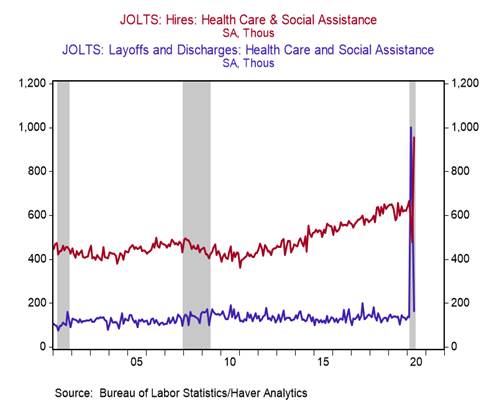

Total hires increased to 6.5m in May, the highest on record (data started in 2000), after tumbling to 4.0m in April (Chart 3). Hiring in the construction (673k), nondurable goods manufacturing (259k), and healthcare & social assistance (956k) were particularly strong, rising to all-time highs, almost fully offsetting layoffs in the prior months and reflecting relatively quick rebounds in activity in these sectors (Charts 4-6). Financial and insurance hiring held up relatively well in March and April, but it was the only private sector that reduced hiring in May.

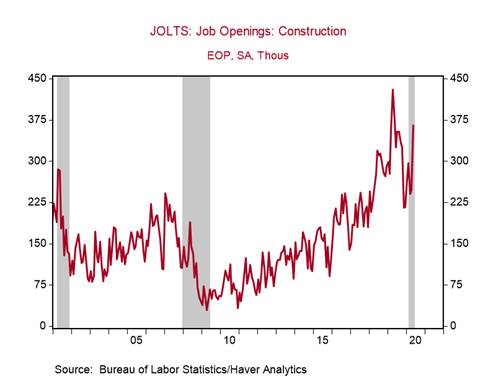

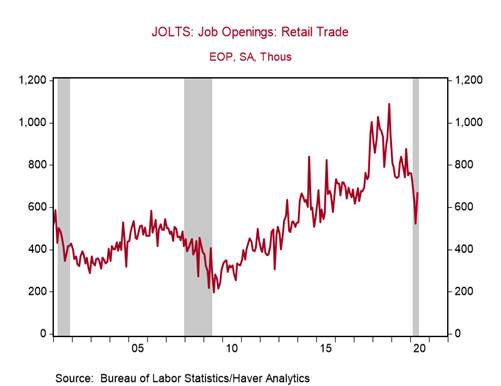

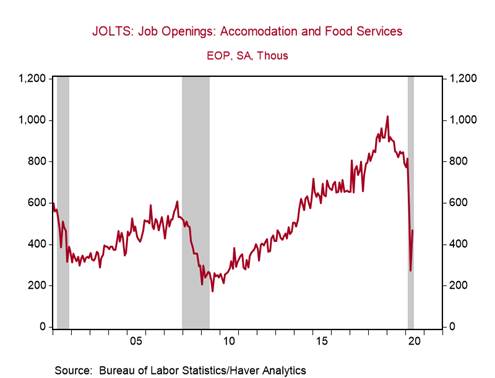

Job openings increased to 5.4m in May from 5.0m in April, placing openings 1.6m below February’s level, reflecting weak labor demand (Chart 7). The construction (+118k to 365k), retail trade (+147k to 668k), and accommodation and food services (+196k to 469k) sectors accounted for the bulk of the increases in job openings in May (Charts 8-10). The large increase in construction job openings to a one-year high is consistent with the quick rebound in housing demand. Although total retail job openings in May were still below February’s level (-6.6%), the sizable gain mirrors the strong growth in May’s retail sales. Despite the strong gain in accommodation and food services openings, they were 43% below February’s level, reflecting the disproportionate effect of the pandemic on the sector.

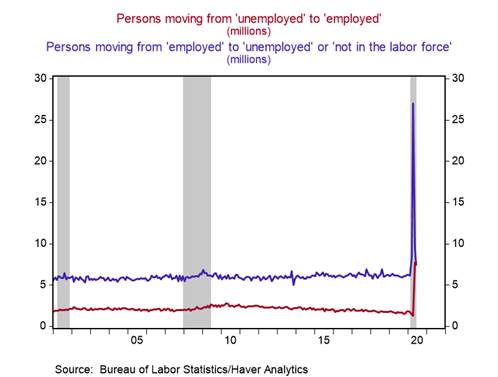

Labor market flows from the Monthly Employment Report point to a continuation of elevated hiring trends in June and declines in layoffs. In June, a massive 7.8 million persons moved from “unemployed” to “employed” and 7.5m persons moved from “employed” to “unemployed” or “not in the labor force,” down markedly from 27m in April, indicating further declines in layoffs (Chart 11).

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Chart 10:

Chart 11:

Roiana Reid, roiana.reid@berenberg-us.com