U.S. Producer Price Index jumps up in January as inflationary pressures remain elevated

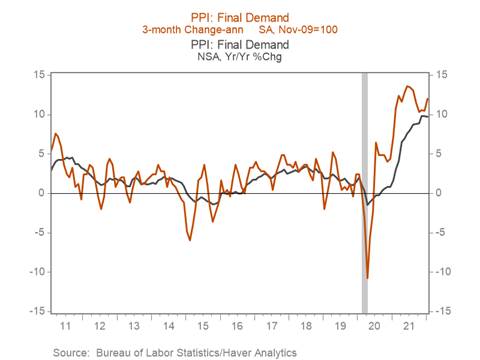

*The headline U.S. Producer Price Index (PPI) for final demand increased 1% m/m in January sharply above consensus (0.5%), reflecting broad based price increases across goods (1.3% m/m) and services (0.7% m/m). The yr/yr change in the PPI for final demand ticked down to 9.7% but remains near November-December’s lofty 9.8%, and the rate of inflation has accelerated in recent months. On a three-month annualized basis, the PPI for final demand increased 9.5% in January, a sharp increase from December’s 8.3% (Chart 1).

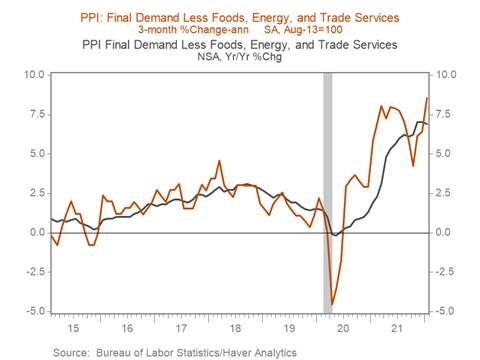

* Core PPI for final demand (which excludes volatile energy, foods, and trade services components), and is thus a more reliable gauge of underlying inflationary pressures, jumped up 0.9% m/m, its largest monthly increase since January 2021, although its yr/yr increase ticked down 0.1pp to 6.9%. Nonetheless, on a three-month annualized basis core PPI inflation surged to 8.5%, more than 2pp higher than in December (Chart 2).

*The 1.3% m/m increase in the PPI for final demand goods was underpinned by sharp increases in food (1.6% m/m) and energy prices (2.5% m/m). January’s sharp increase in energy prices is in part due to a 1.7% m/m decline in December, while the recent surge in energy commodity prices and the threat of geopolitical turmoil in Ukraine are likely to exert upward pressure on measures of energy inflation in the near term. PPI inflation for durable consumer goods accelerated in January, increasing 1% m/m lifting its yr/yr increase to 7.8% from 7.2% in December. Elevated durable goods inflation reflects a mix of strong demand, continued supply chain disruptions, and rising input and labor costs. Despite the acceleration in January, we expect durable goods inflation to moderate through 2022 as supply bottlenecks dissipate and the composition of private consumption readjusts back towards services.

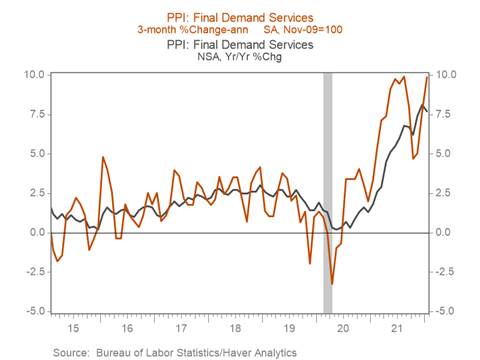

*The PPI for final demand services rose 0.7% m/m, despite a sharp decline in prices of transportation of passengers for final demand (-4.2% m/m). Final demand services PPI inflation accelerated to 9.9% on a three-month annualized basis in January, exceeding its level during the economy’s initial reopening spurt in Summer 2021. Final demand for services (excluding trade, transportation, and utilities), which accounts for nearly two-fifths of the PPI, surged 0.9% m/m and 7.2% on a three-month annualized basis, a 4pp increase from 3.2% in December.

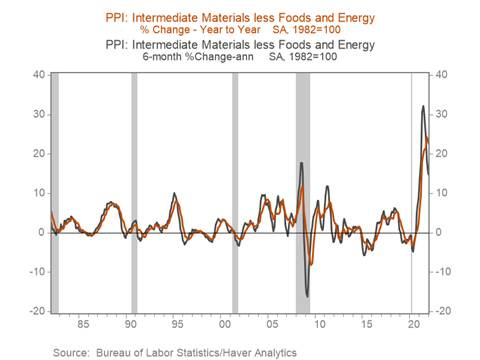

* Pipeline inflationary pressures remain elevated, but may have begun to moderate: prices for unprocessed goods for intermediate demand (excluding food and energy) increased 31.2% yr/yr in January, while the PPI for intermediate materials (excluding food and energy) using the PPI’s old methodology increased 1.2% m/m and 22.6% yr/yr, but only rose 14.6% on a six-month annualized basis, a 3.6pp decline relative to November (Chart 4).

Chart 1. PPI Final Demand 3-month annualized % change vs. yr/yr % change

Chart 2. Core PPI 3-month annualized % change vs. yr/yr % change

Chart 3. PPI Final Demand Services 3-month annualized % change vs. yr/yr % change

Chart 4. PPI Intermediate Materials (ex. Food and Energy)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.