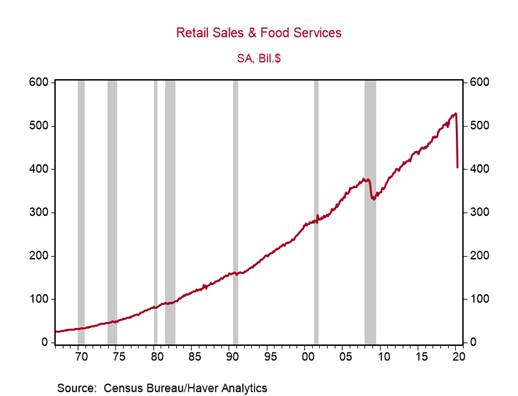

*U.S. retail sales declined 16.4% m/m in April, its largest monthly decline on record (monthly data started in 1967), placing it 23% below February’s level, consistent with the 2.2m decline (-14%) in retail employment since February (Chart 1). Retail sales will increase in May and June as states gradually ease lockdown restrictions, but they will remain well below the pre-COVID level for some time.

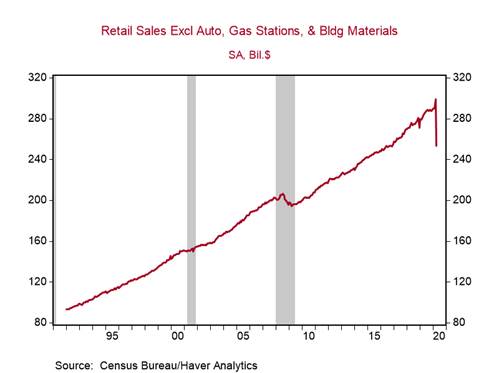

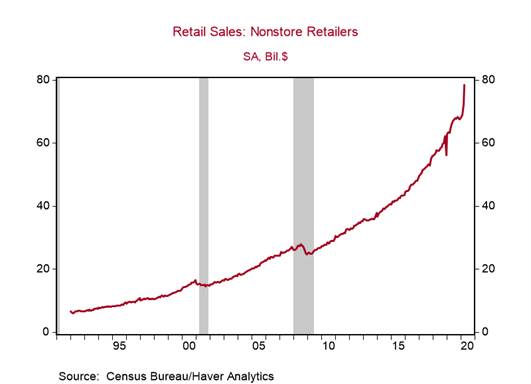

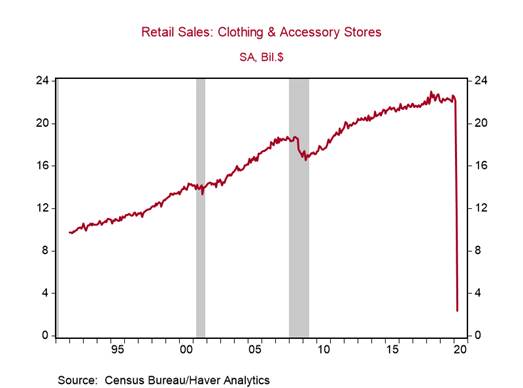

*Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, declined by 15% m/m (Chart 2). Non-store retail sales (includes online) was the lone category increasing in April (+8.4% m/m), as online distribution platforms quickly ramped up capacity and delivery operations to meet the very strong demand (Chart 3). Clothing store sales, the worst performing category, tumbled by 78.8% m/m in April, placing it 89.3% below its February level (Chart 4).

*The recovery in retail sales will depend on household confidence, which hinges on healthcare and economic developments. Households will be reluctant to partake in certain activities until there is a vaccine or effective treatment for COVID-19 and the significant job losses, loss of income, and declines in net worth, will lead households to save more and spend less.

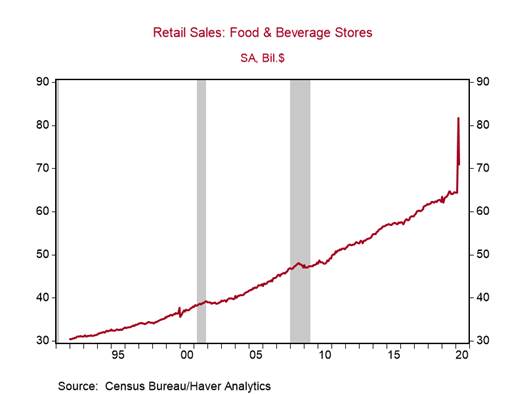

Sales at food and beverage stores declined by $11bn in April as households brought forward grocery purchases to March when they prepared for lockdown (+$17.3bn). Still, food and beverage stores and nonstore retail sales are the only two major categories with sales up from February (Chart 5).

Sales at restaurants and bars continued to plummet in April to half of February’s level (-$13.6bn to $32.4bn). Even as the economy gradually reopens, restaurants will operate at reduced capacity to enforce social distancing, so sales will remain depressed.

Note that retailers are using heavy discounting to boost demand and unload excess inventory: the Consumer Price Index for apparel tumbled by 4.7% m/m in April, the largest decline on record.

Personal consumption, which includes a broader range of services (set for release on May 29), will also show massive declines, even though essential services categories such as housing and utilities will grow steadily. Spending on healthcare services will fall significantly again in April, reflecting the delays of non-emergency dental and medical procedures. Health care employment declined by 1.4m in April.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Roiana Reid, roiana.reid@berenberg-us.com