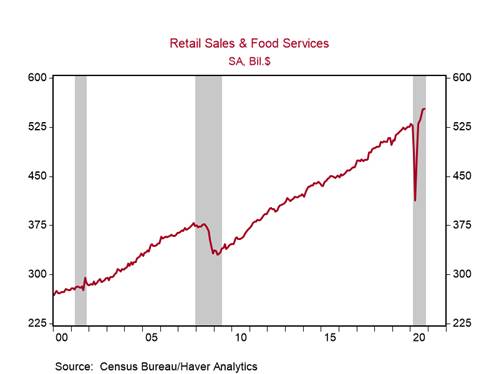

*U.S. retail sales increased by 0.3% m/m in October ‑- following its 1.6% m/m increase in September ‑- its smallest monthly gain in this recovery (Chart 1). Since June, retail sales has exceeded its pre-pandemic level, so this moderation is expected and is consistent with our forecast that U.S. real GDP growth will slow to 4.2% q/q annualized in Q4, following its 33.1% q/q annualized increase in Q3.

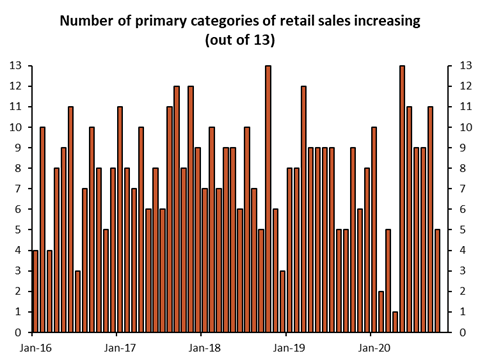

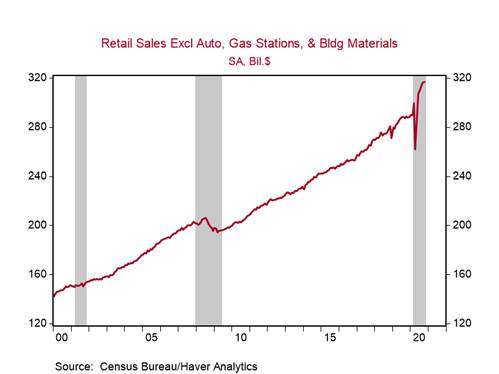

*Retail sales were broadly weak in October, with eight of the 13 categories declining (Chart 2). Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, increased by 0.1% m/m, a marked slowdown from Septemberâs 0.9% m/m gain (Chart 3). Despite the broad-based weakness in Octoberâs sales, eight (out of 13) categories remained above Februaryâs levels (Table 1).

*Based on Octoberâs retail sales, personal consumption growth (includes a broader range of services) likely moderated in October from 1.4% m/m in September. The rebound in consumption has been slower than that of retail sales ‑- consumption was 2.0% below its pre-pandemic level in September ‑- because it is made up of mostly services that have been disproportionately affected by the pandemic. We expect the personal saving rate to decline from 14.3% in October, but remain elevated.

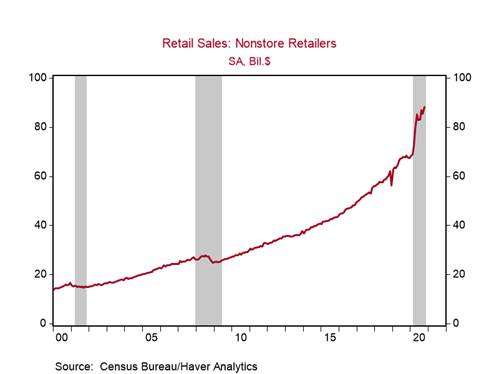

The massive $2.7bn increase in non-store retail sales (includes online) to $88.2bn in October ‑- an all-time high â more than offset the declines in other sales categories (Chart 4). Non-store sales were boosted by promotional sales events in October from key online retailers and by reduced visits to physical retail locations due to the rapid increases in COVID-19 cases and hospitalizations. We expect online sales to continue to grow strongly through the holiday shopping season.

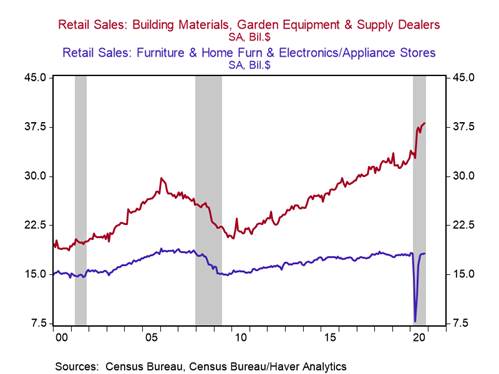

Sales at housing-related retailers remained impressive (Chart 5). Sales at building materials, garden equipment, and supply stores jumped by $330m to $38.1bn, an all-time high, lifting its yr/yr growth to 19.5%. Sales at electronics stores increased by 1.2% m/m, reversing its 1.1% m/m decline in September, placing it just 3.7% below Februaryâs level, and sales at furniture and home furnishing stores declined by 0.4% m/m, remaining near its all-time high and above its pre-pandemic level (+2.7%).

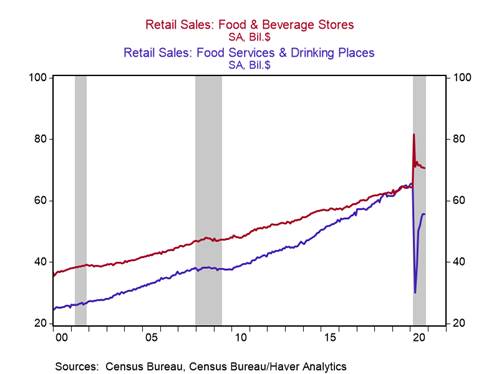

Food and beverage store sales (includes grocery, beer, wine, and liquor stores), and restaurant and bar sales both declined in October (Chart 6). Although sales at restaurants and bars had increased consistently in prior months, it is the worst performing retail category, down 14.9% since February (Table 1). We expect restaurant and bar sales to continue to decline in the coming months as state and local governments increase restrictions on indoor dining to slow the spread of COVID-19 and as colder weather makes outdoor dining less appealing. Sales at grocery stores, which are 10.0% above Februaryâs level, will likely continue to outperform.

High frequency indicators suggest that retail momentum is slowing (Chart 7). North American retail traffic - estimated using sensors mounted on doors at stores in the U.S. and Canada - declined 46% yr/yr during the first week of November, the largest decline since late August, and consumer credit and debit card spending slowed towards the end of October to a 1.5-month low (Real-time insights, economic and financial pulse, November 16, 2020).

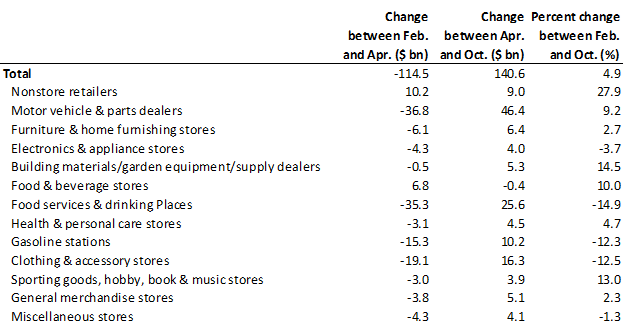

Table 1: Retail sales trends since February

Sources: Census Bureau and Berenberg Capital Markets

Chart 1:

Chart 2:

Sources: Census Bureau and Berenberg Capital Markets

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com