U.S. retail sales hit hard by winter storms in February

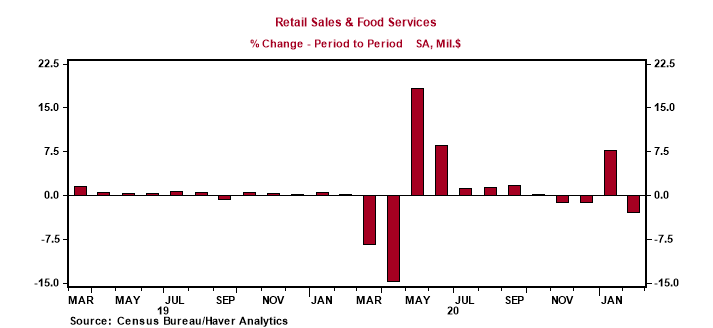

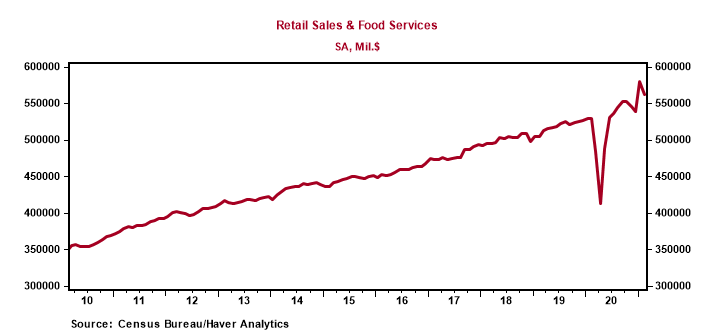

*Retail sales fell 3.0% in February, following a sharp upwardly revised increase of 8.7% in January, as the severe winter storms that crippled much of the country more than offset the positive boost expected from the government’s distribution of fiscal stimulus checks that increased disposable incomes in January (Charts 1 and 2).

*Most components of retail sales displayed the same overall pattern, with outsized increases in January followed by large declines in February. Even with the decline, retail sales in February were 6.3% higher than a year earlier.

*The retail sales control group, which is retail sales excluding autos, building materials, and gas stations and is directly calculated in GDP, fell 3.5% following an upwardly revised 8.7% rise in January. In February, it was 2.6% higher than its Q4 2020 average, consistent with strong growth in Q1.

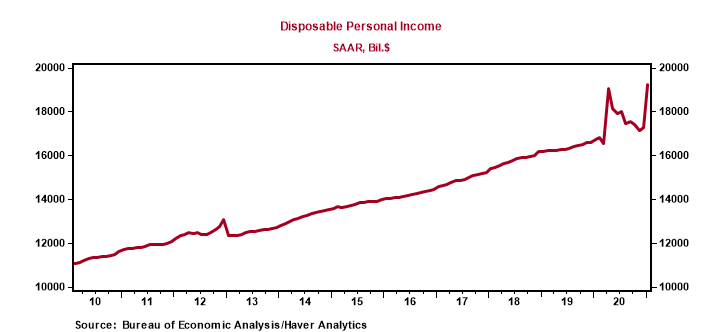

Retail sales are expected to rebound strongly in March, reflecting the government’s fiscal stimulus. The January round of government checks of $600 contributed to a dramatic 11.4% monthly rise in disposable personal income, lifting its yr/yr rise to 15% (Chart 3). This should fuel rapid growth in spending in the spring. Retail inventories remain very low, as producers of goods are having trouble keeping pace with strong demand.

Chart 1

Chart 2.

Chart 3.

Mickey Levy, mickey.levy@berenberg-us.com