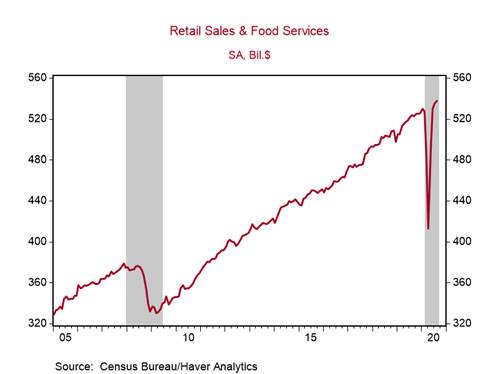

*U.S. retail sales growth moderated to +0.6% m/m in August from +0.9% m/m in July, placing sales on track to increase by 49.5% q/q annualized in Q3 following the 25.6% q/q annualized decline in Q2 (Chart 1). Retail sales have already staged a V-shaped recovery - 1.9% above February’s level - so we expect its monthly gains to remain modest.

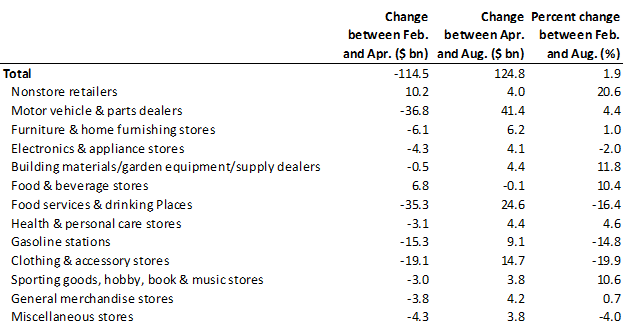

*Sales at restaurants and bars (+$2.5bn) accounted for the bulk of the $3.0bn increase in August’s retail sales, while sales declined at retailers that outperformed throughout the pandemic (food and beverage stores: -$0.8bn, sporting goods: -$0.5bn, general merchandise -$0.3bn). Elsewhere, sales growth was modest. Impressively, sales for eight of the 13 primary retail categories are already above their February levels (see Table 1).

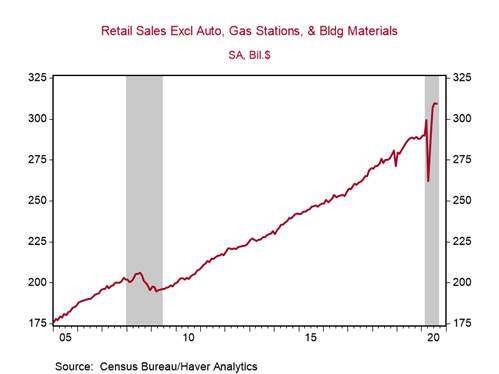

*Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales) which factor directly into GDP declined by 0.1% m/m in August and was revised lower to an increase of 0.9% in July from the initial estimate of +1.4% m/m. Still, it is on track to increase by a massive 32.8% q/q annualized in Q3 after falling by 9.1% q/q annualized in Q2 (Chart 2).

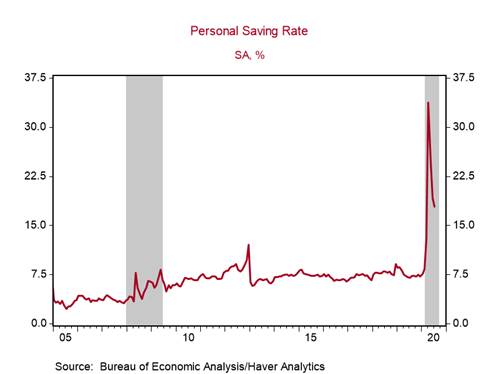

Economic activity has held up better than some had expected despite the expiration of key fiscal initiatives over the summer. The slowing transmission of COVID-19 in the U.S. has enabled states to proceed with reopening plans, sustaining growth. Importantly, the elevated saving rate has given households a sizable financial buffer and room to boost consumption (Chart 3).

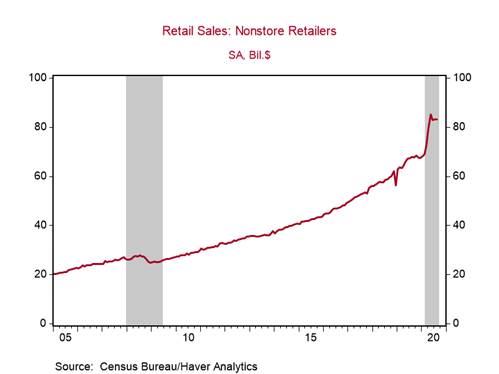

Non-store retail sales (includes online) were flat in August, but elevated at $83.1bn and 20.6% above February’s level (Chart 4). Non-store retail sales will continue to outperform other categories until there is a vaccine for COVID-19.

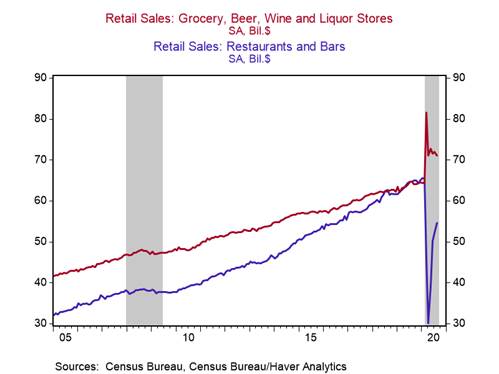

Although sales at restaurants and bars increased by a solid 4.7% m/m in August, it is the second-worst performing retail category since February (-16.4%). See Table 1. With colder weather approaching, sales growth at restaurants and bars will slow, assuming less outdoor dining and limits on indoor dining. Sales at grocery and liquor stores have flattened around $71.0bn since April, but they remain elevated (10.4% above the pre-pandemic level). See Chart 5.

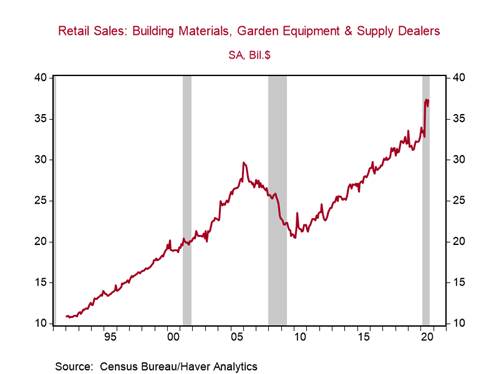

Housing-related retailers continue to post solid gains: 1) furniture, home furnishing, and electronics and appliance stores’ sales increased by 2.1% m/m, placing it just 0.3% below its pre-pandemic level; and 2) sales at building materials, garden equipment and supply dealers increased by 2.0% m/m, nearing the all-time high (Chart 6). The strong growth in home sales will provide a further boost to growth in these categories over the next year.

The growth in retail sales sets a solid baseline for personal consumption in August, which includes a broader range of services (set for release on October 1). The rebound in personal consumption has been slower than that of retail sales - consumption was 4.6% below its pre-pandemic level in July - because it is made up of mostly services that have been disproportionally affected by COVID-19.

Chart 1:

Table 1: Retail sales trends since February

Sources: Census Bureau and Berenberg Capital markets

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Roiana Reid, roiana.reid@berenberg-us.com