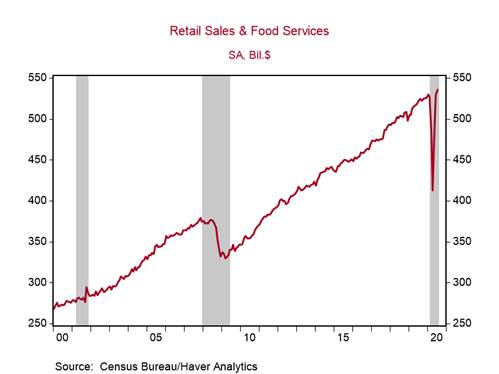

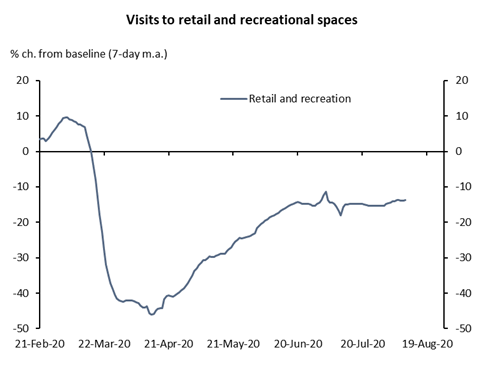

*U.S. retail sales increased by 1.2% m/m in July, placing it 1.7% above February’s level and lifting its yr/yr growth to 2.7% (Chart 1). Due to strong gains of 8.4% m/m in June and 18.3% in May, retail sales have staged a quick V-shaped recovery. We expect its growth to continue to moderate. High frequency data indicate that visits to retail stores are flattening following the strong initial rebound (Chart 2).

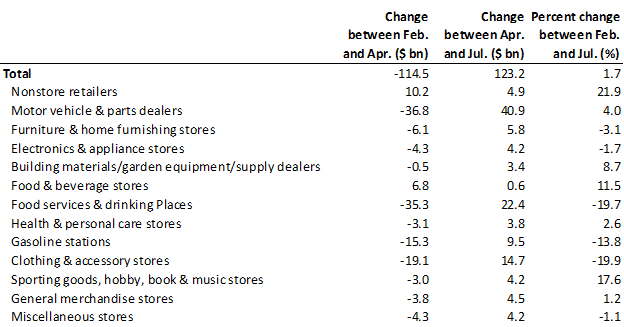

*Restaurants and bars (+$2.5bn), gasoline stations (+$2.1bn), and electronics and appliance stores (+1.5bn) accounted for the bulk of the increase in July’s retail sales (+$6.6bn), but sales were broadly strong elsewhere, with six of the other ten categories increasing. Sales at motor vehicles and parts (-1.2% m/m), building materials (-2.9% m/m), and sporting goods (-5.0% m/m) stores fell after strong gains in prior months. Remarkably, sales for seven of the 13 primary retail categories are already above their February levels (see Table 1).

*Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, increased by 1.4% m/m in July, following the 6% m/m increase in June that lifted it above its pre-pandemic level (Chart 3). Control retail sales are on track to jump by 35% q/q annualized in Q3 after falling by 9.2% q/q annualized in Q2.

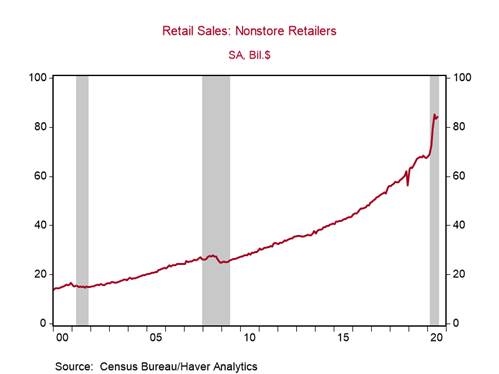

Non-store retail sales (includes online) are now 21.9% above February’s levels, making it the best performing category. We expect this outperformance to persist until there is a vaccine for COVID-19 (Chart 4).

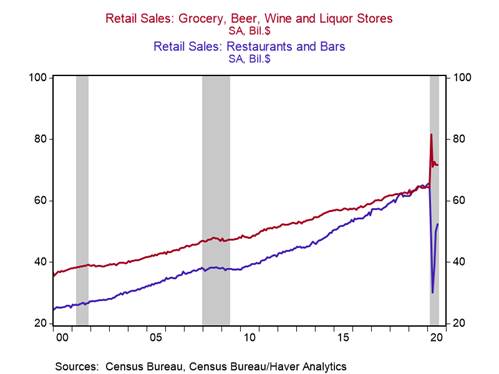

Despite the 5% m/m increase in sales at restaurants and bars in July, it is 19.7% below its pre-pandemic level, tying with clothing and accessories stores (-19.9%) for the worst performing sales category during this crisis. Its sales growth will remain sluggish, with restrictions on indoor dining and bars likely to persist. Sales at grocery and liquor stores have flattened since April but remain well above the pre-pandemic level (+11.5%). See Chart 5.

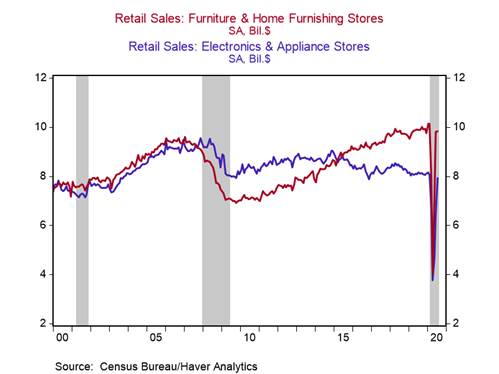

Sales at building materials, garden equipment, and supply dealers declined by 2.9% m/m in July but remain historically high following an outsized gain in May and mild decline in April (Chart 6). Home furnishing stores (+143.4%) and electronics and appliance store sales (+110.7%) have rebounded strongly over the last three months and are only slightly below February’s levels, as persons upgrade their work-from-home spaces (Chart 7). The strong growth in home sales will provide a further boost to growth in these categories in the intermediate term.

The growth in retail sales sets a solid baseline for personal consumption in July, which includes a broader range of services (set for release on August 28). The rebound in personal consumption has been slower than that of retail sales - consumption was 6.9% below its pre-pandemic level in June - because it is made up of mostly services that have been disproportionally affected by COVID-19. Goods consumption is already above its pre-pandemic level, so services consumption must be the source of growth in overall spending going forward (Chart of the week – U.S. services sectors to shape the recoveryandU.S.: strong rebound in goods consumption, but services consumption and labor markets remain depressed).

Chart 1:

Chart 2:

*Baseline is Jan. 3–Feb. 6, 2020. Source: Google

Table 1: Retail sales trends since February

Sources: Census Bureau and Berenberg Capital markets

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com