U.S. personal income soars, consumption rises sharply, and higher inflation comes into focus

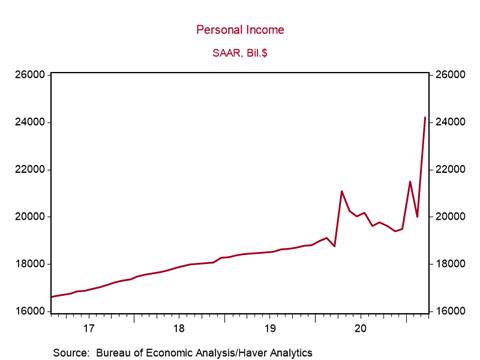

*Personal income spiked 21% in March, its largest increase since 1946, reflecting primarily the government’s distribution of $1400 stimulus checks to most Americans (Chart 1), consumption jumped 4.2%, rebounding from its weather-constrained decline in February, and the PCE price index rose 0.5% and 0.4% excluding food and energy.

*The strength in consumer spending spearheaded the strong 6.4% annualized growth in real GDP in Q1 and lifts the starting point for Q2, setting the stage for robust growth in consumption and GDP. The PCE price index—both headline and core--will jump further in April and lift inflation well above the Fed’s 2% longer-run target. This will draw more attention to the issue of whether the rise in inflation is temporary or the beginning of a sustained upward trend.

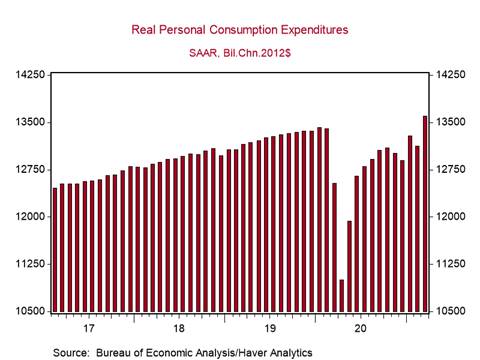

*Real inflation-adjusted consumption rose 3.6% in March, boosted by a 7.3% rise in goods (10.3% in durables and 5.6% in nondurables) and a solid 1.7% in services (Chart 2). Consumption is now 1.3% above its January 2020 level, even though spending on services remain 5.1% below their pre-pandemic level. Even with the shortfall in the services sector, the recovery in consumption has been decidedly V-shaped. Consumption would likely have been even stronger if there had not been supply constraints that resulted in insufficient inventories.

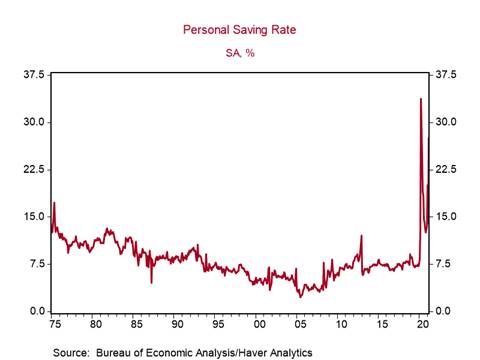

*The gains in personal income and high savings point to sustained rapid growth in consumption. Excluding government transfers, personal income rose 0.9%, reflecting job gains and wage increases. Real disposable income is now an astounding 28.3% above its January 2020 level (Chart 1). A sizable portion of the government transfers were saved, and the rate of personal saving—that is, the portion of disposable personal income not spent—jumped to 27.6%--and the cumulative savings since last May have soared (Chart 3). Along with the significant increases in household net worth (which is not reflected in the personal saving data), consumers have huge purchasing power.

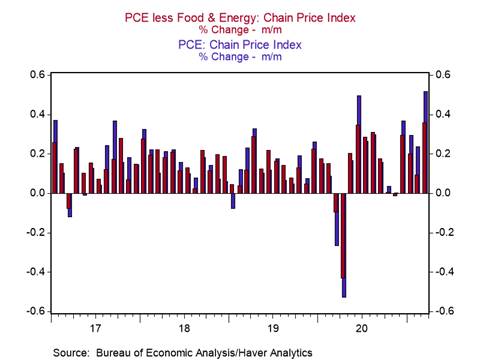

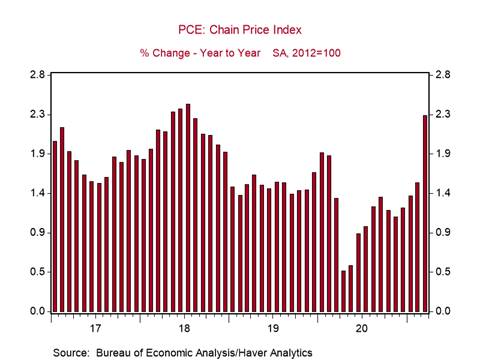

*The 0.5% monthly increase in the PCE price index lifted yr/yr consumer inflation to 2.3%, while the 0.4% monthly rise in the core PCE price index excluding food and energy lifted its yr/yr rise to 1.8% from 1.4% (Charts 4 and 5). Both of these yr/yr measures will rise significantly further in April, reflecting their monthly declines of 0.5% and 0.4% in April 2020. That means PCE inflation will likely rise to 3% and the core PCE inflation close to 2.5%. Although these sharp spikes will dissipate, we anticipate the robust growth in aggregate demand will support more sustained inflation pressures(Strong US growth, inflation and the Fed’s challenges, February 11, 2021).

Chart 1. Real disposable income

Chart 2. Personal consumption expenditures

Chart 3. Rate of Personal Saving

Chart 4. PCE Price Indexes (m/m)

Chart 5. PCE Price Index Inflation (yr/yr)

Mickey Levy, mickey.levy@berenberg-us.com