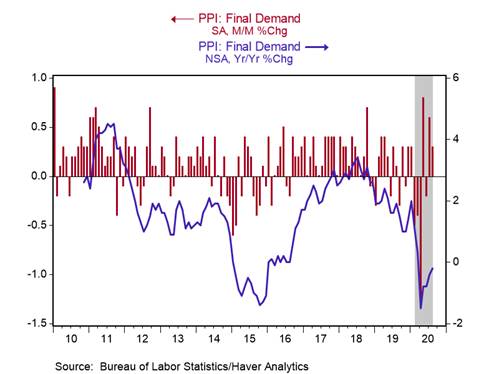

*The U.S. Producer Price Index (PPI) for final demand increased by 0.3% m/m in August, lifting its yr/yr change to -0.2% from -0.4%, well above its low of -1.5% yr/yr in April, but below its pre-pandemic average of 1.6% (Chart 1). In August, declines in energy (-0.1% m/m) and food (-0.4% m/m) prices were offset by a sizable jump in trade services prices (+1.2% m/m), which measures changes in margins and tends to be volatile.

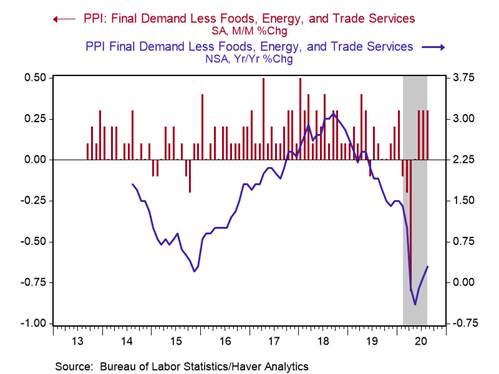

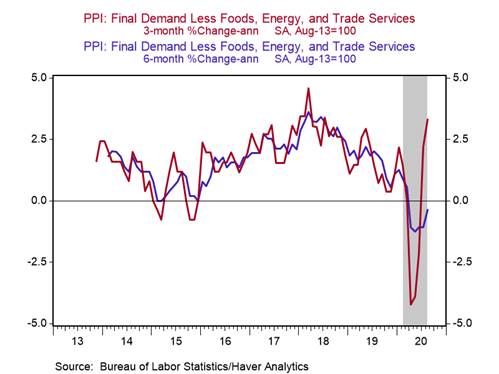

*Core PPI for final demand (excluding volatile food, energy, and trade services components), a better gauge of the underlying price trend, increased by 0.3% m/m for the third consecutive month in August, lifting its yr/yr change to 0.3% from 0.1%, remaining well below February’s yr/yr increase of 1.4% (Chart 2).

*Inflation is likely to remain low over the next year as the effects of the pandemic dominate. Beyond 2021, the path of inflation depends on fiscal policy, the Fed’s monetary policy, in particular its desire for above-2% inflation, and inflation expectations.

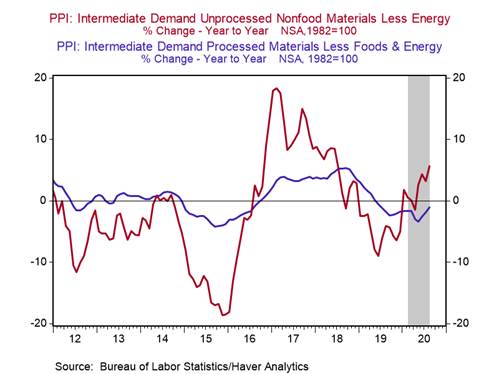

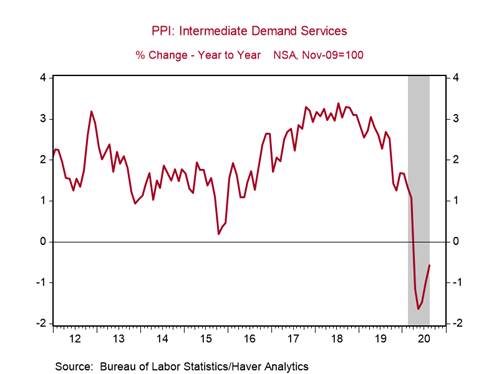

Pipeline inflationary pressures remained benign in August: 1) inflation for unprocessed goods (excluding food and energy) used as inputs to production increased to 5.7% yr/yr from 3.2%; 2) prices for processed goods used as inputs declined by 1.1% yr/yr (Chart 3); and 3) prices for intermediate demand services declined by 0.6% yr/yr (Chart 4).

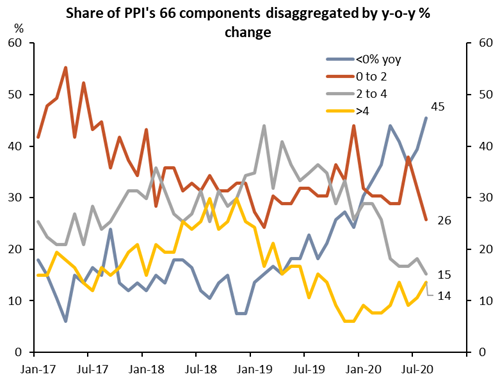

Notably, 45% of the 66 key PPI components declined (yr/yr) in August and only 14% increased by more than 4% yr/yr (Chart 5). Industries reporting the fastest increases in selling prices are those in which demand has bounced back strongly: wood products manufacturing (+12.2% yr/yr), electronics and appliance stores (+11.7%), building material and garden equipment/supply dealers (+10.2%), office supplies, stationery and gift stores (+9.7%), food and beverage stores (+6.5%), gasoline stations (+6.1%), motor vehicle and parts dealers (+5.6%), legal services (+5.2%), and commercial machinery repair and maintenance (+4.4%).

The sharp decline in activity and subsequent rebound are leading to near-term volatility in prices. Indeed, although the three-month annualized change in the core PPI increased to 3.3% from 2.2%, the six-month annualized change was -0.4% (Chart 6). We expect the core PPI to climb above 1% yr/yr in coming quarters.

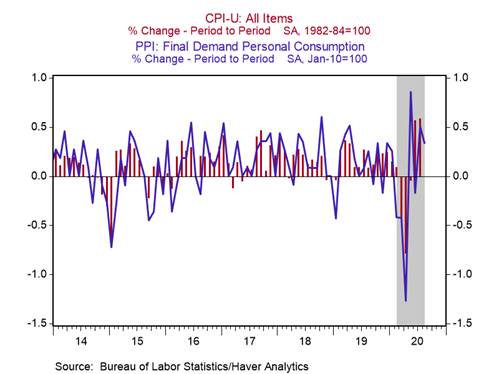

The personal consumption component of the PPI increased by 0.3% m/m. Based on its past relationship with the CPI, it indicates a 0.2% m/m increase in the CPI in August, which would lift its yr/yr change to 1.2% from 1.0% (August CPI is set for release tomorrow, September 11). See Chart 7.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Source: Bureau of Labor Statistics and Berenberg Capital Markets

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com