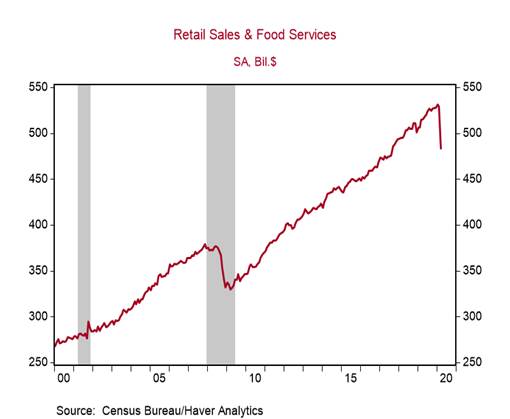

*The shutdown in activities in the second half of March led to an 8.7% m/m decline in U.S. retail sales (consensus: -8.0%), the largest monthly decline on record (Chart 1). March’s retail sales were 6% below year-ago levels. The declines in April’s sales will be even larger, reflecting a full month of lockdown.

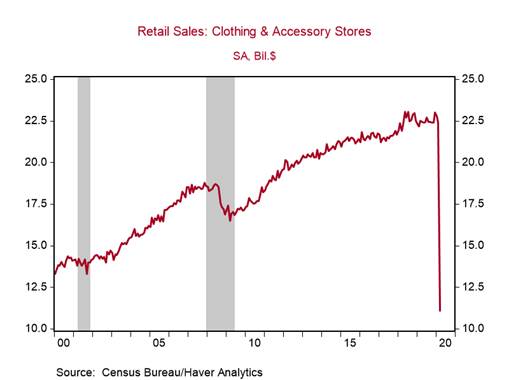

*Control retail sales (excludes gasoline stations, food services and drinking places, building materials, and auto sales), which factor directly into GDP, actually increased by 1.7% m/m, reflecting the massive 25.6% m/m jump in sales at food and beverage stores as households stocked up on essential items. But elsewhere sales were broadly weak, with declines ranging from 14% m/m to 51% m/m at clothing and apparel stores (Chart 2).

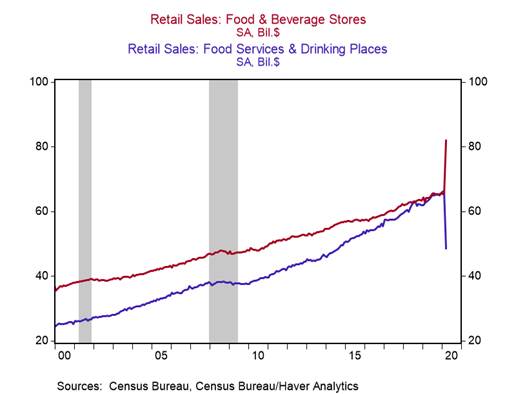

The $17bn increase in sales at food & beverage stores (to $82bn) was offset by the $18bn decline in sales at restaurants and bars (to $49bn). See Chart 3. Sales at building material stores (+1.3% m/m) and general merchandise stores (+6.4% m/m) also increased as households prepared for lockdown, and sales at health and personal care stores rose by 4.3% m/m.

Somewhat surprisingly, non-store retail sales (includes online) rose by only 3.1% m/m, reflecting limitations in quickly ramping up online distribution platforms and delivery services at such short notice. Indeed, online retailers have announced significant hiring plans in recent weeks. We expect stronger non-store retail sales growth in the April report.

We do not expect retail sales to rebound strongly after lockdown restrictions are loosened. Some households will be reluctant to partake in certain activities until there is a vaccine or effective treatment for COVID-19. The large number of job losses is unlikely to be reversed immediately after the acute stage of this crisis ends, and cautious households worried about the economy, labor markets, and future incomes can be expected to save more and spend less, especially on discretionary goods and services.

Personal consumption, which includes a broader range of services (set for release on April 30), will also show massive declines, even though essential services categories such as housing and utilities will grow steadily, and spending on health care services will rise significantly.

Chart 1:

Chart 2:

Chart 3:

Roiana Reid, roiana.reid@berenberg-us.com