U.S. real GDP growth accelerates in Q4, led by private inventory investment

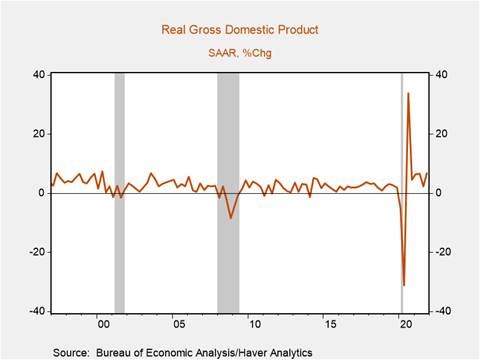

*U.S. real GDP increased 6.9% q/q annualized in Q4, accelerating from its 2.3% increase in Q3, reflecting a robust increase in private inventory investment led by the retail trade and wholesale trade industries, paired with more modest increases in personal consumption expenditures and residential fixed investment (Chart 1). The uptick in the rate of growth in Q4 lifted the yr/yr increase in real GDP to 5.5% despite the lingering impact of the delta variant and the emergence of the omicron variant, which likely dampened in-person services activity through the end of Q4 and will continue to restrain economic activity in Q1.

*Although we anticipate the omicron variant will temporarily weigh on Q1 GDP growth, its effects on the economy are likely to be transient, and sustained increases in employment and disposable income should support consumption through 2022. A partial easing of labor and supply constraints through 2022 will allow businesses to ramp up production to meet strong current demand and continue to replenish depleted inventories, which will add to GDP in coming quarters.

*Nominal GDP, a broad measure of current dollar economic activity and the umbrella beneath which the wage-inflation feedback loop flourishes, rose 10% yr/yr while the GDP price index rose 5.8% yr/yr (6.9% q/q annualized), well above its recent trends and the fastest pace since 1981. The PCE deflator rose 5.5% yr/yr (6.5% q/q annualized) and the core PCE deflator (excluding food and energy) rose 4.6% yr/yr. The sharp increases over the last year reflect the mix of strong aggregate demand, supply constraints, and tight labor markets that will continue to exert upward price pressures through 2022.

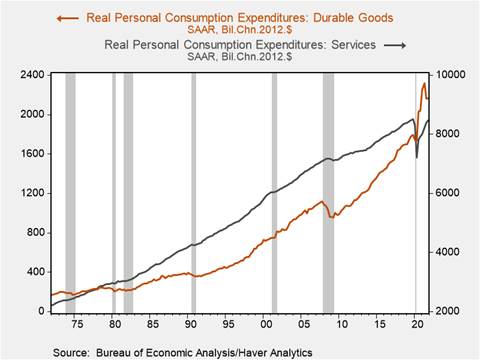

*Real consumption rose 3.3% q/q annualized, led by a 4.7% q/q annualized increase in services consumption and a 1.6% q/q annualized increase in durable goods consumption that contributed 2.1 and 0.1 percentage points, respectively, to annualized q/q GDP growth (Chart 2). Real final sales to domestic purchasers, a measure of domestic demand, increased 1.9% q/q annualized and 6.5% yr/yr, a modest acceleration from Q3 but well below the robust pace of growth in the first half of 2021. December’s soft retail sales data, caused in part by the pulling forward of holiday spending to October and November, and the surge in COVID-19 cases may contribute to a temporary lull in demand in the early part of Q1.

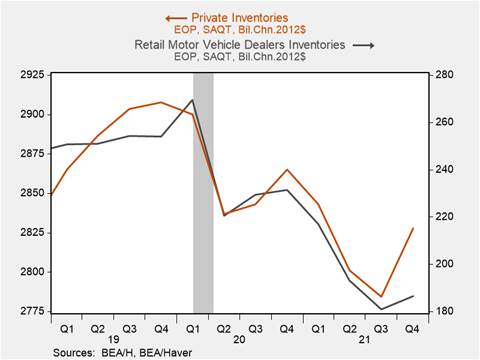

*The real change in private inventories rose to $173 billion annualized and continues to exert an outsize influence on headline GDP growth, contributing 4.9pp to annualized growth in Q4, a dramatic increase from the 2.2pp inventory investment contributed to GDP growth in Q3. Despite the increase, real private inventories declined over the year, as strong product demand and limited supply led to severe inventory depletion, particularly in the auto sector. Auto inventories at the retail level rose $21 billion q/q annualized in Q4. Despite the increase in the change in private inventories, the stock of real private inventories remains depressed relative to pre-pandemic levels (Chart 3). What is relevant for GDP growth is the change in the change in private inventories, and consequently, a deceleration in the pace of inventory investment in coming quarters relative to Q4 could weigh on GDP growth.

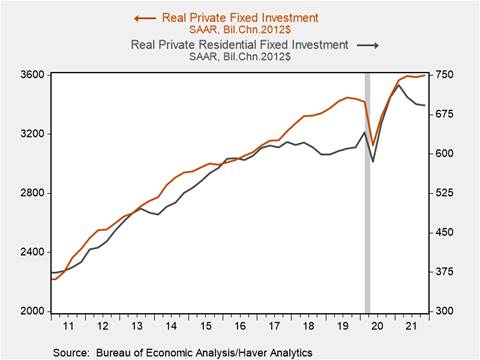

*Real private fixed investment rose 1.3% q/q annualized, underpinned by a 2% annualized increase in non-residential fixed investment that offset a 0.8% decline in real residential fixed investment (Chart 4). Business fixed investment in structures declined 0.3% annualized, the third consecutive quarter of negative growth, while investment in equipment was flat and intellectual property investment increased 0.5% annualized. The shifting composition of business fixed investment likely reflects the adaptations businesses have had to make to remote and hybrid work over the course of the pandemic. Looking forward, businesses have record levels of cash on hand, which, together with strong product demand and cash flows and negative real interest rates, should lead to an expansion in business fixed investment through 2022. The decline in real residential fixed investment partly reflects material and labor shortages that have delayed and constrained construction, which should ebb through 2022.

*Government consumption expenditures declined 3% q/q annualized, led by a 5.7% decline in national defense spending and a 2.2% decline in state and local government expenditures and investment. Federal government spending is likely to pick up in the latter half of 2022 in part due to an anticipated increase in infrastructure investment, while state and local governments whose coffers are flush with cash may begin to ramp up spending. Trade surged in Q4, with exports rising 24.5% q/q annualized and imports rising 17.7%, contributing 2.4p and -2.4 pp, respectively, to annualized real GDP growth in Q4.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.