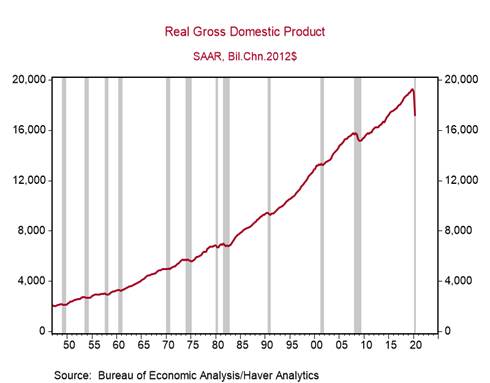

*U.S. real GDP contracted by 32.9% q/q annualized (-9.5% q/q non-annualized) in Q2, the largest quarterly decline on record, reflecting the mandated shutdowns beginning in March and the uneven recovery in activity in May and June (Chart 1). Nominal GDP, the broadest measure of current dollar spending in the economy, fell by 34.3% q/q annualized (-10% q/q non-annualized), as the implicit price deflator decreased by 1.8% annualized.

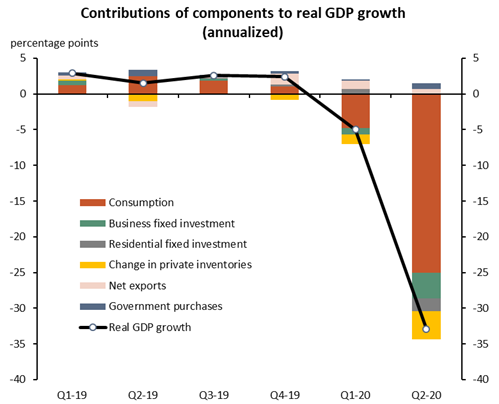

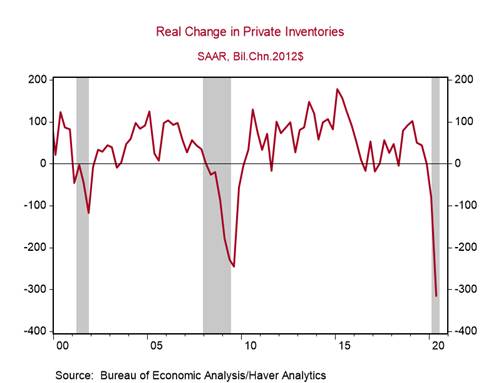

*The private sector components of GDP recorded historic declines: real consumption (-34.6% q/q annualized), real residential fixed investment (-38.7%), and real business fixed investment (-27.0%). Depletion of inventory investment subtracted 4pp from growth (Charts 2 and 3). GDP was lifted by an increase in real government purchases (+2.7% q/q annualized), reflecting the sizable increase in government purchases provided by fiscal legislation, and a narrowing of the trade deficit, which contributed +0.7pp to domestic production.

*Economic activity troughed in April, with monthly data reflecting rebounds in May and June, but high frequency indicators indicate that economic activity has flattened since late June as spikes in incidence of COVID-19 in many states have slowed the recovery. Absent another round of widespread mandated stay-at-home orders, we expect real GDP to increase in Q3, but the economy has a long way to go to attain pre-pandemic levels, and the pace of recovery depends on controlling the virus.

Real final sales to domestic purchasers, a proxy for domestic demand, declined by 28.2% q/q annualized, smaller than the decline in real GDP. The historic decline in real GDP was exacerbated by dramatic inventory liquidation. The government shutdown constrained production while the reopening of the economy resulted in a faster rebound in consumption than production.

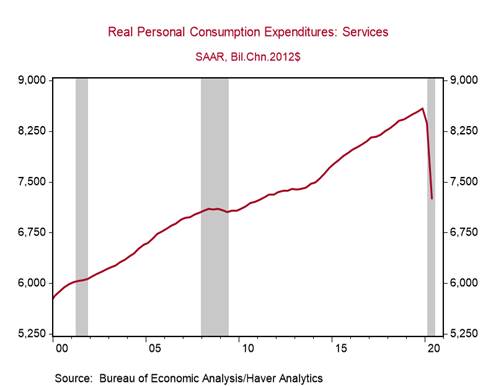

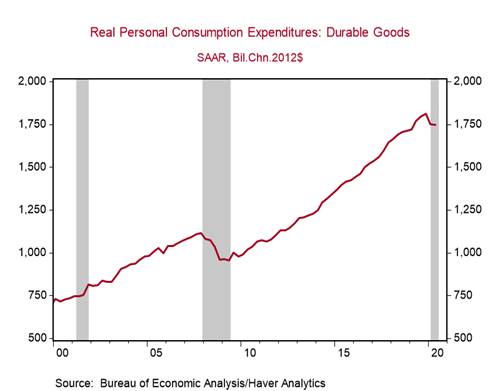

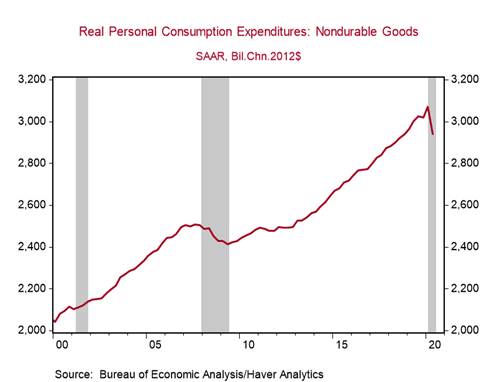

Real consumption, which accounts for nearly 70% of U.S. GDP, declined by 34.6% q/q annualized, driven by a massive 43.5% q/q drop in services consumption. The decline in nondurable goods consumption was more moderate (-15.9% q/q annualized) and durable goods consumption declined by a slight 1.4% q/q annualized (Charts 4-6). Durable goods consumption has staged a V-shaped rebound, in large part due to the generous government income support payments to individuals. Services consumption, on the other hand, continues to be constrained by health concerns and restrictions. Consumption growth going forward will depend on the incidence of COVID-19 and the size of the income support programs agreed to in the next fiscal package.

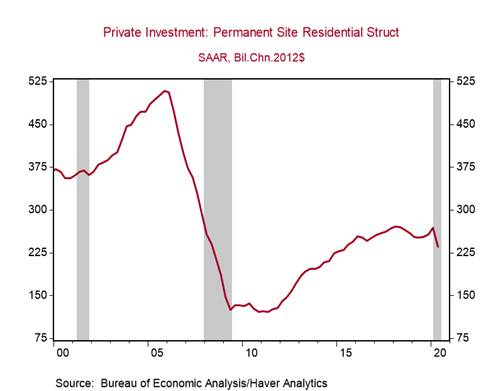

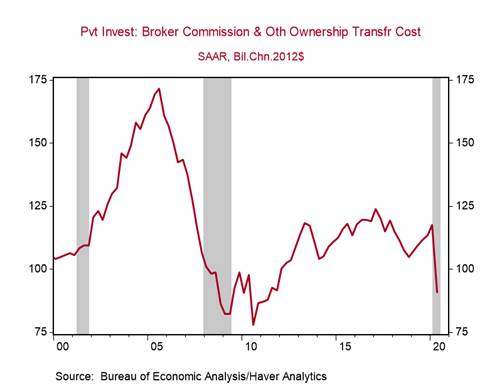

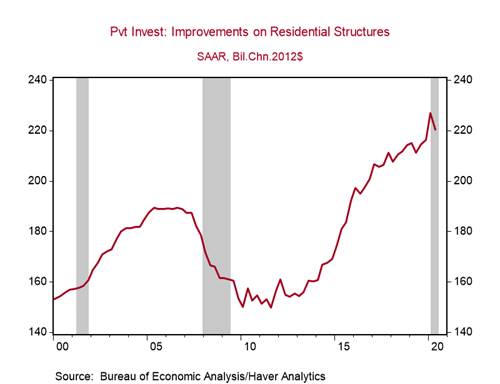

Residential fixed investment, which includes output on new housing construction, brokers’ commissions from home sales, plus home improvements, tumbled by 38.7% q/q annualized in Q2, reflecting sharp declines in single-family and multifamily construction (-41.1% q/q annualized) and a massive 64.1% q/q annualized decline in brokers’ commissions from home sales. Home improvements declined by only 11.2% q/q annualized, as persons upgraded home office spaces while working from home (Charts 7-9). The sharp decline in housing market activity was concentrated in April. A slew of indicators point to strong rebounds in subsequent months. New home sales increased to a 13-year high in June, and pending home sales, which lead existing home sales by 2-3 months, surged to a 14.5 year high in June. These trends will contribute to a significant rise in residential investment in Q3.

Business fixed investment declined by 27% q/q annualized, reflecting massive declines in investment in equipment (-37.7% q/q annualized) and structures investment (-34.9% q/q annualized) and a moderate decline in intellectual property products investment (-7.2% q/q annualized). Low oil prices led to a dramatic 77.8% q/q annualized decline in investment in mining exploration, shafts, and wells. Business investment will likely rebound over the summer months, but only sluggishly, reflecting sluggish global demand, low oil prices, and widespread uncertainties.

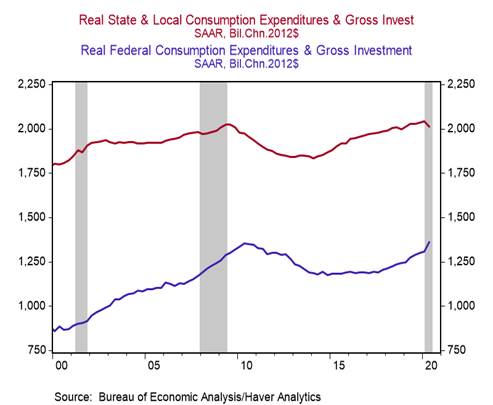

Government purchases increased by 2.7% q/q annualized, led by a massive by 17.4% q/q annualized increase in federal purchases (largest increase since Q1-1967) from the CARES Act. Note that this increase does not include the government’s income support transfers to individuals or its loans/grants to businesses. At the same time, state and local government purchases tumbled by 5.6% q/q annualized, reflecting their sharp 1.5 million in job cuts in response to severely squeezed finances (Chart 10).

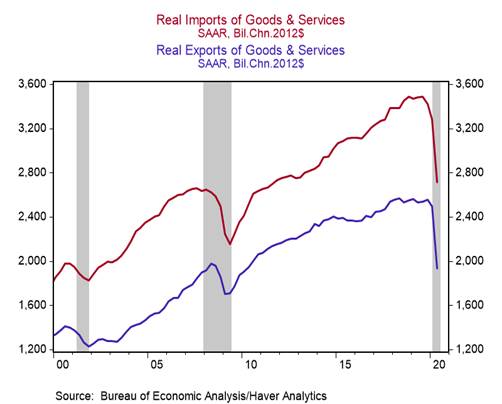

Net trade contributed 0.7pp to Q2 real GDP growth, as imports (-$570.8b) declined by more than exports (-$563.5b). See Chart 11. We expect exports and imports to rise in Q3 as countries emerge from lockdown and as businesses unclog supply chains. The weaker U.S. dollar should support exports.

The 20.4% q/q annualized decline in nominal GDP in H1 reflects the massive drop-off in aggregate demand for a broad array of goods and services. This drop-off in demand outweighed the productive capacity constraints resulting from the shutdowns and put significant downward pressure on prices. As a result, the headline PCE price index declined by 1.9% q/q annualized in Q2 and the core PCE price index (excludes food and energy) declined by 1.1% q/q annualized, the largest quarterly decline on record (Chart 12).

Chart 1:

Chart 2:

Sources: Bureau of Economic Analysis and Berenberg Capital Markets

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Chart 8:

Chart 9:

Chart 10:

Chart 11:

Chart 12:

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com