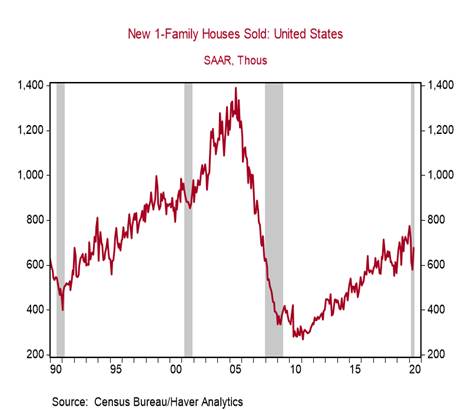

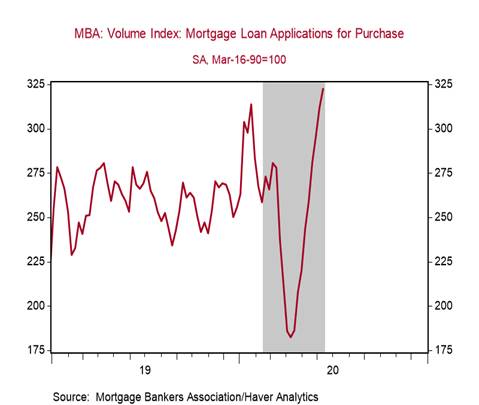

*U.S. new home sales jumped by 16.6% m/m to 676k annualized in May, rebounding strongly from its cumulative 19% decline in March and April, placing it just 5.6% below February’s level (Chart 1). New home sales are counted at initial contract signings, providing a timely read on housing market conditions. The strong rebound in new home sales is consistent with the renewed optimism from home builders, the increase in building permits, and the strong growth in mortgage applications for home purchases (+20.1% yr/yr). See Chart 2.

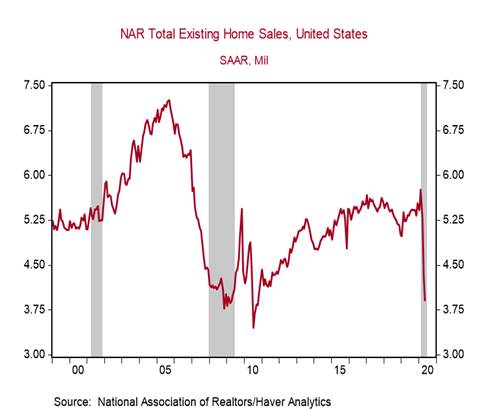

*Existing home sales tumbled by 9.7% m/m to 3.91m annualized in May, a 9.5-year low, placing sales 32% below the February peak (Chart 3). Unlike new home sales, existing home sales are counted at contract closings so they are a lagging indicator of housing market conditions. Home sales transactions usually take two to three months to complete, so May’s existing sales reflect activity in March-April, the peak of the lockdown. We expect a strong rebound in existing home sales in coming months as delayed transactions are completed.

The months’ supply of new homes – ratio of new homes available for sale to homes sold – declined sharply to 5.6 in May from 6.7 in April (Chart 4). At the peak of this crisis, the months’ supply of new homes remained below the end-2018 level when mortgage interest rates spiked and weighed heavily on sales, and remained well below the 2008-2009 housing crisis levels. The relatively low and declining months’ supply of new homes will incentivize builders to continue to break ground at a faster pace in the near term.

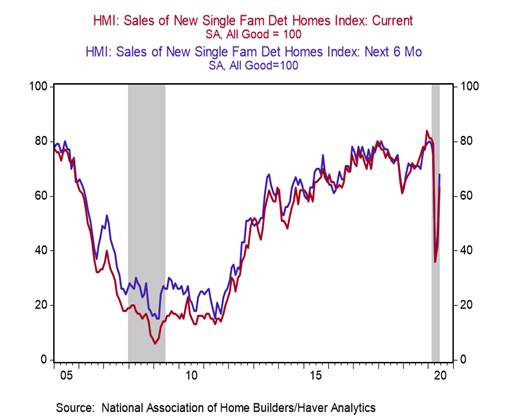

The sharp improvement in the National Association of Home Builders’ assessment of both current (June: 63, April: 36) and future home sales in June (June: 68, April: 36) also bode well for further increases in new home sales (Chart 5).

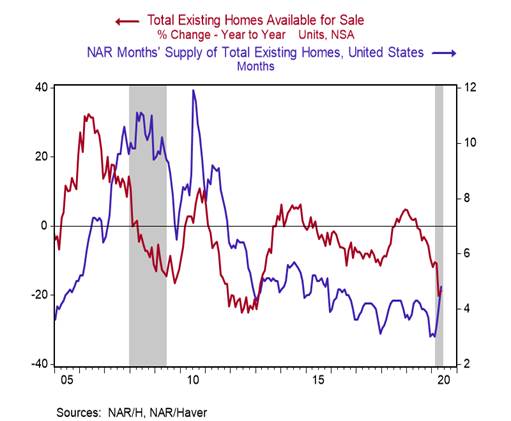

The months’ supply of existing homes ticked up from 4.0 in April to 4.8 in May (still a low level) and the inventory of existing homes available for sale declined by 19% yr/yr, the 12th consecutive monthly decline reflecting the persistent shortage of previously owned homes available for sale (Chart 6). The median sales prices of existing homes increased by 2.3% yr/yr in May, a sharp deceleration from 7.4% yr/yr in April, but, as conditions normalize, we would expect home price growth to reaccelerate.

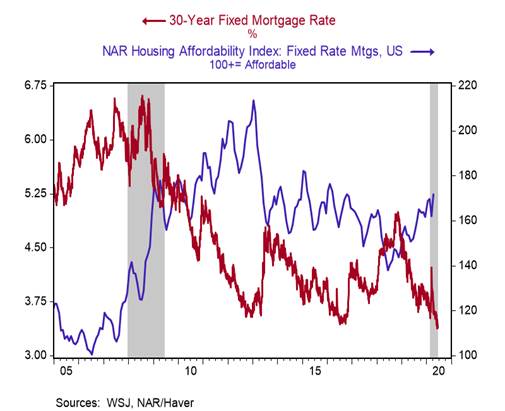

The sharp decline in mortgage rates to historic lows is lifting affordability and is largely responsible for the strong momentum and quick rebound in housing activity (Chart 7). We expect the shortage of reasonably priced existing homes available for sale and strong demand for housing units to continue to spur residential construction and new home sales. Importantly, favorable demographics and pent-up demand from younger cohorts will support demand in the intermediate term.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com