U.S. retail sales edge up in November

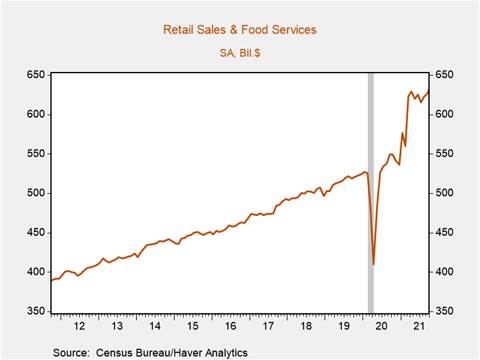

*U.S. retail sales rose 0.3% m/m in November, substantially below consensus (0.8%), following an upwardly revised 1.8% m/m increase in October that lifted the yr/yr increase to 18.2% (Chart 1). Headline sales were depressed by a 5.5% m/m decline in sales at department stores and a 4.6% m/m decline in electronic and appliance store sales, while sales at motor vehicle and parts dealers ticked down 0.1% m/m. Despite the deceleration in retail sales growth, retail sales are 23% higher than in February 2020. Sustained employment growth, nominal wage gains, and healthy household balance sheets should support continued retail sales growth through the holiday retail season.

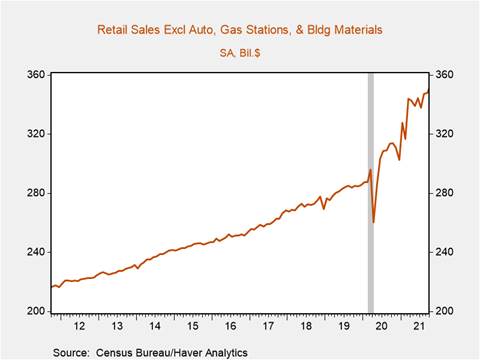

*Control retail sales (excluding autos, building supplies, and gas stations), which are calculated directly in GDP, edged down 0.1% m/m (consensus: 0.7%), although its October rise was revised up to 1.8% m/m (Chart 2). Despite November’s decline, control group retail sales have risen 7.7% on a three-month annualized basis and point to healthy consumption growth in Q4.

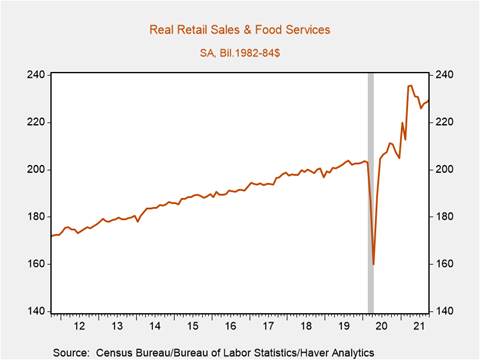

*November’s retail sales report provides tentative evidence that the mix of elevated and pervasive price increases paired with ongoing supply constraints may have begun to weigh on consumer demand, with real retail sales declining 0.5% m/m (Chart 3). It is also likely that some consumers began their holiday shopping earlier than normal this year, reflected in strong m/m retail sales growth at departments stores (2.5%), electronics and appliance stores (3.1%), and non-store retailers (4.1%) in October.

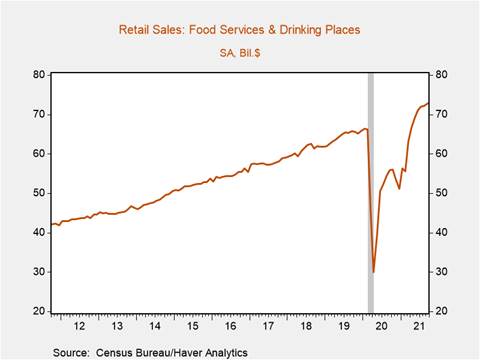

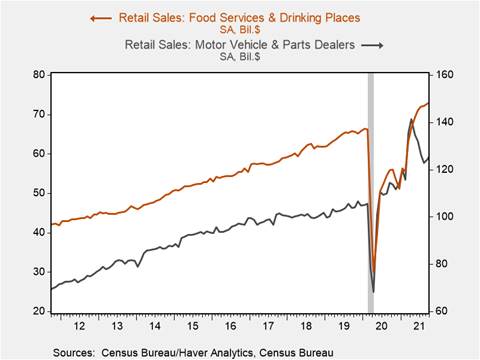

*Sales at food services and drinking places continued to recover, rising 1.0% m/m, their ninth consecutive monthly increase and lifting their yr/yr increase to a striking 37.4% (Chart 4). Sales at food services and drinking places are 11.3% higher than in February 2020 and continued increases bode well for employment in the sector, which remains 750k below its pre-pandemic level despite the marked rise in sales. However, given the emergence of the omicron variant a resurgence in public health concerns that keeps people away from high contact, in-person activities could impair the recovery in the leisure and hospitality sector.

*The decline in motor vehicle and parts dealers sales (-0.1 % m/m) reflects continued supply chain bottlenecks and semiconductor shortages that have disrupted auto manufacturing, and sales are likely to rise as auto production ramps up when supply constraints ease. Rising energy commodity and fuel prices contributed to a 1.7% m/m increase in gasoline station retail sales, which have risen 52.3% over the last year (Chart 5).

Chart 1. Retail Sales

Chart 2. Control Group Retail Sales (ex. Autos, Building Supplies, Gas Stations)

Chart 3. Real Retail Sales

Chart 4. Retail Sales – Food Services and Drinking Places

Chart 5. Retail Sales – Motor Vehicle and Dealers & Gas Stations

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.