*The Bureau of Economic Analysis reported strong gains in personal income and consumption in July while the rate of personal savings remained elevated, suggesting considerable consumer purchasing power.

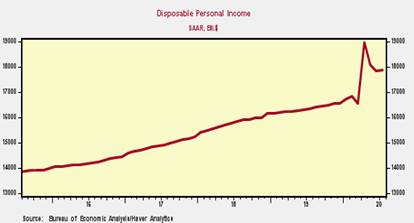

*Personal income increased 0.4% in July, following declines in May-June, lifting its yr/yr rise to 8.2%, while real disposable personal income (after tax and inflation) declined 0.1%, maintaining its yr/yr rise at 8.4%. These sizable gains despite sharply lower employment reflect the sizable government transfer payments to individuals and unemployed. As a result, disposable income is well above its pre-pandemic level (Chart 1).

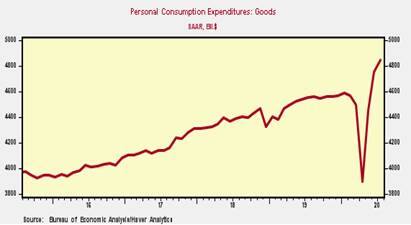

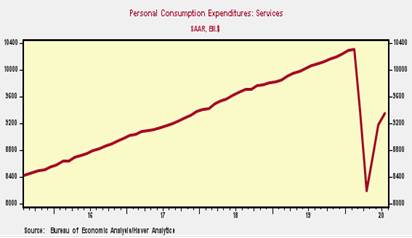

*Consumption in July increased strongly: 1.9%, 1.6% in real (inflation-adjusted) terms. Consumption of durable goods (computers, autos, household appliances, recreational goods, etc.) provided the biggest boost, up 2.5% in real terms. It is now significantly higher than its pre-pandemic level (Chart 2). Consumption of nondurable goods increased 1.1%, and remain very strong. Despite a healthy 1.6% rise in July, spending on services has retraced only half of its steep decline in March-April, and remains the weakest component in the economy (Chart 3). This uneven composition of consumption is mirrored directly in the uneven pattern in the labor markets, with massive unemployment remaining in many service sectors while most employment has been restored in manufacturing and construction.

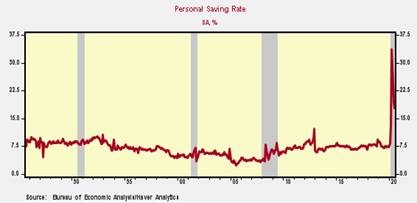

*Total personal saving ‑- that is the portion of disposable income that is not spent ‑- declined 6.75% but remained at an extremely lofty $3.19 trillion on an annualized basis, and the rate of personal saving declined in July to 17.8% from 19.2% in June, also very elevated (Chart 4). These saving measures reflect the combination of the sharp rise in disposable income and the pandemic-constrained consumption. The high savings rate[?or high level of savings?] implies a significant amount of consumer purchasing power that will be spent as the pandemic recedes.

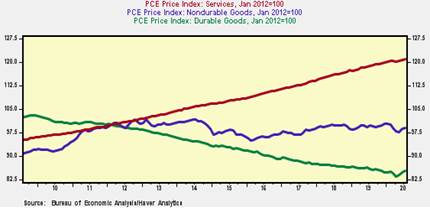

*The PCE price index increased 0.3% in July for both the headline and core measures, lifting their yr/yr increases to 1.0% and 1.3%, respectively (Chart 5). Since January 2012, when the Fed officially began targeting 2% inflation measured by the PCE price index, PCE inflation for services has persistently risen by well over 2%, while the PCE index for durable goods has fallen, reflecting quality adjustment measurement, and the PCE inflation for nondurable goods, which is heavily influenced by energy prices, has fluctuated around 0% (Chart 6). With the July data, the PCE price index for durable and nondurable goods is -0.6% and -0.7% yr/yr, respectively, while the PCE price index for services is +1.7%.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Chart 5.

Chart 6.

Mickey Levy, mickey.levy@berenberg-us.com