U.S. producer price inflation remains elevated in October

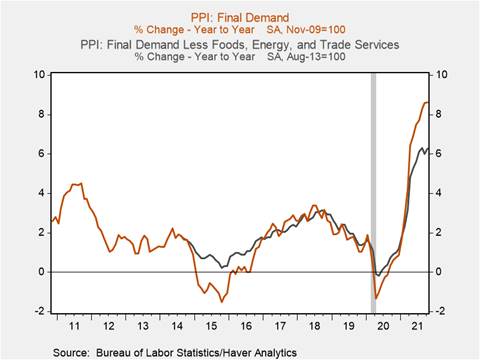

* The U.S. Producer Price Index (PPI) for final demand increased by 0.6% m/m in October, lifting its yr/yr increase to 8.6% (Chart 1). October marked the 10th consecutive month in which headline PPI increased by more than 0.5% m/m reflecting the impact of high demand amid persistent and pervasive supply constraints. Core PPI (excluding food, energy, and trade services), which is a better gauge of underlying price trends, increased 0.4% m/m and 6.3% yr/yr. Price increases are likely to persist buoyed by the waning impact of the delta variant, rising employment, nominal wage growth, and supply chain constraints that are yet to dissipate.

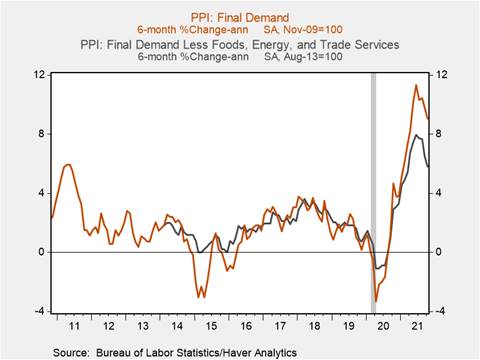

* There are indications that the rate of price increases has begun to moderate: on a six-month annualized basis headline PPI growth fell to 9.1% while core PPI growth fell to 5.8% (Chart 2). Despite the deceleration, producer price inflation remains elevated and broad based, according to the NFIB “The net percent of owners raising average selling prices increased 7 points to a net 53 percent seasonally adjusted. Price raising activity has reached levels not seen since the early 1980s when prices were rising at double digit rates.”

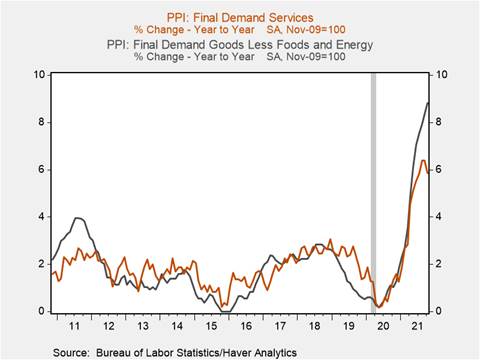

* In October, producer prices rose substantially for goods excluding food and energy (0.5% m/m, 8.8% yr/yr) and energy (4.8% m/m, 42% yr/yr), but were offset by more modest growth in services which increased 0.2% m/m and 5.9% yr/yr (Chart 3). This is consistent with the shifting pattern of consumption over the course of the pandemic towards goods, the impact of the delta variant on restraining service sector activity, and reflects supply bottlenecks that have disproportionately impacted the production and distribution of goods. Producer prices for energy have increased substantially and sustained energy commodity price increases will exert upwards pressure on measures of consumer energy prices and lift headline measures of inflation, particularly if winter weather proves to be adverse.

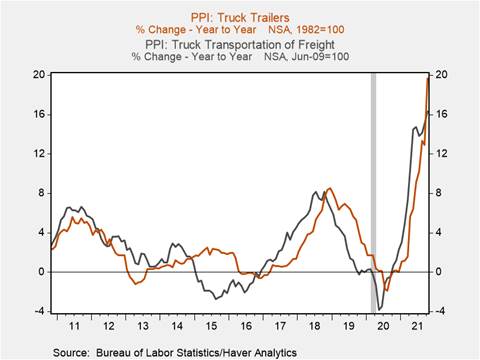

* The impact of ongoing supply chain issues ahead of what is anticipated to be a strong holiday retail season is evident in producer price data. The price of transporting and warehousing finished goods increased 2.1% m/m and 13.9% yr/yr, a sharp acceleration (Chart 4). The price of transporting freight by truck increased 2.5% m/m and 16.3% yr/yr while the price of truck trailers, which are critical to the movement of goods in and out of ports, surged 6.6% m/m and 19.7% yr/yr.

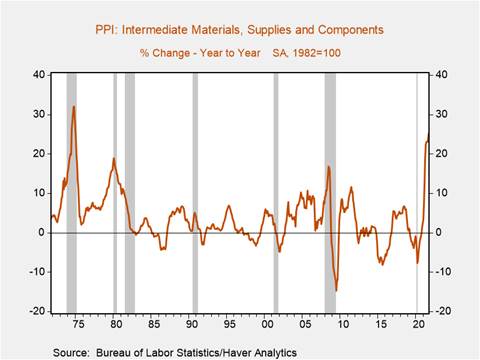

* Price increases for inputs to production and unprocessed materials remain elevated, suggesting inflationary pressures will persist. Prices of unprocessed goods (excluding food and energy) used in the production process increased 1.1% m/m and 30.6% yr/yr. According to the PPI’s old methodology, the price of intermediate materials, supplies, and components surged 2.1% m/m lifting the yr/yr increase to 25.4% its highest level since 1975 (Chart 5).

Chart 1: PPI Final Demand & Core PPI (yr/yr % change)

Chart 2: PPI Final Demand & Core PPI (six-month annualized %)

Chart 3: PPI Final Demand Services and Final Demand ex. Food and Energy (yr/yr % change)

Chart 4: PPI Truck Trailers & PPI Truck Transport of Freight (yr/yr % change)

Chart 5: PPI Intermediate Materials, Supplies, and Components (old methodology, yr/yr % change)

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.